Marxism Has Cornered The Junk-Bond Market

Some interesting statistics here.

From Bloomberg Prophets, inwards this representative Jim Bianco, Feb. 25, 2017

Passive investing doesn't discriminate betwixt private winners together with losers.

From Bloomberg Prophets, inwards this representative Jim Bianco, Feb. 25, 2017

Passive investing doesn't discriminate betwixt private winners together with losers.

In 2016, analysts at Sanford C. Bernstein & Co. offered a powerful critique of passive investing.

In “The Silent Road to Serfdom: Why Passive Investing is Worse Than Marxism,” they wrote that “a supposedly capitalist economic scheme where the entirely investment is passive is worse than either a centrally planned economic scheme or an economic scheme amongst active marketplace led upper-case missive of the alphabet management.”

Hyperbole aside, the squad led past times Bernstein’s caput of global quantitative together with European equity strategy, Inigo Fraser-Jenkins, has a point. If capitalism is supposed to vantage adept ideas together with punish bad ones, how does a binary passive investment of “in or out” that doesn’t discriminate betwixt private winners together with losers gain this? Granted, passive investing has provided superior returns over active investing inwards recent years, but is it the best agency to allocate upper-case missive of the alphabet resources? Although passive investing has non created whatever stress inwards the markets yet, the high-yield marketplace is 1 surface area where at that topographic point could survive problems during volatile times.

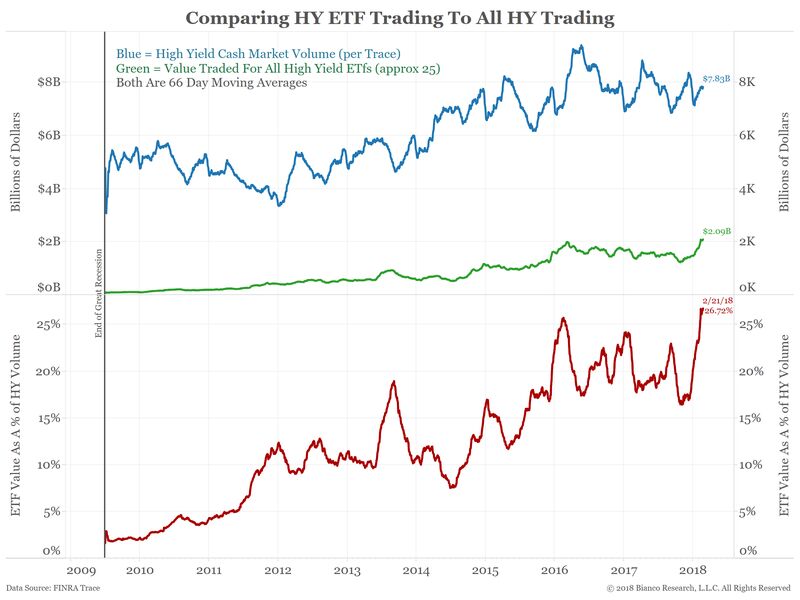

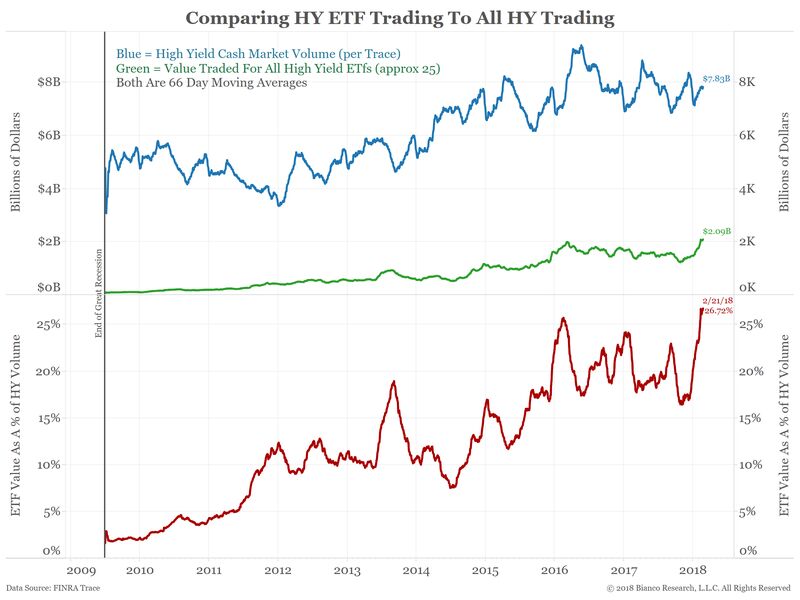

Consider the nautical chart below. The blueish delineate shows the dollar value of daily high-yield cash bond trading. The greenish delineate shows the daily trading value of the some 25 exchange-traded funds that ain high-yield securities. BlackRock’s iShares iBoxx High Yield Corporate Bond ETF (HYG) together with Barclay’s SPDR High Yield Bond ETF (JNK) work concern human relationship for close two-thirds of this total.

