Why The Co-Dependence Betwixt Big Tech In Addition To Passive In Addition To Algorithmic Investing Could Displace Far To A Greater Extent Than Hurting Than Close Anticipate.

From 13D Research:

As recent marketplace position activity suggested, they are non independent threats.

The next article was originally published inward “What I Learned This Week” on Apr 5, 2018. To acquire to a greater extent than nearly 13D’s investment research, please see our website.

In these pages, nosotros conduct repeatedly dissected 2 preeminent threats to the bull run: a regulatory crackdown on tech giants, together with the backfiring of passive together with algorithmic strategies pegged to depression volatility. As Monday’s marketplace position activity suggested, they are non independent threats.

FAANG stocks lost $78.7 billion inward marketplace position value on Mon every bit the continued barrage of negative tech headlines spooked investors. Yet, the haemorrhage was non reserved simply to the giants targeted yesteryear the political together with regulatory backlash. As The Wall Street Journal’s Tuesday recap suggests, investors fleeing tech-heavy indexes probable spread the pain: “As the rout intensified, shares of companies ranging from bit makers to electronic-payment providers to biotechnology firms tumbled too, highlighting the indiscriminate selling spreading across the engineering industry. Every stock inward the S&P 500 engineering sector ended lower for the day.”Throughout the near-decade-long bull run, tech giants together with passive together with algorithmic investing ascended hand-in-hand. The to a greater extent than a modest grouping of tech companies dominated marketplace position returns, the less active investors could outperform tech-heavy indexes. And the to a greater extent than uppercase herded to passive together with quant strategies, the less firm-by-firm cost regain could trammel tech stock inflation. It was a virtual feedback loop together with the trial is historic uppercase concentration inward the tech sector.

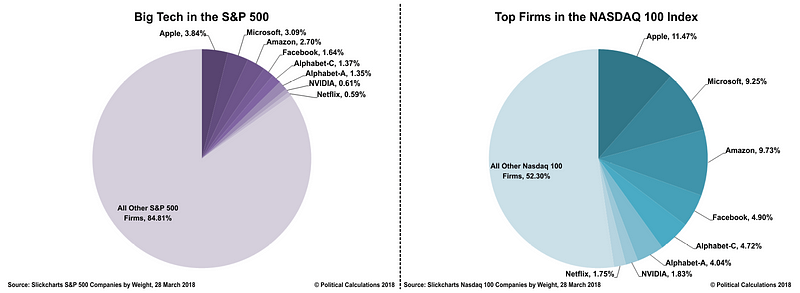

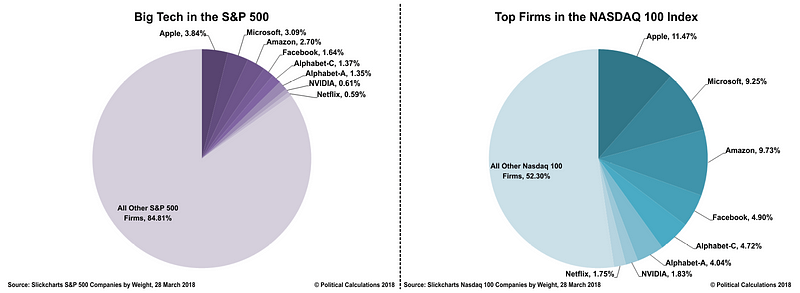

Companies inward the NYSE FANG+ Index are valued at a multiple that’s almost 3 times that of the broader gauge, a greater departure than at the top of the dot-com bubble. According to a Morgan Stanley analysis, “the e-commerce bubble” — which includes FANG addition Twitter together with Ebay — has inflated 617% since the fiscal crisis, making it the 3rd largest bubble of the yesteryear twoscore years behind exclusively tech inward 2000 together with the United States of America housing inward 2008.Now, the commutation inquiry is: What would crusade tech-heavy passive together with quant strategies to unwind together with where volition uppercase acquire when they do? With tech earnings to live released presently together with the buyback blackout menstruum ending thereafter, there’s skilful argue to believe a seismic rotation powerfulness non live imminent despite the recent turbulence. However, global regulatory headwinds volition exclusively intensify. To empathise the implications of the tech drawdown that could result, it is essential to empathise how tech’s bull run sculpted the passive together with quant investing revolution.The topline stats are staggering regardless of how ofttimes they’re repeated. From the 2009 depression to the recent highs, the S&P 500 advanced 331%. Meanwhile, Facebook advanced 413% (from its 2013 IPO), Amazon surged 2,102%, Apple 1,123%, Netflix 5,349%, together with Google 586%. Combining those names alongside Microsoft together with Nvidia, just 8 tech stocks immediately concern human relationship for over 15% of the entire S&P 500 index, together with a staggering 48% of the Nasdaq 100.

Source: Political Calculations

However, earthworks deeper into the passive investing universe, the tech overweighting grows fifty-fifty to a greater extent than severe. Almost 10% of all ETF assets nether management — or simply about $340 billion — track either increase or value indexes, as Nicholas Colas reported for Bloomberg View last month. These indexes conduct real concentrated sector together with stock holdings. Colas writes:“All-or-nothing methods of index structure create portfolios alongside dramatic over/under weights inward volatile sectors…Instead of helping investors diversify via traditional “style boxes,” increase together with value immediately herd them into tightly fenced pens…[creating] dramatic together with potentially risky sector concentrations versus broader marketplace position averages.”As that concentration pertains to tech, increase indexes are the concern. Colas goes on:“The S&P 500 Growth Index has a 41.3% weighting to technology. The Russell grand Growth Index carries similar exposure, at 39%. At the average of the two, this represents a 60% overweight versus the S&P 500’s 25% exposure to engineering stocks.”This brings us to passive investing’s slap-up illusion: diversification. As Jared Dillian, sometime caput of Lehman Brothers’ ETF desk, explained to Bloomberg in November: “Retail investors who are buying ETFs or indexed funds are beingness sold on the thought that they’re diversified. What [they] don’t realize is that the merchandise is real crowded — like twenty million-other-people crowded.”Index owners may technically concur tens, if non hundreds of equities, but it is nonetheless simply a unmarried merchandise that tin give the sack live exited alongside a unmarried “click”. Moreover, indexes weight according to marketplace position cap together with then ownership concentrates inward the biggest companies, together with inward a sustained bull run, narrower indexes — like growth — can outperform broader indexes, farther herding passive investors towards greater concentration. Given their weighting inward indexes, tech stocks could shatter the diversification illusion....MORE

No comments