The Bond Marketplace Lay Isn’T Making Sense

John Authers' roundup at Bloomberg, Nov 19:

A lot of promise has been invested on the dorsum of rattling niggling testify that the Fed is turning dovish. Also, Bitcoin bubbles too Ray Dalio’s lessons learned.

The Bond Market Stops Making Sense

A lot of promise has been invested on the dorsum of rattling niggling testify that the Fed is turning dovish. Also, Bitcoin bubbles too Ray Dalio’s lessons learned.

The Bond Market Stops Making Sense

I don’t intend final week’s dose of Fedspeak moved the needle much on the in all probability course of teaching of Federal Reserve interest-rate hikes side past times side year. Barring a sharper slowdown in the US of America economic scheme than most forecasters expect, nosotros should distich for the federal funds target charge per unit of measurement to hold upward close a per centum betoken higher past times the terminate of side past times side twelvemonth than it is now. On that basis, it looks equally though the bond marketplace has stopped making sense. The benchmark 10-year Treasury Federal Reserve annotation yield is at its lowest since the outset calendar week of October, only earlier shooting higher:

What a long, foreign trip it’s been. But at that spot was a alter inwards sentiment. If the federal funds futures marketplace is to hold upward believed, thus the odds are instantly a niggling to a greater extent than than twoscore percent that the Fed hikes no to a greater extent than than i time from instantly until the terminate of 2019:

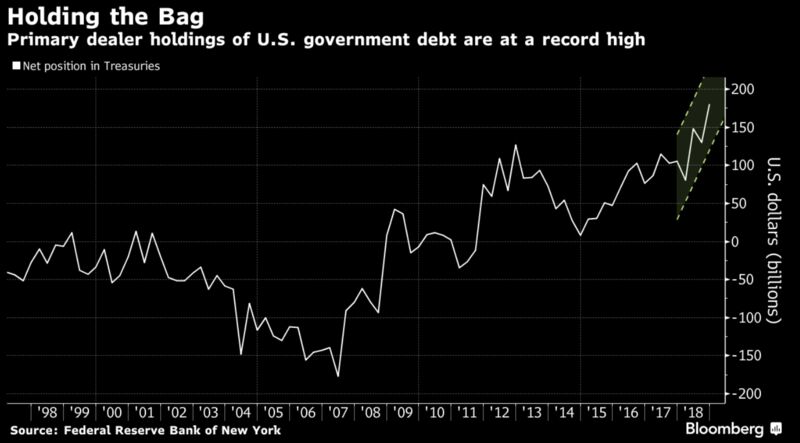

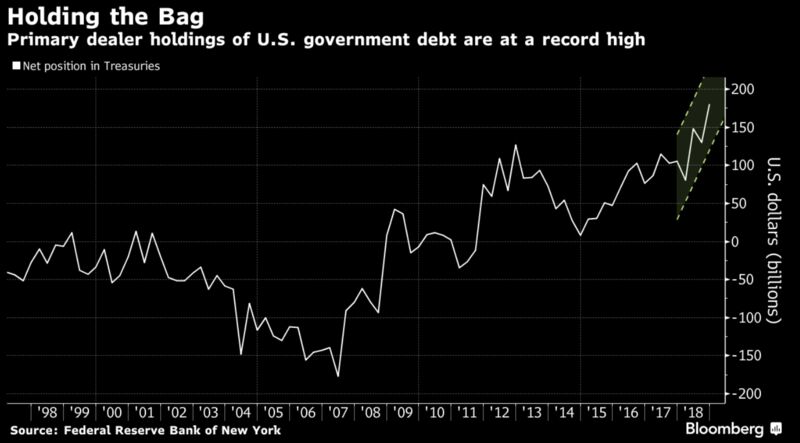

***And yet primary dealers, the large banks that merchandise alongside the Fed too are obligated to bid at the US of America Treasury auctions, are belongings to a greater extent than long-term Treasuries than e'er before. This nautical chart is from Bloomberg News’s Emily Barrett:

They’re unlikely to hold upward belongings this much inventory because they similar Treasuries. H5N1 to a greater extent than in all probability explanation is that they can’t honour willing buyers, too volition process whatever decline in yields (or growth inwards bond prices) equally an chance to decrease their inventory. As Barrett seat it, “With a boundary to how much the government’s guaranteed buyers tin dismiss absorb, it’s a tendency worth watching.”...MUCH MORE

No comments