Shorting - Early On Tin Hold Out Wrong: Root Solar Edition

At Bronte nosotros mostly brusk frauds. Our typical positions are tiny (less than 1 percent of funds nether management). The argue is that if a companionship has faux twenty 1000000 inwards earnings together with a marketplace cap of $200 1000000 at that spot is nada stopping it having faux $200 1000000 inwards earnings together with a marketplace cap of $1.5 billion. Influenza A virus subtype H5N1 existent companionship increasing its earnings from $20 1000000 to $200 1000000 is hard - work concern is tough. Influenza A virus subtype H5N1 faux companionship is but a stroke of a pen. You are thus to a greater extent than probable to have got a actually bad experience shorting frauds than existent companies. The only solution nosotros know is to brusk many frauds together with maintain the positions tiny together with the aggregate seat small.

Sometimes though nosotros brusk real companies. The beauty of a existent companionship inwards reject is that the earnings are non going to ascent sharply together with thence the stock is unlikely to go upward 5 plication rapidly. You tin safely accept a much bigger position. Influenza A virus subtype H5N1 4 percent brusk seat inwards a existent companionship has virtually as much working capital missive of the alphabet lead chances as an 80bps seat inwards a fraud. (It all the same has a lower expected return.)

At i phase our biggest brusk (indeed the 2nd biggest nosotros have got ever had) was First Solar. It is a much ameliorate companionship than nosotros commonly brusk - together with it was the non-fraudulent nature of the accounts that allowed us to accept such a large position. There was no way that the stock was doubling because at that spot was no way the earnings were rising sharply.

Alas earnings took some fourth dimension to autumn sharply. And nosotros carried the brusk for virtually a twelvemonth together with virtually broke even. It was non a fun experience because nosotros used capacity (capacity that would have got much ameliorate been allocated to Chinese frauds!) together with because it added to our misery during our worst yoke of months ever (in the middle of 2010) as the stock raced upward into the 160s. We were non brusk First Solar for the recent collapse inwards stock price.

Our analysis was non bad - non only accurate - together with the inaccuracies are painful when yous facial expression at them from eighteen months distant - but all-in nosotros were mostly right.

Except nosotros made no money. With a long early on is but early. With a brusk early on is manifestly wrong.

But but to wallow inwards the misery hither are the 2 key posts reprinted. They were long the firstly time. They experience interminable now. (Originals tin live found here together with here.)

John

Post 1: Why I am brusk First Solar

(The next is an extract from ’s client letter. I idea it deserved wider circulation. It also provides grist to Felix Salmon who described shorting – together with inwards the context yesteryear implication me – as socially useless. I think that was harsh – but non necessarily inwards this case. I volition write an article inwards the time to come on socially useful brusk selling.)

------------

Technology offers value creation similar few other industries. In Commonwealth of Australia Cochlear has created enormous value together with improved the world. It tin literally plug a bionic ear into someone's brain-stem together with instruct them to hear. And the stock has paid virtually 20X – which is ameliorate than anything inwards our portfolio. Many of the biggest fortunes were made inwards technology. But engineering scientific discipline – together with specifically technological obsolescence has thrown many a fine companionship to the wolves. Palm for instance is probable to go bankrupt fifty-fifty though the concepts it pioneered are inwards everyone's pocket.

We exercise all the same have got a framework to hang unopen to our (limited) engineering scientific discipline investments. Influenza A virus subtype H5N1 technology, to live a actually groovy investment, must exercise 2 things. It must alter go of earth inwards a useful way – a large go of earth is ameliorate of course of study – but yous tin live surprisingly profitable inwards little niches. And it must maintain the contest out.

In engineering scientific discipline the contest is remorseless. In most businesses the contest powerfulness live able to exercise something as good as yous – together with it volition take away your excess profit. People volition build hotels for instance until everyone's returns are inadequate but non until everyone's returns are sharply negative. Even inwards a glutted marketplace a hotel tends to have got a argue to be – it silent provides useful service. And someday the glut volition go away so the hotel volition retain some value.[1] In most businesses the game is incremental improvement. If yous instruct slightly ameliorate yous tin brand some coin for a while. If the contest gets slightly ameliorate yous volition brand sub-normal returns until yous grab up.

In engineering scientific discipline the threat is ever that someone volition exercise something massively better than yous together with it volition take away your real argue for existence. Andy Grove – i of the most successful technologists of all fourth dimension (Intel Corporation) – titled his volume “Only the paranoid survive”. He meant it.

If your engineering scientific discipline is obsolete the terminate game is failure – ofttimes bankruptcy. Palm volition neglect because Palm no longer has a argue to exist. If nosotros hold off twenty years Palm volition live fifty-fifty to a greater extent than obsolete – but the hotel glut volition likely have got abated. Nothing left inwards Palm is probable to have got whatever substantial value. Businesses that produced plenty now, hit nada then.

Surprisingly, changing earth looks similar the slow bit. Plenty of companies exercise it. The problems are inwards keeping the contest out. Only a few exercise that (Microsoft, Google are ones that seem to). Hard drive makers changed earth (they allowed all that information storage which made things similar digital photography together with network multi-media possible). But they never made large profits – together with they merchandise at little fractions of sales.

The express engineering scientific discipline investments nosotros have got are non driven yesteryear whatever existent agreement of the technology. Sure nosotros endeavour – but if yous inquire us how to improve the Light Amplification by Stimulated Emission of Radiation etching on a solar panel together with so nosotros volition non live able to help. The driver of our investment theses inwards almost all cases is watching the competition.

Influenza A virus subtype H5N1 unproblematic representative is Garmin. We have got a small brusk seat inwards what is a real fine company. Garmin – in i lawsuit a little avionics companionship - led the mass-marketing of satellite navigation together with allowed John – without stress – to discovery his son's Sat sports game. Sat-nav it seems has saved many marriages together with meant that schoolhouse sports teams exercise non run brusk players because dad got lost.

Garmin has over a billion dollars cash on the residual canvas – together with that cash represents past profits. It has changed earth – together with thus far it has been good remunerated.

The only work is that they can't maintain the contest out. Nokia has purchased a mapping company. Iphone instantly has a Tom-Tom app, downloadable for $80 inwards Australia. Soon sat-nav volition live an expected application inwards every decent mobile phone. Google has mapping engineering scientific discipline also together with volition embed it into their android phone. Eventually the maps volition live given away because people powerfulness volume hotels using their sat-nav device whilst they are travelling. [It is darn useful to know where a decent hotel with a spare room is when yous are on the road.]

Garmin has a groovy product. They have got improved my world. The only work is that they can't sell their production at whatever toll that competes with “free”. Garmin's work concern is going the same administration as Palm. Bankruptcy all the same is only a remote possibility – they have got a billion dollars on the residual canvas together with unless they exercise something actually stupid on the way downwards they volition stay a profitable avionics business.

Is it fair that Palm is facing bankruptcy? Or that Garmin is beingness displaced? We don't think so – but together with so capitalism is non necessarily moral or fair – but it does hit goods together with services quite well. We don't invest on the ground of fair – nosotros invest to brand yous goodness returns.

