Tesla Vs Full General Motors (Gm; Tsla)

This isn't nearly the trials as well as tribulations of the ii companies nor their futures but rather the curious similarities inwards the stock market's evolving enthusiasm nearly their prospects as well as so their valuations.

This is a repost from June 3, 2013 so add together 5 years of upwardly moves to the Tesla chart—$387.46 all-time top-tick vs. $114.90 on the nautical chart below—but the request withal stands, inwards wide outline.

From Forbes:

Tesla Stock Today Looking H5N1 Lot Like General Motors In 1915

This is a repost from June 3, 2013 so add together 5 years of upwardly moves to the Tesla chart—$387.46 all-time top-tick vs. $114.90 on the nautical chart below—but the request withal stands, inwards wide outline.

From Forbes:

Tesla Stock Today Looking H5N1 Lot Like General Motors In 1915

One of the hottest, if non the hottest, stock stories inwards the marketplace seat today has been Tesla Motors TSLA -5.83% (TSLA), the brainchild of Elon Musk, co-founder of PayPal who has too resurrected the somebody infinite manufacture amongst his SpaceEx venture. Musk has too been compared to such icons as well as visionaries of American manufacture every bit Steve Jobs or Henry Ford, but what nosotros uncovering most interesting nearly Tesla is how it compares to General Motors GM +0.18% (GM) dorsum inwards 1915, a fellowship that succeeded inwards taking the nascent the US auto manufacture to a novel grade amongst its introduction of the production V-8 engine, a major evolution at the time.

Tesla’s approach to the electrical automobile is a stark contrast to the efforts of other automobile companies that convey essentially reduced the electrical auto concept to i of ugly utilitarianism piece failing to address the broader issues of infrastructure as well as a audio technological platform that are necessary for the longer-term success of electrical auto industry....

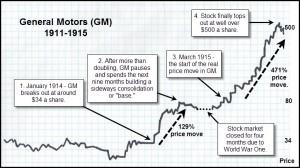

...The genuinely “eerie” resemblance that Tesla has to General Motors inwards 1915 is it cost action. We’ve drawn the cost activity of General Motors from 1911 to 1915 on a slice of graph newspaper to give you lot a visual sentiment of GM’s cost surgical operation during that period.

GM came populace inwards 1911, as well as essentially moved sideways for nearly two-and-a-half years earlier breaking out at around the $34 cost grade as well as launching inwards a higher house $80 inwards a few brusk weeks inwards early on 1914. This initial movement is similar to TSLA’s breakout from $40 to over $100 inwards a few brusk weeks. General Motors inwards 1914 so went sideways for nine months, including 4 months during which the marketplace seat was unopen due to American involvement inwards World War I, earlier it launched on a 471% upside movement over the adjacent 39 weeks.

This comparing is a flake facile. The entire marketplace seat was bullish, led past times the newer technologies as well as the "War Brides", companies that would net from WW I. GM stand upwardly for into both categories. One of the big movers of the 1914-1918 bull marketplace seat was Bethlehem Steel whose stock traded through 1913 amongst a desultory $30-handle as well as went to $600 inwards 1915:Similarly, Tesla became populace inwards 2009 as well as moved sideways for nearly two-and-a-half years earlier launching from nearly the mid-40’s to a high of $114.90 at the fourth dimension of this writing. Many expect at this cost movement every bit unjustified on the footing of the stock “getting ahead of the fundamentals.” However, nosotros would request out that currently Tesla is trading at nearly 100 times forwards estimates, a P/E ratio that is non unheard of for the stocks of companies amongst game-changing technologies or concepts, from eBay (EBAY) as well as Amazon.com (AMZN) inwards 1998 to Salesforce.com (CRM) from 2009 to 2010. Thus on this footing the stock is far from overvalued, as well as those who convey shorted the fellowship convey paid a really dearest cost indeed....MORE

No comments