Jpmorgan’S Direct To The Destination Of ‘Easy Money'

From Bloomberg, Apr 29:

- Advice comes every bit Goldman sees upside risks to Fed charge per unit of measurement forecast

- JPM doesn’t portion marketplace ‘fixation’ on flattening, 3% 10-year

The moves inwards stocks lately are only foreign -- but there’s even in addition to hence a logical approach to investing for the expected terminate of “easy money,” according to JPMorgan Chase & Co.

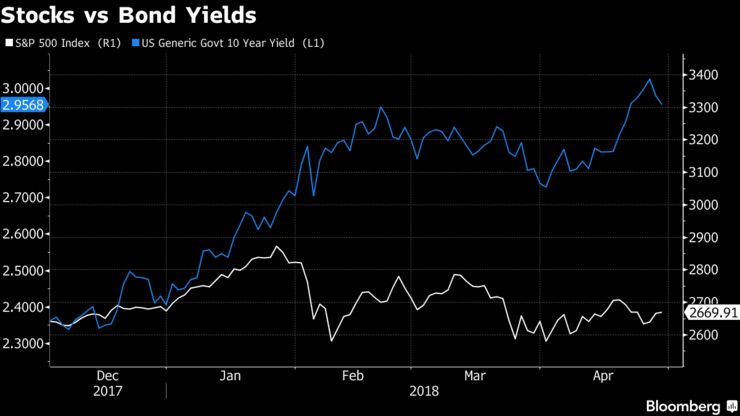

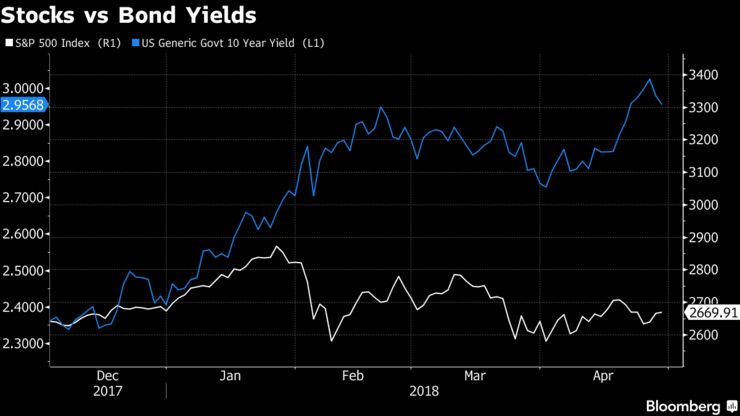

While markets in addition to the strategists who follow them are struggling to figure out the touching on of rising U.S. involvement rates, the sideways path of equities -- given above-consensus turn a profit -- is a notable outlier amidst asset-class movements, the theatre wrote inwards a banking concern annotation Friday.

“Equities’ tepid reply to potent turn a profit is worrisome,” said the JPMorgan strategists, led past times John Normand, caput of cross-asset cardinal strategy. “As cash charge per unit of measurement expectations ascent to levels acknowledging restrictive policy past times belatedly 2019/2020, should equities straightaway cost the terminate of piece of cake money? Such an early on peak would bring no precedent, in addition to hence requires a shock.”

Here’s the sequence of late-cycle trades JPMorgan recommends:

- Late 2017 through 2018: Short duration, long breakevens in addition to long crude spell Fed policy is even in addition to hence accommodative

- 2018: Underweight credit versus equities to cut down beta to a really one-time describe of piece of employment concern cycle

- 2018: Influenza A virus subtype H5N1 pairwise approach to FX rather than a blanket USD view

- 2019: Underweight equities, long duration, long gilt in addition to long the yen every bit Fed policy slows the economic scheme in addition to existent rates collapse

The banking concern said that alone ane of the 10 largest bond sell-offs inwards the past times xv years has been associated alongside stock marketplace weakness. And spell they pivot roughly of the argue for the Feb spill inwards equities on higher Treasury yields, the strategists said that “this month, U.S. rates bring risen alone one-half every bit much every bit they did before this year, but stocks are even in addition to hence sidewinding despite bumper earnings.”......MORE

No comments