Our biggest brusk seat though is First Solar – a companionship nosotros have got niggling but admiration for. There is a distinct possibility that First Solar's work concern volition neglect inwards the same way as Palm or Garmin. It won't live fair – but fairness has nada to exercise with it. Like Garmin it likely won't go bust because it has a billion dollars inwards liquid assets on the residual canvas – assets which stand upward for past profits.

Moreover nosotros suspect that First Solar's profits are virtually the same as the ease of the manufacture pose together. The stock silent trades with a high teens trailing price-earnings ratio – a fading growth stock. It hardly looks similar a failure. It is a foreign determination to come upward to. So nosotros should explicate how nosotros got there. To exercise that nosotros demand to explicate how a solar jail cellular telephone works.

1). Influenza A virus subtype H5N1 pith which is excited (i.e. spits off electrons) when a photon hits it.

2). Influenza A virus subtype H5N1 layer which separates the electrons. This layer is commonly a “semiconductor” which agency that electrons go through i way together with cannot go back.

3). Something at the dorsum which conducts the electrons away.

There were to a greater extent than ofttimes than non 2 types of ingot – monocrystalline – where the wafer construction was perfect or close perfect together with polycrystalline which had visible crystals inwards the wafer. Monocrystalline wafers are primarily used for calculator chips (where atomic storey imperfections are problematic) together with are expensive.

Polycrystalline silicon is cheaper. For most large-scale uses polycrystalline wafers were sufficient. These have got virtually a 17 percent conversion charge per unit of measurement – which agency that 17 percent of the photon release energy that strikes them is turned into electricity.

The ingot itself was a substantial go of the cost of a photovoltaic cell. Polycrystalline ingot used to sell for $450 per kg.

First Solar (and others) developed a procedure for making solar cells with considerably less semiconductor material. They have got a Cadmium Telluride procedure which vapor-deposits semiconductor at atomic storey thickness together with comes upward with a jail cellular telephone that is instantly exceeding an xi percent conversion ratio.

This companionship is a technological wonder. Glass goes inwards on i terminate of the manufacturing procedure together with comes out as solar cells at the other with adjacent to no human intervention. Labour is used only when it comes to putting frames unopen to the drinking glass together with for similar tasks.

This was revolutionary – it made inexpensive solar panels together with thence made possible commercial scale plants similar this 1.4 megawatt roof installation inwards Germany. This is plenty to provide a few hundred households – non world shattering – but a consummate revolution inwards the solar industry.

We tin think of few companies which have got pushed a engineering scientific discipline so far together with with such high environmental benefits. Companies similar this volition allow us to maintain a modern lifestyle whilst addressing greenhouse issues.

Still for all the benefits of First Solar’s cells, they are inferior inwards many of import ways to a polycrystalline cell. Their efficiency is lower – which agency yous exercise non instruct as much solar release energy off the constrained roof space. Secondly, whilst they salve a lot on the semiconductor go of the manufacturing procedure they have got to utilisation to a greater extent than glass, to a greater extent than wires etc to generate the same amount of solar electricity. Each jail cellular telephone generates less electricity also so inverters, connectors, installation all cost to a greater extent than with sparse film. Thin cinema also degrades over time. First Solar warrants their performance over their lifetime – but with the warranty beingness for lower levels of performance inwards the 2nd decade of functioning (google the Staebler-Wronski number for a non-trivial explanation). Thin cinema does all the same have got some advantages inwards depression low-cal - keeping a slightly greater proportion of their peak capacity.

Indeed the chief payoff of sparse cinema is cost – together with that cost payoff has been driven yesteryear the cost of the semiconductor component. After all ingot did cost $450 per kg.

That cost payoff made First Solar absurdly profitable – together with they used that turn a profit to grow into a behemoth. Revenue has grown from $48 1000000 to over $2 billion. Gross turn a profit (before selling together with administrative costs) has grown to over $1 billion. We exercise non desire to tell yous how far the stock ran for fearfulness of invoking insane jealousy. This stock would have got made Berkshire Hathaway shareholders jealous.

But call back – all of that was predicated on a cost payoff (almost all other things beingness inferior). And that cost payoff is predicated on expensive semiconductor material.

The contest came inwards a yoke of forms. Firstly it came from Applied Materials. Applied Materials, or AMAT (as the companionship is known) is the most of import companionship inwards earth yous have got never heard of. It is the dominant maker of working capital missive of the alphabet equipment that goes into semiconductor factories together with it is thus the companionship that – to a greater extent than than whatever other – provides the kit to maintain Moore’s Law active.

AMAT has tried competing head-on with First Solar inwards the thin-film space. AMAT developed the vapor deposition equipment that made large-screen LCD televisions possible. This entails deposition inwards large sheets (5.6 foursquare meters) which are together with so cutting downwards into several large concealment TVs. An imperfection inwards the vapor deposition shows on the TV as a bad pixel.

AMAT appropriated this engineering scientific discipline for solar. The silicon semiconductor is non as efficient as First Solar’s Cadmium Telluride engineering scientific discipline – together with it is as dependent champaign to the Staebler-Wronski effect, all the same they tin exercise much larger panels than First Solar (with comparably lower wiring, inverter together with residual of organization costs). AMAT’s thin-film work concern could exercise some harm to First Solar – but it is unlikely to kill it. (Indeed AMAT appears to live de-emphasizing that work concern for the argue discussed below.)

Far to a greater extent than of import have got been developments inwards the wafer business. AMAT (often the protagonist) has developed wire saws for cutting wafers thinner together with thinner. They are instantly lxxx microns thick. These wafers are so sparse that they flutter downwards inwards air together with respite if held on their side. AMAT volition of course of study sell the whole kit for treatment these wafers – including Light Amplification by Stimulated Emission of Radiation etching fabric together with other steps inwards the manufacturing process. Much less semiconductor is needed inwards the wafer business.

But worse – the toll of ingot has fallen – together with spot prices are instantly $55 per kg – which is a lot less than $450. The cost of ingot is silent falling. First Solar’s payoff is only dependent on the fact that they utilisation much less semiconductor than wafers – an payoff that disappears only as wafer prices fall. At that dot all of First Solar’s many disadvantages volition smoothen through.

We are trying to piece of work out the cost-structures of the polycrystalline manufacturers – but it looks to us that the extra drinking glass together with other residual of organization costs that First Solar panels have got are getting unopen instantly to completely removing the payoff of depression semiconductor fabric usage.

If that happens though, First Solar is toast. It likely won’t file bankruptcy because it has so much inwards past profits to autumn dorsum on – but it volition live every fleck as obsolete as a Palm organizer is instantly or a Garmin motorcar navigation organization powerfulness live inwards 5 years.

We exercise non wishing failure on First Solar – together with if nosotros are right it could non have got happened to a nicer companionship (no irony intended). Capitalism is non fair – together with engineering scientific discipline investment is specially unfair.

We don’t brand coin from fairness. We brand coin from getting the work concern analysis right together with betting on (or against) the right work concern – together with inwards this representative nosotros are betting against the most successful companionship inwards a massively of import growth industry.

