The Big Bet Against Italian Banks

From SafeHaven, Nov. 22:

The eurozone’s third-largest economy, Italy, is marooned inward a deep political too economical crisis, amongst seeming endless problems: an economic scheme that has barely grown inward decades, sky-high unemployment rates, ballooning national debt, an inability to shape a stable coalition regime and, lately, a looming showdown amongst the European Union over mounting debt.

These accept precipitated a moving ridge of populism that has rejected the quondam establishment too brought inward a novel guard.

Unfortunately, that has done lilliputian to resolve around other Italian bugaboo: a massive banking crisis.

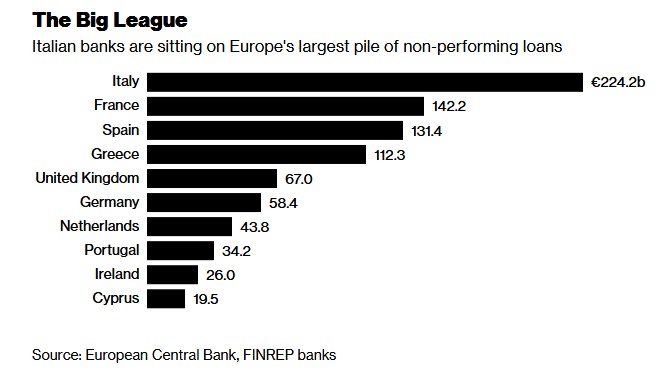

European banks accept accumulated virtually $1.2 trillion inward bad too non-performing loans (NPLs) that accept continued weighing downward heavily on their balance sheets. Italian banks are sitting on the biggest pile of bad debt: €224.2B ($255.9B), amongst NPLs too advances making upward nearly a quarter of all loans.

As if that is slap-up enough, the banks straightaway accept to debate amongst potentially heavy penalties coming from Brussels afterward Italy’s recalcitrant leadership refused to revise the country’s financial 2019 budget to lower debt too borrowing.

The sharks tin already odor the blood inward the water, too investors have been shorting Italian banking stocks to death. Italian banks concord nearly a 5th of the country’s regime bonds.

Source: Bloomberg

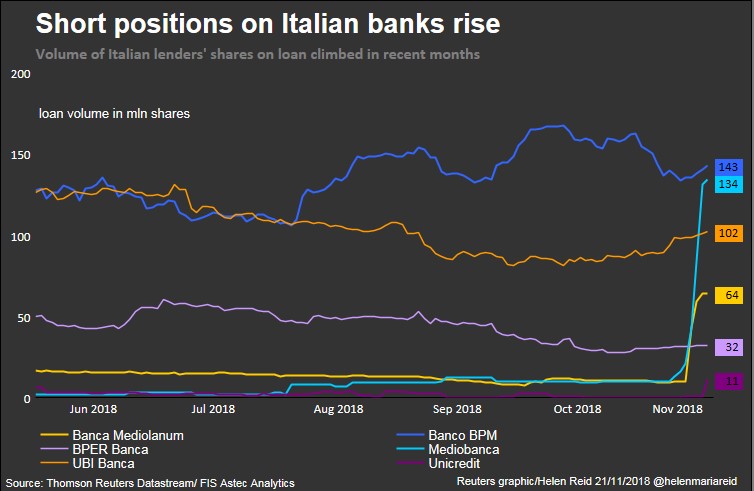

Source: Reuters

Short sellers accept mainly been targeting medium-sized lenders also every bit property managing director Banca Mediolanum too investment depository financial establishment Mediobanca. According to FIS Astec Analytics data, the book of these banks’ shares on loan—a expert proxy for brusque interest—has shot to its highest inward fifteen months....MORE

Short involvement on Mediolanum’s shares straightaway stands at 8.7 percentage of outstanding shares, spell Mediobanca has fifteen percentage of its shares sold short....

No comments