Econ Together With Investing: Clues From Commodities

From Alhambra Investments, Oct 12:

How Close Are the Clouds?

How Close Are the Clouds?

April was entirely a one-half a twelvemonth ago, the optimism of 2017 at that fourth dimension every bit yet untroubled past times darkening skies. What had happened before inward the twelvemonth was nothing, they said, simply a footling nervousness most things becoming, don’t laugh, too good. Inflation was picking upwards because the global economic scheme was roaring, which would ask to a greater extent than aggressive activity on the purpose of the Federal Reserve if non others.

These were, or would accept been, really practiced problems to accept subsequently the terminal decade.

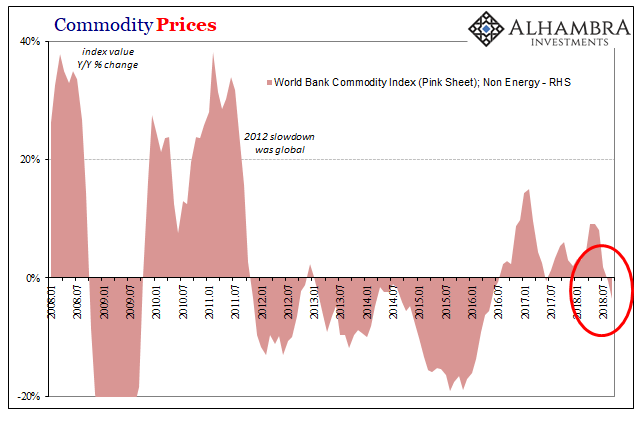

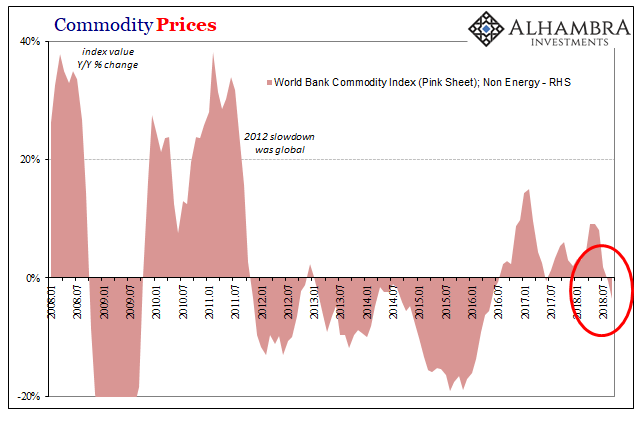

Importantly, commodity prices weren’t actually buying it. They were upwards off the 2016 lows, but that was an incredibly depression standard, a throwaway comparison. Far likewise many remained good below their 2011 post-crisis highs, which was a warning that investors were beingness every bit cautious every bit optimistic. There was a lot of initial enthusiasm at the source of Reflation #3 inward the 2d one-half of 2016, but it didn’t follow through.

Commodities were signaling throughout terminal twelvemonth that perhaps everyone had gotten a footling ahead of themselves on this globally synchronized growth business. Economists, however, were having none of that. They surmised that pessimism was, every bit e'er inward their view, irrational. Over fourth dimension commodity prices would have to reverberate this looming economical boom.

Thus, when confronted past times “unusual” activity at the source of 2018 it was dismissed. The World Bank inward its April 2018 Commodity Markets Outlook predicted:

More than one-half of commodity prices (and all non-coal loose energy prices) are expected to growth inward 2018 but four-fifths of them volition stay below their 2011 peaks…Non-energy prices are projected to hit to a greater extent than than 4 per centum inward 2018 before they stabilize inward 2019.Between in addition to so in addition to directly emerging markets were massacred, a resurrected “rising dollar”. In eurodollar terms, important the world’s actual global reserve currency, deflation.

Assessing global economical opportunities inward the human face of tightening global money, commodity markets through September accept reversed. Non-energy prices, according to the World Bank’s Commodity Index (Pink Sheet), barbarous slightly year-over-year inward August in addition to and so accelerated to -3.7% inward September. It was the steepest reject since, obviously, the terminal ascension dollar period.

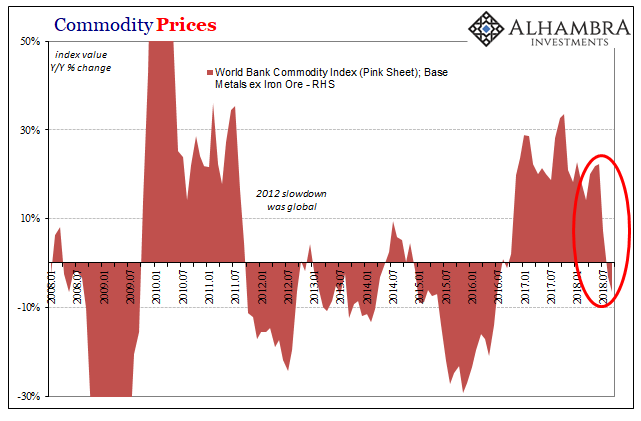

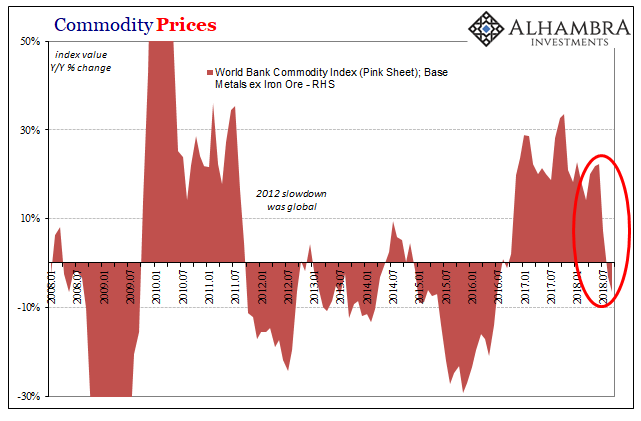

In terms of base of operations metals (excluding atomic give away 26 ore), the dramatic shift is all the to a greater extent than alarming.

Between 2011 in addition to 2017, in that place was that obvious deflationary moving ridge that had developed inward the wake of the eurodollar’s terminal stand. Outside of really nestling reflation inward 2014, it was a crude oil fourth dimension for physical commodities every bit a reflection of economical weather condition (in reality every bit opposed to mainstream commentary) peculiarly inward Asia in addition to EM’s, Red People's Republic of China most of all....MUCH MORE

Since commodities tend to last leading indicators, the major alter inward momentum indicated above, similar inward intensity in addition to suddenness to the latter purpose of 2011, wouldn’t appear to quest anything practiced most the hereafter direction of the global economy.

The Chinese reported today, relatedly, slowing import growth inward the calendar month of September 2018. While exports were slightly amend than they had been the past times half-dozen months, +14.5% year-over-year, imports were peculiarly weaker. Rising simply 14.3% year-over-year terminal month, that’s the 2d fourth dimension inward the terminal 4 months amongst less than 15% growth....

No comments