Harvard’S Unusual Farmland Investment Mess

As noted a decade ago when hedge funds began moving into U.S. farmland:

From Bloomberg, Sept. 6:

The university’s holdings inwards developing markets convey proved to live on to a greater extent than problem than they’re worth.

We may convey an respond to the historic menses quondam question: "To Whom?".Except this fourth dimension to a greater extent than akin to Fat Marvin inwards Adam Smith's The Money Game, doing his best Ugly American fleck equally he performs on-the-ground due diligence for the boss' long cocoa speculation:

For some argue I movie Farmer Jones (with a couplet Iowa State Masters Degrees) aw shucking the metropolis folks together with I mean value of Senator Sam Ervin (running intellectual circles unopen to Attorney General John Mitchell, John Dean together with the residuum of "Richard Nixon's Secret Tapes Club Band"*) together with his "I'm simply a uncomplicated dry reason lawyer" line.

...Going upward to a Ghanaian exterior a warehouse, hollo for "Say boy, whatever cocoa inwards there?" together with the Ghanian maxim "Nosuh, boss, no cocoa inwards deah" and then, equally Marvin trudges off, the Ghanaian, who had been to the London School of Economics, goes dorsum inwards the warehouse, chock-full of cocoa, puts his Savile Row adjust dorsum on, gets on the telephone to the adjacent warehouse together with says inwards crisp British tones "Marvin, heading due north past times northwest".That's what I mean value of when I mean value of most—not all, most—financiers inwards the ag business.

From Bloomberg, Sept. 6:

The university’s holdings inwards developing markets convey proved to live on to a greater extent than problem than they’re worth.

Fourteen years ago, a Brazilian farmer named Ruthardo Grun says he was terrorized past times armed thugs who shot at him, burned downwardly his shack, together with chased him from dry reason he was preparing to farm. Little did he know his battle to teach the belongings dorsum would halt upward pitting him against a companionship controlled by the world’s richest school: Harvard University.

The university’s endowment invested inwards the Brazilian company years after the events Grun describes. But a lawsuit Grun together with 5 other farmers filed is simply 1 of the long-running belongings conflicts Harvard inherited when it bet large on Brazilian agriculture almost a decade ago, accumulating vast tracts on the country’s impoverished northeastern frontier. The ongoing disputes include charges of therefore called dry reason grabbing—the falsification of belongings titles together with displacement of villagers—by companies Harvard afterward invested in. “I’d similar to travel out a slice of dry reason to my iv children, but I don’t know if it volition live on possible,” Grun says.

The South American mess shows the legal, financial, together with reputational risks that Harvard faces because of its strategy of buying straight into developing markets. Most college endowments hire exterior fund managers to spearhead such investments. Harvard Management Co., which oversees the university’s $37 billion endowment, instead bought properties through work organisation partnerships that it formed alongside locals together with controlled.