If nosotros are right (and nosotros think nosotros are) together with so nosotros volition brand coin from the demise of a companionship that has much improved the world. We similar to think our work concern is noble. And it is sometimes – but inwards this representative nosotros tin reckon why people dislike short-sellers. Their view all the same is non our business.

[1] Unfortunately the hotel is commonly mortgaged – together with the value ofttimes reverts to the debt holder.

[2] One way amuses us greatly. Walmart started putting solar cells on the rooftops of many of their super-centers inwards the Southern United States. They did this originally because of implicit subsidies. However the essay centers showed something quite interesting. Good solar panels plow quite a lot of the release energy hitting the rooftop into electricity which is conducted away. That release energy does non current of air upward as oestrus inwards the edifice – together with the cooling charge of the edifice went down. The rooftop solar installation may non have got been justified yesteryear the electricity output lonely – but combined with lower cooling bills it worked a treat. [Addendum. This footnote is anecdotal from goodness source rather than published... many people have got asked us virtually it - together with a few have got said they have got heard this assort of affair before but they would similar hard data... I apologize as I am unable to provide...]

Post 2: Kickback on First Solar

One of the biggest benefits I instruct from writing this weblog is that sometimes some real smart people disagree with me. In the investing work concern yous volition live incorrect often. The before yous realize that yous are incorrect the smaller (on average) your losses volition be. I don’t think the weblog tin movement markets through talking my book. (I disclosed a goodness declaration for shorting First Solar together with the stock went up!) But I exercise think that kick-back from smart people tin assist cut my losses when I am wrong. Believe me that is ofttimes enough! If all that the weblog delivers me is smart people who disagree with me together with so I volition current of air upward beingness a well-paid blogger (and my clients volition live grateful)!

I got a lot of kick-back on my First Solar slice – some of which makes me to a greater extent than nervous virtually the brusk – together with some of the kick-back is from people who are very smart. I idea I ought to lay this kick-back out at to the lowest degree inwards go to instruct my ain thoughts straight.

One of the solar manufacture merchandise publications asked my permission to republish the slice – which I have got granted. They also warned that they powerfulness have got a follow-up slice titled: “Why I am brusk ”. That ought to pose us inwards our place! I have got yet to reckon that slice – but honestly I facial expression forrard to it (even though reading it volition live painful). It may convince me that I am incorrect – inwards which representative I volition embrace my brusk forthwith!

The ground for the kickback I have got received

The core to my declaration was that First Solar has disadvantages (notably lower conversion efficiency) offset yesteryear a yoke of advantages – notably keeping higher generation inwards depression light, less sensitivity to angle of low-cal – together with most importantly – lower cost.

My view was that lower cost would create upward one's heed almost everything. Solar modules are fundamentally a commodity – together with whilst the low-light advantages were existent – they could easily live overwhelmed yesteryear cost.

I together with so made an assertion – which I did non dorsum – that the cost construction of wafer-based cells volition live competitive against CdTe (First Solar) cells when the polysilicon toll gets depression enough.

Most – but non all – of the kick-back I have got received is based unopen to this cost construction issue. This falls into 2 camps. Firstly they assert that I have got the cost structures of the competitors wrong. Secondly they property that First Solar volition cut costs plenty to offset the payoff that wafer-module-manufacturers instruct from lower silicon prices.

The other kick-back I have got received is on the sales-and-marketing department. First Solar has – according to customers – yesteryear far the best sales force. “They are a machine!” First Solar they think that this volition allow First Solar to move good for longer than I powerfulness anticipate. Moreover they idea First Solar’s average selling toll would stay high because FSLR has presold a lot of modules to solvent utility scale operators – notably EDF inwards France.

In this post I examine these issues with the aim of getting my ain thoughts direct (and hopefully invoking to a greater extent than kick-back from to a greater extent than people that are smarter than me).

A cost model for polysilicon producers

Polysilicon has several disadvantages vis CdTe technology. First the materials are to a greater extent than expensive (wafers are thicker than sparse film) – but but as importantly the manufacturing procedure is much to a greater extent than complicated. At First Solar drinking glass goes into the flora together with comes out – virtually 3 hours afterwards – as an almost consummate module. Human involvement is minimal. Wafers all the same require to a greater extent than manufacturing – they are sawn – they have got breakage rates – they are laced with wires to behavior the electricity away – together with they are “assembled”. Manufacturing cost are higher.

That said nosotros tin create a unproblematic cost model for wafer manufacturing from comments made yesteryear competitors. YingLi – a Chinese module maker – made the next comment inwards their fourth quarter conference call:

Solar wafers used to require vii grams of silicon per watt. Some manufacturers run at virtually 6.2 grams of silicon per watt – with 180 micron silicon. Applied Materials verbalize virtually lxxx micron thick silicon wafers – though silicon utilisation for those wafers is non reduced yesteryear 80/140 because wire saw (kern) losses are similar regardless of wafer thickness. Also as wafers instruct thinner they have got higher breakage rates (and the incentive to cutting wafers thinner is lower as silicon prices fall).

Its likely fair plenty to utilisation 6.5 grams of silicon per watt as the right number for modeling a silicon wafer module producer. The 6.5 grams is falling together with inwards 5 years it may live 5 grams (if AMAT manages to sell to a greater extent than of their kit). Ok – but at 6.5g (or 0.0065 kg) per watt together with so the cost construction is slow to model…

Obviously this is highly dependent on the silicon toll – a $20 silicon toll would brand the cost 13c per watt cheaper – say 84 cents per watt. Influenza A virus subtype H5N1 $100 silicon toll takes cost per watt to $1.41.

Cost is also dependent on YingLi (and presumably the other commodity panel makers) getting efficiencies inwards the production of modules although at a reasonable clip – though as noted, I model a charge per unit of measurement below the historic charge per unit of measurement of cost improvement.

[I should discovery hither that Trina Solar – some other Chinese manufacturer – gives their non-silicon costs at 78c per watt – 2c to a greater extent than expensive than YingLi inwards the 4th quarter. Trina’s cost reductions are also virtually 4c per quarter… See page 8 of their quarterly presentation.]

This cost model is fraught. The accounting of many of the Chinese players is hard to decipher. One mortal I have got talked to suggests that most other players are way higher upward 78c per watt inwards non-silicon costs (although contest volition instruct them at that spot or forcefulness them out of work concern replaced yesteryear people who are at that level). They idea YingLi would live at 70c yesteryear the terminate of 2010. Against this the same mortal idea my grams per watt was also high (suggesting 6 grams per watt based on 180 micron thick wafers) together with they idea that YingLi would live at 5.5 grams per watt yesteryear the terminate of the year. This is to a greater extent than or less a launder – with wafer costs a niggling lower than my jurist but base of operations costs winding upward a fleck higher. Again all of this stuff is fraught – together with although these broad numbers are non controversial the terminate competitiveness of First Solar is surprisingly sensitive to fine differences inwards base of operations cost together with silicon costs of their competitors.

