Asness Together With Liew On Efficiency

| have a prissy slice inward Institutional Investor on Fama, Shiller, Nobel Prizes as well as efficiency. They practise a skillful project on the articulation hypothesis theorem -- peradventure a to a greater extent than of import business office of Fama's 1970 newspaper than efficiency itself -- as well as value as well as momentum strategies. They signal out i big difficulty for the inefficiency thought (p.5). If value stocks are simply overlooked as well as increment stocks irrationally overpriced, why practise value stocks all later ascension or autumn together, as well as increment stocks cash inward one's chips the other way? "Cheap stocks would acquire cheaper across the board at the same time. It didn't thing if the stock was an automaker or an insurance company. When value was losing it was losing everywhere." Influenza A virus subtype H5N1 2nd rattling of import theorem: the average investor must concur the marketplace position portfolio, so alpha is a nothing amount game. If you're going to profit, it helps a lot to position simply who the morons are whose coin you lot are taking as well as why they're willing to give it to you. Everyone thinks the other guy is "behavioral." Are you lot sure it's non you? Cliff as well as John convey a theory (p.5) "we've seen that a lot of individuals as well as groups (particularly committees) convey a rigid style to rely on 3 to five-year functioning evaluation horizons. Of course, looking at the data, this is precisely the horizon over which securities most unremarkably acquire inexpensive as well as expensive... these investors human activeness similar momentum traders over a value fourth dimension horizon." Be careful though, so far they are assuming a value resultant -- "securities acquire cheap" agency expected returns convey already risen. How does this behaviour than cause a value effect? They cash inward one's chips on: When these people purchase or sell, "price pressure" (from people slow as well as passively rebalancing over a 3-5 yr horizon?) "leads to around [additional!] mispricing (inefficiency) inward the direction of value." Hmm, it sounds pretty sparse guys. Influenza A virus subtype H5N1 deeper as well as to a greater extent than of import criticism of the risk-factor interpretation: "many practitioners offering value-tilted products.. But if value plant because of risk, at that spot should move a marketplace position for people who wishing the opposite...Some should wishing to surrender provide to lower their exposure to this risk... nosotros know of nobody offering this systematic reverse production (long expensive, brusk cheap)." This is i my MBA students convey heard for a while. Go dorsum to Fama as well as French's storey for the value premium equally chance factor. People whose labor income or nonmarketed concern income is correlated with value stocks should shun value stocks on diversification grounds. If at that spot are to a greater extent than such people (steel workers, say) than people whose human uppercase or concern income is correlated with increment stocks (computer programmers), as well as then the onetime force downwards the cost as well as upwards the expected returns of value stocks. The problem is, for everyone that an investment theatre finds who has non yet idea close this premium, bought value to write insurance, at that spot should move someone else who has non idea close insurance as well as wants to sell value to purchase insurance. Or, the premium volition cash inward one's chips away. So where are these customers, who withdraw heed close AQR as well as DFA as well as say, "Great, I wishing to brusk that!" (The occupation is fifty-fifty worse for momentum, for which at that spot isn't fifty-fifty a story.) In fact, Cliff as well as John are exaggerating here. There are enough of people offering the reverse product. There are lots of increment funds for sure! There must move shortable value ETFs equally well. And I recall that observation paints a partial answer. Lots of people practise overweight increment stocks, as well as hence underweight value stocks, though the value premium says the increment stocks are overpriced. Why? Well, each i of them thinks their growth stocks are the skillful ones, as well as they're taking alpha from the other morons who picked the incorrect increment stocks. Growth stocks are where all the trading as well as mass as well as information as well as novel products as well as excitement is. Invest inward railroads, steel as well as banks (value)? That's nuts, you lot wishing to move inward the moving ridge of the future, Google as well as Facebook, thinks the average investor. Jim Davis (Table 3 here) truly finds positive alpha with increment managers. This is non to state it's all "rational." Influenza A virus subtype H5N1 rational storey for information trading is hard to find. But it sure as shooting does pigment a dissimilar painting demonstrate of who is buying increment stocks than simply "morons" as well as "dumb committees."

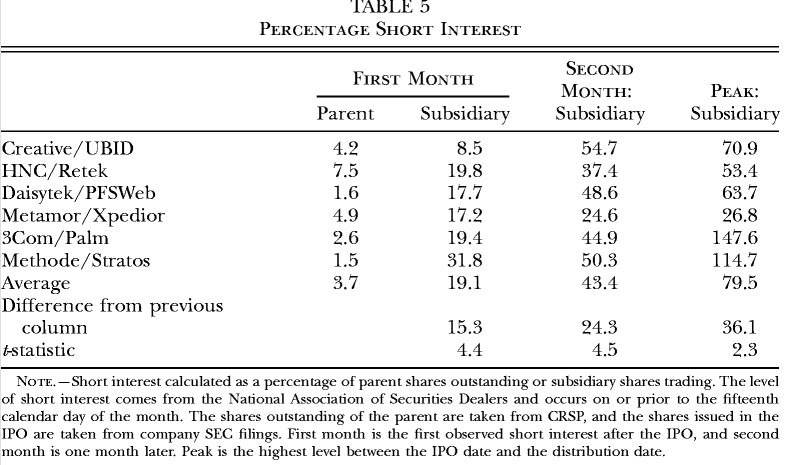

Notice the huge brusk involvement inward Palm, the overpriced security. At the peak, 147% of Palm's shares convey been sold short. OK, that's what you lot expect. But notice that 2.6 per centum of 3com's shares are sold brusk too! Now, who inward the the world was short the long cease of the greatest arbitrage chance of the century? Well, AQR (Cliff as well as John's fund), I bet. This was the tech boom, as well as whatever long-value short-growth strategy volition recall 3Com is also "overpriced.'' So long equally the correlation matrix gauge does non notice that 3com as well as Palm are perfectly correated at a half dozen calendar month horizon -- they are non inward daily as well as weekly information -- it volition brusk 3com. So, it's quite sensible that people who invest for other purposes cease upwards looking variety of giddy when you lot status downwards to i predictor. People who purchase increment stocks as well as shun value stocks are looking for something else. Not an answer, but a rattling interesting laid of questions. And the remainder of the try is skillful too. In the end, I notice the whole "rational" vs. "behavioral" combat quite empty. Anything people convey been fighting close for xl years truly can't brand much sense, as well as debating whether whole classes of models are correct or incorrect is pretty empty. Gene's articulation hypothesis theorem proved that 45 years ago. All methodological debates are pretty empty. We brand progress past times writing specific models as well as looking at data. Behavioral finance is nonetheless first-class marketing for active managers -- each of whom tells you lot all the other guys are behavioral.

Subscribe to:

Post Comments

(

Atom

)

|

No comments