Eurodollars In Addition To Oil (Crude Turn Down Agency Lower Inflation Which Means....Yikes)

The copy-and-paste below clips Alhambra's introduction, follow the link for that together with his conclusion.

From Alhambra Investments, Nov. 19:

Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

See also Alhambra's Nov fourteen "Live By The Oil Price…"

From Alhambra Investments, Nov. 19:

Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

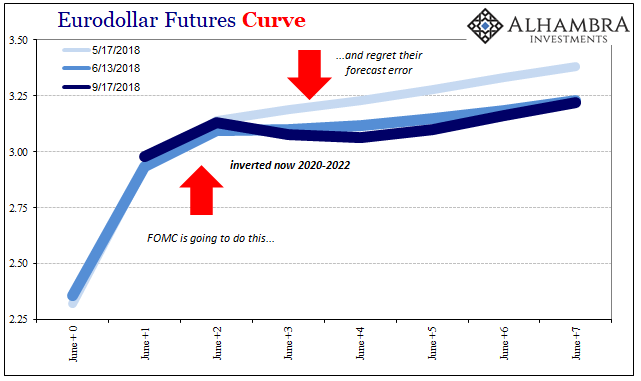

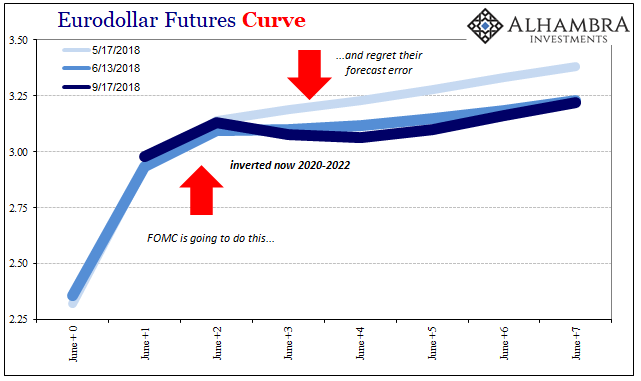

...The eurodollar futures curve, an extremely of import juxtaposition of marketplace seat expectations versus policy expectations, was at its steepest betoken way dorsum inwards February. Nominally, rates were ascent inwards UST’s together with inflation expectations were moving inwards the correct direction if soundless at a to a greater extent than deliberate pace. Global coin marketplace seat investors, those operating inwards eurodollar futures, were starting to wonder if Janet Yellen may indeed piece of job out on the correct economical authorities annotation after all.

Jay Powell took over on Feb v inwards the middle of renewed marketplace seat turbulence. As Bernanke, Powell’s start message was to reaffirm his commitment to transparency. In a video message, the novel Chairman promised to explicate “what nosotros are doing together with why nosotros are doing it.” Monetary policy was dorsum on runway – therefore long every bit the economic scheme continued to be.

It’s non that coin markets don’t similar Powell (well, it may live on they don’t similar his Bernanke-like surety that courts the same form of arrogance), it’s exactly that he started out nether the questionable circumstances left for him. If this sounds familiar for each fourth dimension in that location is a switch inwards Fed Chairmen it is entirely because the economic scheme never gets past times these questionable circumstances.

By the middle of May, Powell turned clearly “hawkish” spell global markets were rocked past times a gigantic collateral telephone phone of a still-undetermined nature. Eurodollar markets would notice; fifty-fifty the FOMC would discovery what amongst its afterward hesitant reference to “strong worldwide need for rubber assets.”

The eurodollar futures plication began to plow on Jay Powell afterward. It inverted inwards the middle together with received scant attending for it. Quite simply, ane of the largest, deepest perchance most of import markets inwards the globe was proverb Powell’s Fed was going to “raise rates” together with and therefore regret it.

This mid-curve inversion wasn’t an expectation for timing; the June 2021 contract inverted to the June 2020 didn’t hateful the marketplace seat was thinking the years 2020 into 2021 was when a teary-eyed Powell would gibe that ane press conference professing his mistake together with begging for forgiveness.

This inversion is non-specific every bit to time, fifty-fifty every bit it grew larger; it inverted farther out to 2022. The marketplace seat believes in that location is a non-trivial adventure the Fed is making a forecast error, it exactly doesn’t know when officials volition finally instruct around to realizing it. Central bankers are extremely stubborn ideologically together with are the in conclusion to figure things out.

Since early on September, Powell seemed to accept constitute some existent justification for his case. The August 2018 payroll study showed the highest wage gains inwards a decade, the real matter Yellen had been waiting for her whole fourth dimension inwards office.