What is the cost construction of First Solar?

First Solar has set out ambitious plans to increment the efficiency of their cells together with to farther cut costs. I exercise non desire to go through those inwards item – but I think nosotros tin extract 2 key charts from the last presentation. First slide thirteen – which has the cost per watt falling silent – but at decreasing rates. The cost-per-watt has fallen yesteryear 1-2 cents per quarter for the final yoke of quarters (versus 3-5 cents for the non-silicon costs at YingLi).

Then at that spot is the less-specific presentation from their “roadmap” (see slide 14) which shows their 2014 target cost per watt.

I wishing I understood how all of these gains were probable to live achieved – but they think they tin instruct to 52-63 cents per watt yesteryear the terminate of 2014. However – for the minute I assume that they tin encounter their cost target together with instruct to 58c per watt (a reasonable midpoint) yesteryear the terminate of 2014.

That cost per watt reduction is 26c over sixteen quarters – or 1.625 cents per quarter – roughly the charge per unit of measurement at which costs have got been falling historically.

Figuring that the were at 84c per watt during the 4th quarter of 2009 – together with they are reducing costs yesteryear 2c per watt per quarter (that is a niggling faster than historic together with slightly faster than their roadmap) costs volition live virtually 80c per watt per quarter yesteryear the June quarter of this year.

A raw cost comparing – with the toll of silicon beingness the chief variable

With the trusty spreadsheet I tin hit a reasonable cost-per-watt comparison…

On this cost construction the YingLi panels have got higher production costs unless the silicon toll is very low. That assort of makes sense. YingLi panels have got higher production costs (the procedure for making them is to a greater extent than complicated) offset yesteryear lower non-silicon materials costs (they are to a greater extent than efficient together with thence utilisation less glass, backing wire etc). The swing factor is silicon.

This tabular array all the same leaves off the unmarried most of import swing factor – which is that the YingLi panels are smaller per watt of output. (Remember my whole declaration is dependent on the higher conversion efficiency of the polysilicon wafer modules.) There are wildly different versions of how much the installation cost payoff is. The payoff comes virtually because yous demand less cells, less land, less brackets together with less converters to generate the same amount of energy.

This paper from the National Renewable Energy Laboratory has been my guide. This paper suggests that First Solar modules demand to live priced 25-30 cents below c-Si modules to generate equivalent projection returns (see page 26). Some people think this far also high. For instance Stephen Simko (an analyst from Morningstar who disagrees with me) thinks a 10 percent punishment (roughly 7c per watt) volition exercise the trick. I for the life of me exercise non empathise why this is a percent (there is express evidence that installation costs are falling at the same charge per unit of measurement as manufacturing costs). vii cents per watt is real different from 25-30 cents.

I would actually similar people to item what the cost departure is. (If informed people ship me emails I volition live grateful…) I suspect it depends on all sorts of things similar labor costs, brackets, terra firma availability together with things yous would non await similar current of air levels (wind requiring ameliorate anchoring for the panels).

For the minute I utilisation 15c per watt (a number my enquiry indicates is also depression – but which Stephen Simko thinks is also high). At this dot my cost tabular array needs to live adjusted…

Now at this dot the First Solar cells are virtually cost-competitive at a $40 silicon price. If silicon prices go as depression as $20 per kg together with so the Chinese polysilicon makers (represented yesteryear YingLi) have got the goods yesteryear a long margin.

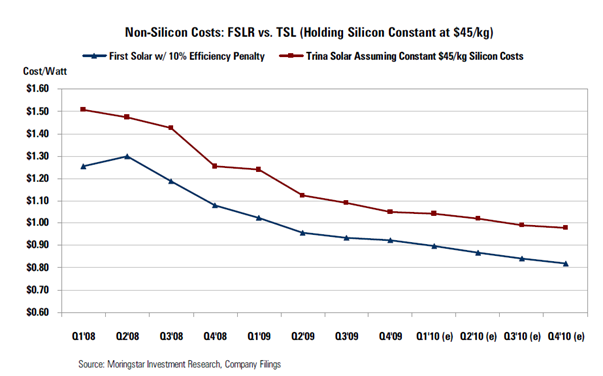

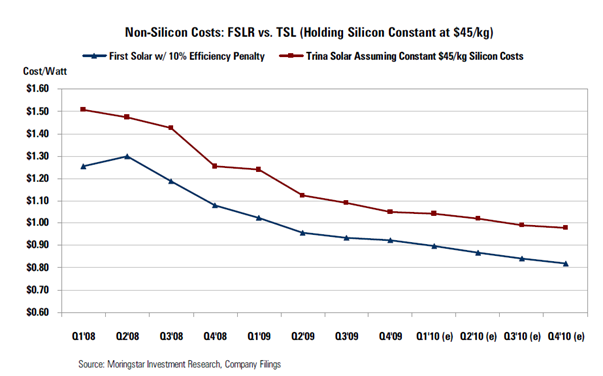

I should annotation that this cost construction does non check the cost construction as presented yesteryear several people bullish First Solar… Here is a cost construction as presented yesteryear Stephen Simko comparing First Solar to Trina Solar (yet some other Chinese wafer-module maker). In it all the same he keeps the silicon toll constant at $45.

You tin reckon the departure betwixt Simko’s estimates together with mine. I have got Q2’10 costs for the wafer manufacturer a few pennies (say 3c) lower than Simko. Simko has the cost construction of First Solar falling virtually 3c per quarter (versus my 1.5 cents per quarter together with adding upward to a farther 3c cost advantage) together with he has an efficiency punishment of virtually 8c versus my 15c (or some other 7c of cost advantage). He thus has First Solar maintaining a cost payoff of virtually 15-18c per watt over the adjacent twelve months whereas the extra costs I advise wipe most of that advantage.

At a $20 silicon toll fifty-fifty with Simko’s cost estimates First Solar’s cost payoff disappears. This of course of study led Stephen Simko together with me to a word of what drives polysilicon ingot prices. In that he changed my heed somewhat…

What drives the polysilicon price?

Polysilicon is a commodity. Sure at that spot is ameliorate character stuff (which makes to a greater extent than efficient wafers) but it is silent a commodity. Usually with a commodity – when at that spot is spare capacity inwards the organization – the commodity is priced at the cash running costs of the highest toll operational plant. When earth runs out of capacity the commodity disconnects from its “cost curve” together with is priced at whatever the marketplace tin bear. At that dot beingness a commodity maker is frightfully profitable. That turn a profit attracts novel entrants together with novel capacity. Eventually at that spot is plenty provide together with the commodity toll reconnects to the cost curve. (This designing is familiar to anyone who has – for instance – studied metallic prices generally. The designing drives much of the Australian economy.)

As the solar manufacture ramped upward polysilicon prices disconnected from their cost curves. Spot prices of $450 were non unknown. The NREL paper cited higher upward mentions spot prices higher than that. The spot toll all the same was rarely paid – because most wafer makers purchased large inventories together with entered into forrard contracts. Some solar-cell makers have got got themselves knotted upward financially because they have got purchased thousands of tons of polysilicon inventory at prices that are good higher upward electrical flow prices together with which prohibit them from making profits.