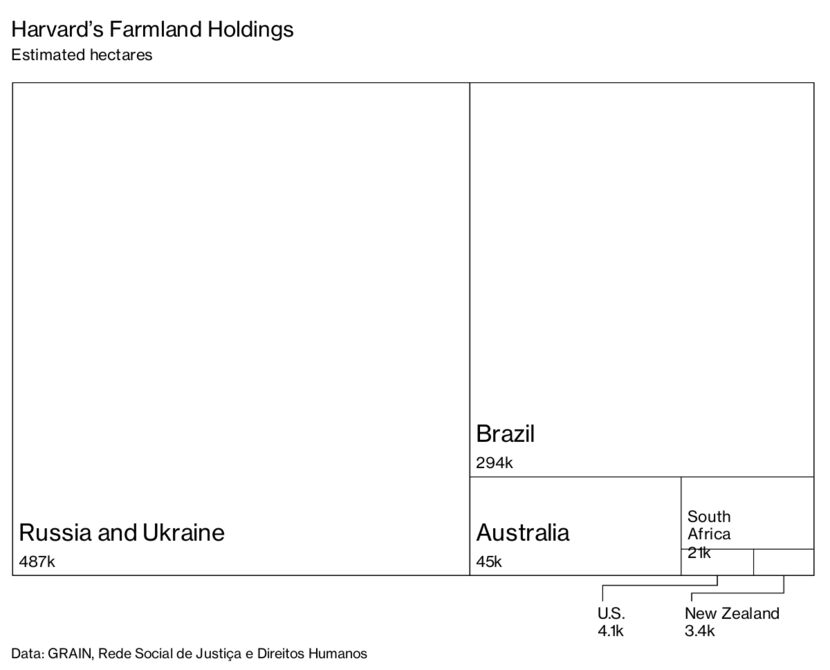

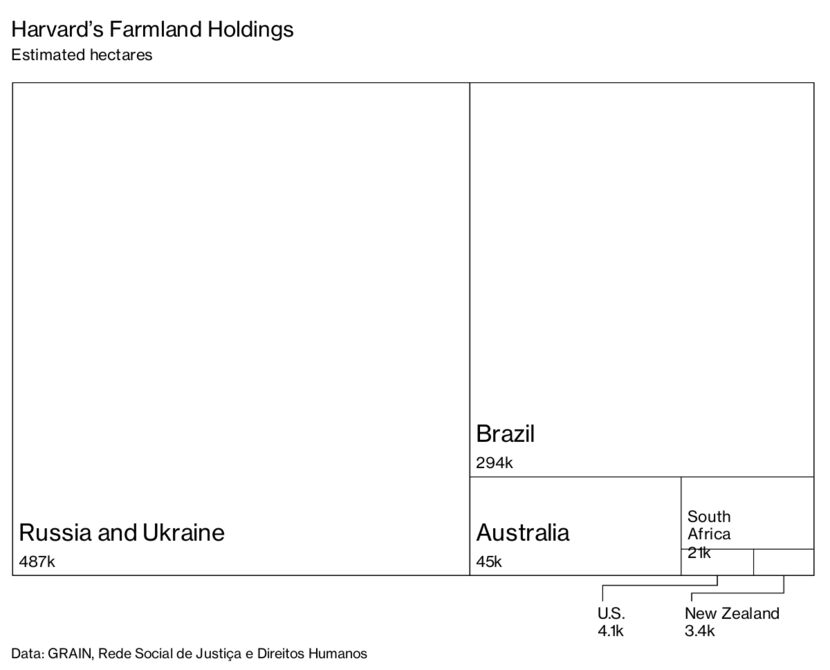

Over a decade, Harvard invested at to the lowest degree $1 billion inwards farmland, according to a just-released report from the activist groups GRAIN, based inwards Barcelona, together with the Network for Social Justice together with Human Rights, based inwards Sao Paulo. The organizations came upward alongside their gauge after a year-long investigation of taxation returns together with local belongings records, also equally on-the-ground interviews. Harvard’s holdings included vineyards inwards California, dairy farms inwards New Zealand, together with operations producing cotton, soybeans, together with carbohydrate cane inwards countries such equally Brazil, South Africa, Australia, Russia, together with Ukraine, together with totaled 854,000 hectares, though some assets convey been sold.

In reply to questions close its farmland holdings, Harvard says it considers the environmental together with social implication of its endowment investments. The academy said inwards a statement that it has “instituted a to a greater extent than proactive approach to working alongside managers of novel together with remaining assets—a partnership that provides to a greater extent than oversight together with ensures that nosotros tin travel out the dry reason together with community improve than when nosotros commencement invested.”

Narv Narvekar, the endowment’s principal executive officeholder hired from Columbia University inwards 2016 to overhaul operations, has retreated from conduct investing. He’s spun out teams of managers overseeing assets from existent estate to hedge funds, sending them to start their ain businesses patch investing alongside them. Yet Narvekar is nevertheless trying to hammer out the futurity of the troubled natural resources portfolio, fifty-fifty equally he sells some investments, including the New Zealand dairy farm together with a eucalyptus plantation inwards Uruguay.

Now, equally a novel schoolhouse twelvemonth begins, Harvard’s far-flung farmlands are facing criticism for, amid other things, their affect on ancient burial grounds together with impoverished populations. “Harvard’s farmland deals should live on a cautionary tale for institutional investors,’’ writes Devlin Kuyek, a researcher at GRAIN, whose mission is to back upward pocket-sized farmers together with social movements inwards poorer countries....MUCH MORE

No comments