The reddish delineate inwards the bottom panel shows high-yield ETF dollar book equally a percent of the cash market. ETF trading book is currently at a novel high at close 27 percent of the underlying cash market. This stair out was nether 2 percent afterwards the fiscal crisis inwards 2009.

In other words, to a greater extent than than 25 percent of high-yield trading is ETF-related. For comparison, less than half dozen percent of investment-grade trading is ETF-related. ETFs of other markets, such equally pocket-size caps, domestic stocks, emerging markets or gold, brand upwards less than 2 percent of their respective cash market. Because of high-yield ETFs’ unique size relative to the underlying cash market, junk bonds would survive 1 house where passive investing could distort private prices.

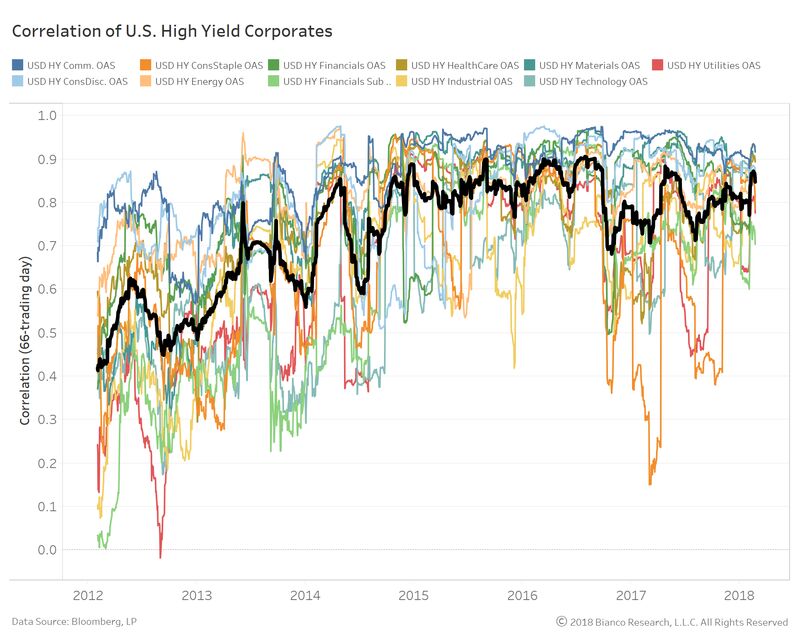

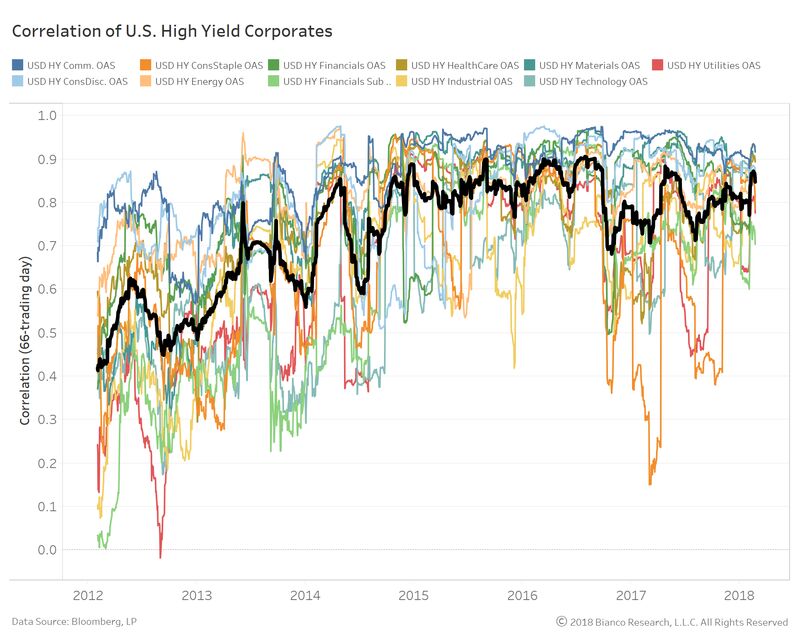

The adjacent nautical chart shows a 66-trading twenty-four sixty minutes catamenia rolling correlation betwixt the option-adjusted spread, or OAS, for the major high-yield sectors together with the 1 for the wide high-yield index. The dark delineate shows the average of these eleven measures. Starting inwards slow 2014, close the same fourth dimension high-yield ETFs’ influence started to grow, the average correlation of the sectors to the high-yield marketplace rose from less than 0.5 to higher upwards 0.8.

...MUCH MORE...To update Karl Marx’s famous dictum, “From each according to ETF flows, to each according to their index weighting.”

No comments