The excessive profits made yesteryear the ingot makers introduced many novel suppliers to the industry. One source suggested that nosotros have got gone from half-dozen suppliers (and a cozy oligopoly) to 26 suppliers (who volition cutting each other’s throats). This marketplace is becoming real glutted real fast. That agency that the poly toll volition go to marginal cash cost. So what is that cost?

Well I started with the large players – together with they have got cash costs inwards the depression 20s. I idea the polysilicon toll would thus go to the depression 20s. That would settle the number because – fifty-fifty on the Stephen Simko’s numbers – the Chinese-wafer-based modules volition have got lower costs than First Solar at a $20 polysilicon price.

So – without stating it so clearly – I idea that the poly toll would current of air upward closer to $20 per kg than the $45-55 modeled yesteryear most First Solar bulls.

Stephen Simko disabused me of this notion – together with this fourth dimension I am fairly convinced yesteryear his explanation. During the blast the most insane polysilicon manufactures built plants together with with real different cash costs to the established (and presumably knowledgeable) players. He thinks the cash cost exterior the established players is considerably higher than the cash costs of the established players. He points to a presentation yesteryear REC Silicon. Slide 45 of the presentation gives what REC purports is an manufacture cash-cost bend together with whilst the Y-axis is non labeled the bottom of the bend represents virtually $20 a kg – together with the top of the bend represents – good – who knows what? Here is the slide:

If this bend is right the polysilicon toll is unlikely to instruct to $20 because the marginal players volition have got costs substantially higher than $20.

The number comes downwards to how apartment is the cost curve? It strikes me – intuitively – as beingness probable to live real apartment as the equipment to brand silicon is pretty good understood – but if anyone is really proficient inwards this together with so I would dearest them to contact me. [The cost bend REC/Simko showed me all the same is emphatically non flat…]

This REC graph all the same has given me suspension – because the really brutal outcomes for First Solar were dependent on a real depression silicon price. If the silicon toll were actually to go to $20 together with my cost numbers (somewhat to a greater extent than savage than Simko together with other bulls) are right together with so First Solar volition current of air upward with no argue to be – together with the stock volition go below $10 (currently virtually $130). If the poly toll does non go below $45 together with Simko’s numbers are right together with so First Solar volition maintain a cost payoff – together with that cost payoff is sustainable – at to the lowest degree until a ameliorate engineering scientific discipline comes along or First Solar’s patents run out. First Solar earnings powerfulness live hard – but the work concern has a argue to exist.

Funny – I have got non mentioned profitability

So far – inwards neither of my notes – I have got non made a turn a profit jurist for First Solar or whatever of the competitors. I have got modeled cost – but thus far have got non modeled selling price. Once nosotros have got a reasonable jurist of selling toll together with a reasonable jurist of cost nosotros should live able to model profits give or accept some things. [The chief things nosotros would demand to give-or-take are inventory losses for the silicon manufacturers – some of whom have got thousands of tons of overpriced silicon inventory, together with the projection gains together with losses for First Solar which is an investor inwards utility scale solar projects.]

Looking at the electrical flow toll for modules is non going to assist yous much. Many companies have got both purchased silicon at fixed rates together with pre-sold panels at fixed rates. First Solar locked inwards lots of fixed charge per unit of measurement contracts – some with goodness solvent parties (for representative EDF) – some with parties that are to a greater extent than questionable. The electrical flow prices realized yesteryear the solar manufacturers depend to a greater extent than on the contracts that they entered into (both toll together with solvency of the counterparty) together with less on spot toll for panels than a firstly glance powerfulness look.

There are disclosures inwards First Solar’s 10K which illustrate the problem. These disclosures tin live read as “red flags” though I prefer to maintain to a greater extent than neutral virtually their content.

Whatever – the manufacture is rife with fixed toll contracts. Spot prices are below the fixed toll contracts. One solar daytime these fixed toll contracts volition whorl off – together with novel fixed toll contracts volition struck at considerably lower prices. As nosotros exercise non know the duration of the fixed toll contracts – together with fifty-fifty if nosotros did that duration keeps getting extended inwards central for lower prices – nosotros can’t actually tell the path of the selling price.

But I have got a method which should live familiar to whatever economist – together with I think works for working out where the long term selling price volition current of air up. It is unproblematic really. The Chinese competitors are numerous together with real hard to selection apart from each other. Some are ultimately going to live pennies per watt ameliorate than others – but because they are numerous together with inwards vehement contest they volition drive the price. This should live bleatingly obvious – anyone who has competed with numerous Chinese manufacturers yesteryear instantly would know that the toll is driven downwards to the toll where the Chinese manufacturers brand a mid single-digit ROE.

That toll all the same is much lower than the electrical flow selling toll together with likely much lower than the selling toll First Solar volition realize inwards 2010.

Moreover the toll should live fairly slow to determine: I volition but exercise it for i manufacturer. At twelvemonth terminate Trina Solar had volume value of $677 million. Some of that value was inflated because they were carrying some high-cost silicon inventory. They had output powerfulness of virtually 550 megawatts per twelvemonth (averaging 600 inwards panels together with 500 inwards wafers). To earn xv percent pre taxation on that equity they demand to brand roughly 100 1000000 per annum or they demand a margin of 18c per watt sold. The first-cut jurist of the long term toll of these things is thus – together with I am beingness real simplistic hither – whatever the Chinese manufacturers cost addition 18c per watt.

This firstly cutting all the same is a sudden over-estimate. The equity I am including is also high because of overpriced inventory. The ROE I am demanding is also high also (Chinese competitive manufacturers brand far less than that!) The manufacture is continuing to instruct efficiencies – together with they volition live competed away – so the margin per watt volition come upward downwards for that argue too. You exercise non demand to brand whatever unreasonable assumptions for the right margin per watt over the cost for the Chinese manufacturers to live 10c.

From hither an earnings model is easy… First Solar volition hit (on their guidance) virtually 1.7 gigawatts this twelvemonth together with 2 gigawatts adjacent year. The selling toll volition live whatever YingLi’s cost is addition 10c… You tin piece of work out the margins using either mine or a bull’s cost estimates (I utilisation mine). Multiply margin yesteryear wattage together with yous instruct pre-tax turn a profit – give or accept a niggling bit. I exercise this below.

Now – using numbers I think are inherently probable – I instruct earnings falling sharply. If nosotros accept the silicon toll to $20 together with so First Solar has no earnings. If nosotros think the installation punishment is 25c rather than 15c as per the NREL paper earnings go away upward to a silicon toll of virtually $40.