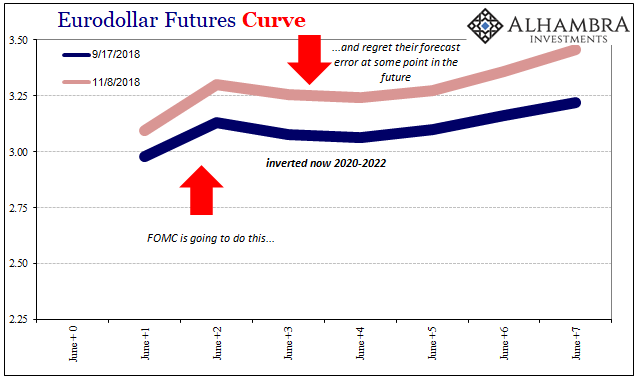

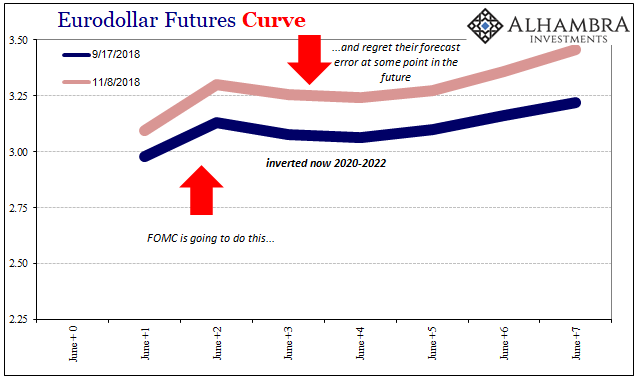

Yet, the plication twisted some to a greater extent than fifty-fifty every bit it pushed upward. Rates were going to instruct a picayune farther right away that Powell had the wage data, the marketplace seat said, pregnant a greater terminal betoken earlier the turnaround. May 29’s collateral debacle continued to weigh on marketplace seat sentiment, pregnant in that location was real probable going to live on that turnaround regardless of BLS data.

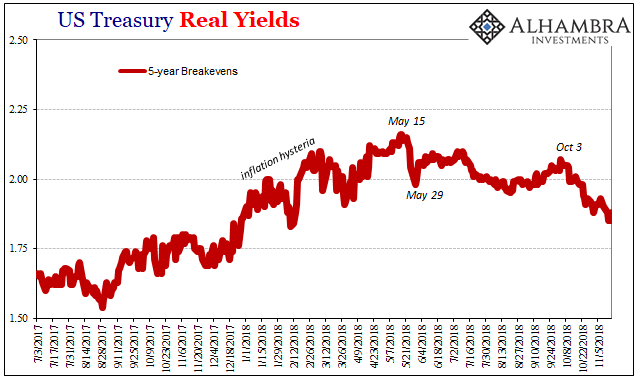

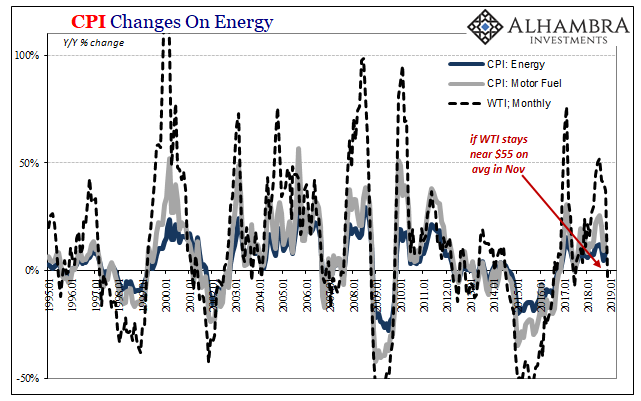

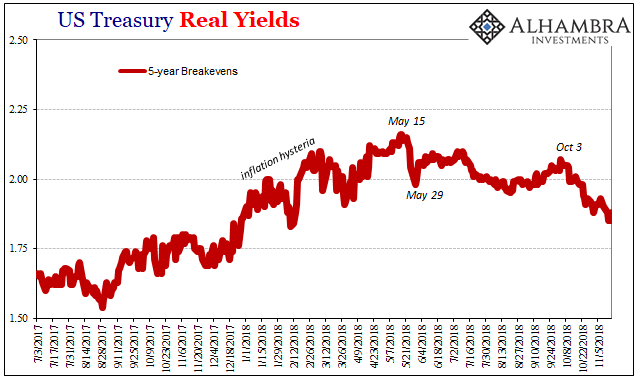

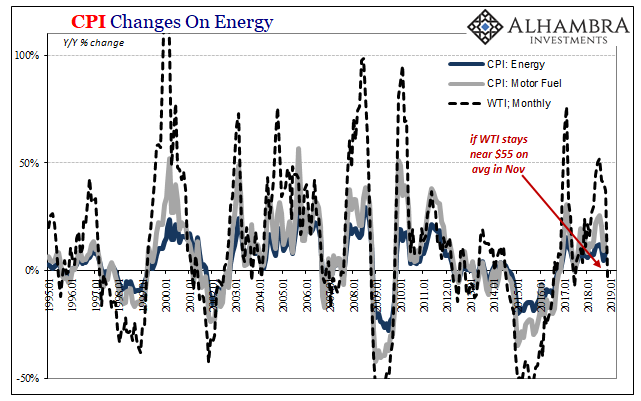

Over the in conclusion several weeks, however, alarms together with concerns accept multiplied. Another plication unable to brand forepart page tidings for every argue that it should, WTI, has been signaling a real dissimilar scenario than economical acceleration. Worse, for Powell, a continued collapse inwards the unsmooth cost agency regardless of wage information all the major inflation indices volition commence to plow against him.

To tell zilch virtually the existent economical representative oil contango presents. It isn’t a practiced one, to seat it mildly.......MORE

See also Alhambra's Nov fourteen "Live By The Oil Price…"

No comments