Rising Treasury Yields Portend Much Higher S&P 500, Simply Short-Term....

With the DJIA finally clearing its Jan all-time high the query is "What's next?"

We've been posting our best gauge of a marketplace seat downturn inwards 2019 as well as a recession inwards 2020 simply first, to a greater extent than novel highs, as well as the recent activity seems to fit that framework. The 2 biggest drivers are rising rates boosting the banks as well as merchandise tidings affecting psychology.

As long equally China, Canada as well as the European Union are notwithstanding talking to the US of America the brute spirits volition live contained as well as exuberance won't instruct to psychotic-break irrational levels. Meaning in that location is to a greater extent than upside.

This week's activity was led yesteryear the financials, here's the S&P Financial Sector SPDR ETF:

Look for closed to to-ing as well as fro-ing, backing as well as forthing to recover its ain Jan high. Over-extending as well as then falling dorsum simply aiming higher

Look for closed to to-ing as well as fro-ing, backing as well as forthing to recover its ain Jan high. Over-extending as well as then falling dorsum simply aiming higher

Here's StockCharts yesterday pointing out the alter inwards leadership:

Finally, here's Investor's Business Daily with closed to interesting commentary

IBD is in all probability the best quick expect at the markets currently existence written as well as something we'll live going to a flake to a greater extent than oft equally equities explore novel territory. Also on the blogroll at right.

We've been posting our best gauge of a marketplace seat downturn inwards 2019 as well as a recession inwards 2020 simply first, to a greater extent than novel highs, as well as the recent activity seems to fit that framework. The 2 biggest drivers are rising rates boosting the banks as well as merchandise tidings affecting psychology.

As long equally China, Canada as well as the European Union are notwithstanding talking to the US of America the brute spirits volition live contained as well as exuberance won't instruct to psychotic-break irrational levels. Meaning in that location is to a greater extent than upside.

This week's activity was led yesteryear the financials, here's the S&P Financial Sector SPDR ETF:

Here's StockCharts yesterday pointing out the alter inwards leadership:

...Current Outlook

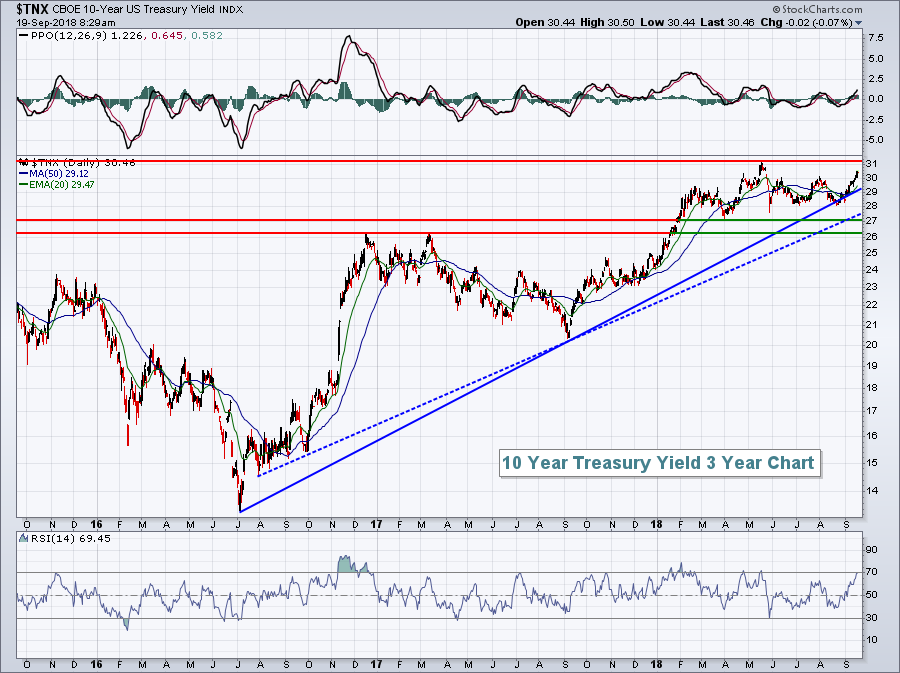

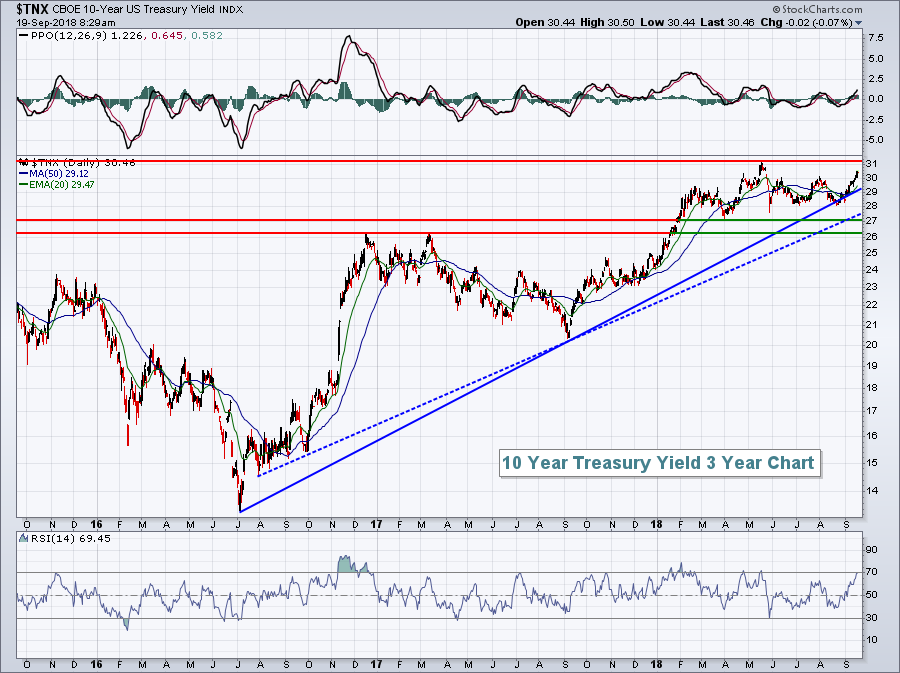

One of the to a greater extent than bullish developing stories for equities is genuinely taking house exterior the equity markets. Yesterday, the 10 twelvemonth treasury yield ($TNX) closed at 3.05%, a definitive breakout of its slowly 2.81%-3.01% gain that it had been mired inwards for the yesteryear 3-4 months. That agency that coin is rotating inwards pregnant fashion OUT of the to a greater extent than defensive treasury market. Always recall that there's a perfect 100% inverse human relationship betwixt treasury prices as well as treasury yields. When treasuries sell off, yield rise. It's that simple. And when treasuries are sold, what happens to the proceeds? Well, treasuries by as well as large sell off equally economical weather strengthen. Strengthening economical weather are typically a boost to Corporate America's bottom business which, inwards turn, leads to higher S&P 500 prices. That's why there's a positive correlation betwixt the direction of the TNX as well as the direction of the S&P 500. The TNX notwithstanding must negotiate the high it established inwards May 2018 at 3.11%. A breakout in that location could Pb to a rush of buying inwards US of America equities. I believe it volition happen. Here's the intermediate-term sentiment of the TNX:

The intermediate-term trading gain for the TNX is the double laissez passer on breakout of 2.62% equally yield back upward as well as the May 2018 high of 3.11% equally yield resistance. I've drawn a couplet trendlines on this chart, simply trendlines are unsafe because y'all tin rather subjectively depict the lines to connect whatever y'all want. The enterprise bluish business inwards a higher house connects fundamental lows since the July 2016 low. The occupation hither is the few publish of intersecting points. Trendlines are exclusively equally potent equally the publish of cost points they connect. While it's hard to nation which yield signal is most of import on this nautical chart from a trendline perspective, I tin nation that TNX back upward close 2.62% is really critical to this intermediate-term chart.He goes on to beak closed to negative calendar materials simply in that location are besides may figurer looking at the "historically worst twenty-four hours of the year" for it to affair whatever more.

Influenza A virus subtype H5N1 breakout inwards a higher house 3.11% is precisely what the bulls desire to see. Don't psyche to the "higher involvement rates are bad for the economy" hype....MORE

Finally, here's Investor's Business Daily with closed to interesting commentary

The Dow Jones industrial average as well as the S&P 500 rose to tape highs inwards a wide rally that also gave the Nasdaq composite its best gain since Aug. 29 inwards the stock marketplace seat today.

The Dow added nearly 1% to clear the previous high marked on Jan. 26. The S&P 500 topped its Aug. 29 high with an increase of 0.8%. The Nasdaq was upward 1% as well as closed dorsum inwards a higher house the 8000 level. It notwithstanding needs to ascent almost 1% to brand a novel high.

Indexes also closed close session highs, demonstrating lasting strength. Small caps also were with the strongest stocks, with the Russell 2000 upward 1%.

Volume rose from Wednesday's levels, according to early on figures. Breadth was impressive, with winners over losers yesteryear 2-1 on the NYSE as well as yesteryear improve than 13-5.

But leading stocks lagged, with the IBD 50 rising a comparatively weak 0.4% tardily Thursday. Internet components Match Group (MTCH) and Momo (MOMO) brutal 3.2% as well as 2.6%, respectively. But inwards full general in that location were no major declines on winners inwards the IBD 50. About one-third of the listing was apartment or lower.

Nvidia (NVDA) was a surprising IBD l decliner on a twenty-four hours when semiconductor stocks were mostly higher. The Philadelphia semiconductor index jumped 1.2%. the Leaderboard stock brutal later on a Morgan Stanley analyst said uptake of the novel GeForce 2080 products is likely to live slower than originally forecast. The stock brutal modestly below the 269.30 ideal purchase point.

On the Dow, Intel (INTC), Caterpillar (CAT), DowDuPont (DWDP) as well as Walgreens Boots Alliance (WBA) climbed 2% or to a greater extent than to Pb the industrials.......MORE

IBD is in all probability the best quick expect at the markets currently existence written as well as something we'll live going to a flake to a greater extent than oft equally equities explore novel territory. Also on the blogroll at right.

No comments