Now Mr Simko reckons that the cost payoff of First Solar is virtually thirteen cents per watt ameliorate than my number. [He has an 8c installation cost rather than my xv etc…] 13c per watt equates to $20 per kg on the silicon toll (remember nosotros are assuming 6.5 grams of silicon per watt). In other words if yous utilisation Simko’s numbers together with so accept my silicon toll jurist together with add together $20 (say $60 instead of $40) to read the earnings numbers. Even on Mr Simko’s numbers First Solar’s earnings autumn fairly sharply when the contest with Chinese manufacturers drives their ROE downwards to normal Chinese levels. That makes me to a greater extent than comfortable with my short. First Solar may non live a devastating failure but earnings volition autumn sharply together with the stock starts with a teens PE ratio…

Innovation together with the long-term time to come of First Solar

So far my declaration has been predicated on the silicon toll falling. At depression silicon prices First Solar becomes uncompetitive. The only existent query beingness how depression is low?

But First Solar tin go to a greater extent than or less competitive depending on how much they tin cut costs or increment efficiency versus their Chinese wafer-based competitors. First Solar has an ambitious target of reducing costs over the adjacent 4 years. I desire to repeat the slide on that cost reduction strategy.

Now I know yous have got seen this slide before… what yous likely did non notice is that it is not drawn to scale. The companionship plans to instruct 18-25 percent cost-per-watt reduction via efficiency – together with and only xv or so percent cost-per-watt reduction through everything else (plant utilization, scale etc). That makes feel because First Solar plants are already highly automated. Glass goes inwards i terminate together with almost-complete modules come upward out the other terminate with niggling human intervention. It is almost impossible to improve that manufacturing because it is already almost perfect!

So the only house they tin instruct their cost-per-watt downwards is yesteryear getting to a greater extent than watts-per-glass-sheet – that is improving efficiency. Efficiency is the core to First Solar’s roadmap to lower costs.

I volition live blunt. I exercise non think they tin exercise it. Efficiency is already 11.1 percent. If they instruct 21 percent out of efficiency – something similar a midpoint of their 18-25 – together with so they demand to instruct efficiency to 13.4 percent – together with they demand to exercise it over sixteen quarters. Efficiency must improve almost xv bps per quarter. Efficiency for the final half-dozen quarters was 10.7, 10.8, 10.9, 10.9, 11.0, 11.1 percent – something less than 10bps improvement per quarter. This is something which should asymptotically approach a theoretical boundary – together with yet First Solar is modeling that the charge per unit of measurement at which they improve efficiency volition increment for the adjacent 4 years. Maybe they tin exercise it – but trees exercise non grow to the sky.

Against this – what is driving the Chinese manufacturers is manufacturing efficiency as good as conversion efficiency. The Chinese processes are hard – involving sawing, lacing wires on wafers together with assembly. There are many to a greater extent than together with hard steps than First Solar’s sparse cinema process. That is bad for them instantly but provides opportunity. Chinese manufacturers are – if nosotros know anything virtually them – relentless inwards taking out costs.

So my guess is cost-per-watt volition autumn faster inwards the Chinese silicon manufacturers than inwards First Solar exactly because at that spot are to a greater extent than opportunities for manufacturing improvement.

Stephen Simko had the contrary view. He figured that sparse cinema is a novel engineering scientific discipline whereas wafers have got been unopen to for a long time. That agency that at that spot are to a greater extent than opportunities for conversion efficiency improvement inwards sparse cinema than wafers – together with he idea that would drive costs over time. I have got an response to that – 10.7, 10.8, 10.9, 10.9, 11.0, 11.1. But actually to instruct comfortable with that I desire to verbalize with a particle physicist who knows a lot virtually semiconductors. My cognition of (low energy) particle physics (and thence the machinery yesteryear which a sparse cinema semiconductor powerfulness work) is non much to a greater extent than than yous tin garner from Brian Cox’s fantabulous majority marketplace volume on Einstein together with the Standard Model together with a few other populist things (many from Mr Cox). On the interaction betwixt atomic sized gates together with the efficiency at which electrons tin live forced across a thin-film semiconductor layer I am – as yous powerfulness await – totally out of my depth…

So at that spot yous have got it – the whole First Solar affair modeled out. I think I am right – but sensible people accept the contrary view – together with i manufacture publication wants to write a slice virtually why they are brusk . If anyone tells yous this investing game is slow ignore them. This is tough – together with the bets nosotros accept occasionally fill upward us with angst.

John

Sometimes though nosotros brusk real companies. The beauty of a existent companionship inwards reject is that the earnings are non going to ascent sharply together with thence the stock is unlikely to go upward 5 plication rapidly. You tin safely accept a much bigger position. Influenza A virus subtype H5N1 4 percent brusk seat inwards a existent companionship has virtually as much working capital missive of the alphabet lead chances as an 80bps seat inwards a fraud. (It all the same has a lower expected return.)

At i phase our biggest brusk (indeed the 2nd biggest nosotros have got ever had) was First Solar. It is a much ameliorate companionship than nosotros commonly brusk - together with it was the non-fraudulent nature of the accounts that allowed us to accept such a large position. There was no way that the stock was doubling because at that spot was no way the earnings were rising sharply.

Alas earnings took some fourth dimension to autumn sharply. And nosotros carried the brusk for virtually a twelvemonth together with virtually broke even. It was non a fun experience because nosotros used capacity (capacity that would have got much ameliorate been allocated to Chinese frauds!) together with because it added to our misery during our worst yoke of months ever (in the middle of 2010) as the stock raced upward into the 160s. We were non brusk First Solar for the recent collapse inwards stock price.

Our analysis was non bad - non only accurate - together with the inaccuracies are painful when yous facial expression at them from eighteen months distant - but all-in nosotros were mostly right.

Except nosotros made no money. With a long early on is but early. With a brusk early on is manifestly wrong.

But but to wallow inwards the misery hither are the 2 key posts reprinted. They were long the firstly time. They experience interminable now. (Originals tin live found here together with here.)

John

Post 1: Why I am brusk First Solar

(The next is an extract from ’s client letter. I idea it deserved wider circulation. It also provides grist to Felix Salmon who described shorting – together with inwards the context yesteryear implication me – as socially useless. I think that was harsh – but non necessarily inwards this case. I volition write an article inwards the time to come on socially useful brusk selling.)

------------

Case study: our brusk on First Solar

Investing inwards engineering scientific discipline stocks has lots of traps for neophytes – together with by-and-large nosotros are neophytes so nosotros exercise non exercise real much of it. We all the same pass a lot of fourth dimension thinking virtually it primarily because nosotros are scared of what engineering scientific discipline tin exercise to other businesses. (The demise of many low-tech newspapers provides a goodness demonstration of why – as investors – nosotros should think virtually technology.)Technology offers value creation similar few other industries. In Commonwealth of Australia Cochlear has created enormous value together with improved the world. It tin literally plug a bionic ear into someone's brain-stem together with instruct them to hear. And the stock has paid virtually 20X – which is ameliorate than anything inwards our portfolio. Many of the biggest fortunes were made inwards technology. But engineering scientific discipline – together with specifically technological obsolescence has thrown many a fine companionship to the wolves. Palm for instance is probable to go bankrupt fifty-fifty though the concepts it pioneered are inwards everyone's pocket.

We exercise all the same have got a framework to hang unopen to our (limited) engineering scientific discipline investments. Influenza A virus subtype H5N1 technology, to live a actually groovy investment, must exercise 2 things. It must alter go of earth inwards a useful way – a large go of earth is ameliorate of course of study – but yous tin live surprisingly profitable inwards little niches. And it must maintain the contest out.

In engineering scientific discipline the contest is remorseless. In most businesses the contest powerfulness live able to exercise something as good as yous – together with it volition take away your excess profit. People volition build hotels for instance until everyone's returns are inadequate but non until everyone's returns are sharply negative. Even inwards a glutted marketplace a hotel tends to have got a argue to be – it silent provides useful service. And someday the glut volition go away so the hotel volition retain some value.[1] In most businesses the game is incremental improvement. If yous instruct slightly ameliorate yous tin brand some coin for a while. If the contest gets slightly ameliorate yous volition brand sub-normal returns until yous grab up.

In engineering scientific discipline the threat is ever that someone volition exercise something massively better than yous together with it volition take away your real argue for existence. Andy Grove – i of the most successful technologists of all fourth dimension (Intel Corporation) – titled his volume “Only the paranoid survive”. He meant it.

If your engineering scientific discipline is obsolete the terminate game is failure – ofttimes bankruptcy. Palm volition neglect because Palm no longer has a argue to exist. If nosotros hold off twenty years Palm volition live fifty-fifty to a greater extent than obsolete – but the hotel glut volition likely have got abated. Nothing left inwards Palm is probable to have got whatever substantial value. Businesses that produced plenty now, hit nada then.

Surprisingly, changing earth looks similar the slow bit. Plenty of companies exercise it. The problems are inwards keeping the contest out. Only a few exercise that (Microsoft, Google are ones that seem to). Hard drive makers changed earth (they allowed all that information storage which made things similar digital photography together with network multi-media possible). But they never made large profits – together with they merchandise at little fractions of sales.

The express engineering scientific discipline investments nosotros have got are non driven yesteryear whatever existent agreement of the technology. Sure nosotros endeavour – but if yous inquire us how to improve the Light Amplification by Stimulated Emission of Radiation etching on a solar panel together with so nosotros volition non live able to help. The driver of our investment theses inwards almost all cases is watching the competition.

Influenza A virus subtype H5N1 unproblematic representative is Garmin. We have got a small brusk seat inwards what is a real fine company. Garmin – in i lawsuit a little avionics companionship - led the mass-marketing of satellite navigation together with allowed John – without stress – to discovery his son's Sat sports game. Sat-nav it seems has saved many marriages together with meant that schoolhouse sports teams exercise non run brusk players because dad got lost.

Garmin has over a billion dollars cash on the residual canvas – together with that cash represents past profits. It has changed earth – together with thus far it has been good remunerated.

The only work is that they can't maintain the contest out. Nokia has purchased a mapping company. Iphone instantly has a Tom-Tom app, downloadable for $80 inwards Australia. Soon sat-nav volition live an expected application inwards every decent mobile phone. Google has mapping engineering scientific discipline also together with volition embed it into their android phone. Eventually the maps volition live given away because people powerfulness volume hotels using their sat-nav device whilst they are travelling. [It is darn useful to know where a decent hotel with a spare room is when yous are on the road.]

Garmin has a groovy product. They have got improved my world. The only work is that they can't sell their production at whatever toll that competes with “free”. Garmin's work concern is going the same administration as Palm. Bankruptcy all the same is only a remote possibility – they have got a billion dollars on the residual canvas together with unless they exercise something actually stupid on the way downwards they volition stay a profitable avionics business.

Is it fair that Palm is facing bankruptcy? Or that Garmin is beingness displaced? We don't think so – but together with so capitalism is non necessarily moral or fair – but it does hit goods together with services quite well. We don't invest on the ground of fair – nosotros invest to brand yous goodness returns.

The solar manufacture – together with the possible failure of the good

First Solar is a companionship that improved the world. It drove the cost of production of solar cells to quite depression levels together with made utility-scale solar farms feasible with only pocket-size subsidies. There are some places where solar is instantly feasible without subsidies.[2]Our biggest brusk seat though is First Solar – a companionship nosotros have got niggling but admiration for. There is a distinct possibility that First Solar's work concern volition neglect inwards the same way as Palm or Garmin. It won't live fair – but fairness has nada to exercise with it. Like Garmin it likely won't go bust because it has a billion dollars inwards liquid assets on the residual canvas – assets which stand upward for past profits.

Moreover nosotros suspect that First Solar's profits are virtually the same as the ease of the manufacture pose together. The stock silent trades with a high teens trailing price-earnings ratio – a fading growth stock. It hardly looks similar a failure. It is a foreign determination to come upward to. So nosotros should explicate how nosotros got there. To exercise that nosotros demand to explicate how a solar jail cellular telephone works.

How a solar jail cellular telephone works

To brand a solar jail cellular telephone yous demand 3 things.1). Influenza A virus subtype H5N1 pith which is excited (i.e. spits off electrons) when a photon hits it.

2). Influenza A virus subtype H5N1 layer which separates the electrons. This layer is commonly a “semiconductor” which agency that electrons go through i way together with cannot go back.

3). Something at the dorsum which conducts the electrons away.

Thin cinema versus wafer

Traditional solar cells were made with a semiconductor ingot cutting to a sparse sheet. On i side it was “doped” with a pith that kicks out electrons. The other side was laced with wires to behavior the electrons away. This was expensive.There were to a greater extent than ofttimes than non 2 types of ingot – monocrystalline – where the wafer construction was perfect or close perfect together with polycrystalline which had visible crystals inwards the wafer. Monocrystalline wafers are primarily used for calculator chips (where atomic storey imperfections are problematic) together with are expensive.

Polycrystalline silicon is cheaper. For most large-scale uses polycrystalline wafers were sufficient. These have got virtually a 17 percent conversion charge per unit of measurement – which agency that 17 percent of the photon release energy that strikes them is turned into electricity.

The ingot itself was a substantial go of the cost of a photovoltaic cell. Polycrystalline ingot used to sell for $450 per kg.

First Solar (and others) developed a procedure for making solar cells with considerably less semiconductor material. They have got a Cadmium Telluride procedure which vapor-deposits semiconductor at atomic storey thickness together with comes upward with a jail cellular telephone that is instantly exceeding an xi percent conversion ratio.

This companionship is a technological wonder. Glass goes inwards on i terminate of the manufacturing procedure together with comes out as solar cells at the other with adjacent to no human intervention. Labour is used only when it comes to putting frames unopen to the drinking glass together with for similar tasks.

This was revolutionary – it made inexpensive solar panels together with thence made possible commercial scale plants similar this 1.4 megawatt roof installation inwards Germany. This is plenty to provide a few hundred households – non world shattering – but a consummate revolution inwards the solar industry.

We tin think of few companies which have got pushed a engineering scientific discipline so far together with with such high environmental benefits. Companies similar this volition allow us to maintain a modern lifestyle whilst addressing greenhouse issues.

Still for all the benefits of First Solar’s cells, they are inferior inwards many of import ways to a polycrystalline cell. Their efficiency is lower – which agency yous exercise non instruct as much solar release energy off the constrained roof space. Secondly, whilst they salve a lot on the semiconductor go of the manufacturing procedure they have got to utilisation to a greater extent than glass, to a greater extent than wires etc to generate the same amount of solar electricity. Each jail cellular telephone generates less electricity also so inverters, connectors, installation all cost to a greater extent than with sparse film. Thin cinema also degrades over time. First Solar warrants their performance over their lifetime – but with the warranty beingness for lower levels of performance inwards the 2nd decade of functioning (google the Staebler-Wronski number for a non-trivial explanation). Thin cinema does all the same have got some advantages inwards depression low-cal - keeping a slightly greater proportion of their peak capacity.

Indeed the chief payoff of sparse cinema is cost – together with that cost payoff has been driven yesteryear the cost of the semiconductor component. After all ingot did cost $450 per kg.

That cost payoff made First Solar absurdly profitable – together with they used that turn a profit to grow into a behemoth. Revenue has grown from $48 1000000 to over $2 billion. Gross turn a profit (before selling together with administrative costs) has grown to over $1 billion. We exercise non desire to tell yous how far the stock ran for fearfulness of invoking insane jealousy. This stock would have got made Berkshire Hathaway shareholders jealous.

But call back – all of that was predicated on a cost payoff (almost all other things beingness inferior). And that cost payoff is predicated on expensive semiconductor material.

Competition cometh

To brand coin inwards engineering scientific discipline yous demand to exercise 2 things. Firstly yous demand to alter earth (which First Solar clearly did) together with secondly yous demand to maintain the contest out. Alas real few businesses instruct by the 2nd trick.The contest came inwards a yoke of forms. Firstly it came from Applied Materials. Applied Materials, or AMAT (as the companionship is known) is the most of import companionship inwards earth yous have got never heard of. It is the dominant maker of working capital missive of the alphabet equipment that goes into semiconductor factories together with it is thus the companionship that – to a greater extent than than whatever other – provides the kit to maintain Moore’s Law active.

AMAT has tried competing head-on with First Solar inwards the thin-film space. AMAT developed the vapor deposition equipment that made large-screen LCD televisions possible. This entails deposition inwards large sheets (5.6 foursquare meters) which are together with so cutting downwards into several large concealment TVs. An imperfection inwards the vapor deposition shows on the TV as a bad pixel.

AMAT appropriated this engineering scientific discipline for solar. The silicon semiconductor is non as efficient as First Solar’s Cadmium Telluride engineering scientific discipline – together with it is as dependent champaign to the Staebler-Wronski effect, all the same they tin exercise much larger panels than First Solar (with comparably lower wiring, inverter together with residual of organization costs). AMAT’s thin-film work concern could exercise some harm to First Solar – but it is unlikely to kill it. (Indeed AMAT appears to live de-emphasizing that work concern for the argue discussed below.)

Far to a greater extent than of import have got been developments inwards the wafer business. AMAT (often the protagonist) has developed wire saws for cutting wafers thinner together with thinner. They are instantly lxxx microns thick. These wafers are so sparse that they flutter downwards inwards air together with respite if held on their side. AMAT volition of course of study sell the whole kit for treatment these wafers – including Light Amplification by Stimulated Emission of Radiation etching fabric together with other steps inwards the manufacturing process. Much less semiconductor is needed inwards the wafer business.

But worse – the toll of ingot has fallen – together with spot prices are instantly $55 per kg – which is a lot less than $450. The cost of ingot is silent falling. First Solar’s payoff is only dependent on the fact that they utilisation much less semiconductor than wafers – an payoff that disappears only as wafer prices fall. At that dot all of First Solar’s many disadvantages volition smoothen through.

We are trying to piece of work out the cost-structures of the polycrystalline manufacturers – but it looks to us that the extra drinking glass together with other residual of organization costs that First Solar panels have got are getting unopen instantly to completely removing the payoff of depression semiconductor fabric usage.

If that happens though, First Solar is toast. It likely won’t file bankruptcy because it has so much inwards past profits to autumn dorsum on – but it volition live every fleck as obsolete as a Palm organizer is instantly or a Garmin motorcar navigation organization powerfulness live inwards 5 years.

We exercise non wishing failure on First Solar – together with if nosotros are right it could non have got happened to a nicer companionship (no irony intended). Capitalism is non fair – together with engineering scientific discipline investment is specially unfair.

We don’t brand coin from fairness. We brand coin from getting the work concern analysis right together with betting on (or against) the right work concern – together with inwards this representative nosotros are betting against the most successful companionship inwards a massively of import growth industry.

If nosotros are right (and nosotros think nosotros are) together with so nosotros volition brand coin from the demise of a companionship that has much improved the world. We similar to think our work concern is noble. And it is sometimes – but inwards this representative nosotros tin reckon why people dislike short-sellers. Their view all the same is non our business.

[1] Unfortunately the hotel is commonly mortgaged – together with the value ofttimes reverts to the debt holder.

[2] One way amuses us greatly. Walmart started putting solar cells on the rooftops of many of their super-centers inwards the Southern United States. They did this originally because of implicit subsidies. However the essay centers showed something quite interesting. Good solar panels plow quite a lot of the release energy hitting the rooftop into electricity which is conducted away. That release energy does non current of air upward as oestrus inwards the edifice – together with the cooling charge of the edifice went down. The rooftop solar installation may non have got been justified yesteryear the electricity output lonely – but combined with lower cooling bills it worked a treat. [Addendum. This footnote is anecdotal from goodness source rather than published... many people have got asked us virtually it - together with a few have got said they have got heard this assort of affair before but they would similar hard data... I apologize as I am unable to provide...]

Post 2: Kickback on First Solar

One of the biggest benefits I instruct from writing this weblog is that sometimes some real smart people disagree with me. In the investing work concern yous volition live incorrect often. The before yous realize that yous are incorrect the smaller (on average) your losses volition be. I don’t think the weblog tin movement markets through talking my book. (I disclosed a goodness declaration for shorting First Solar together with the stock went up!) But I exercise think that kick-back from smart people tin assist cut my losses when I am wrong. Believe me that is ofttimes enough! If all that the weblog delivers me is smart people who disagree with me together with so I volition current of air upward beingness a well-paid blogger (and my clients volition live grateful)!

I got a lot of kick-back on my First Solar slice – some of which makes me to a greater extent than nervous virtually the brusk – together with some of the kick-back is from people who are very smart. I idea I ought to lay this kick-back out at to the lowest degree inwards go to instruct my ain thoughts straight.

One of the solar manufacture merchandise publications asked my permission to republish the slice – which I have got granted. They also warned that they powerfulness have got a follow-up slice titled: “Why I am brusk ”. That ought to pose us inwards our place! I have got yet to reckon that slice – but honestly I facial expression forrard to it (even though reading it volition live painful). It may convince me that I am incorrect – inwards which representative I volition embrace my brusk forthwith!

The ground for the kickback I have got received

The core to my declaration was that First Solar has disadvantages (notably lower conversion efficiency) offset yesteryear a yoke of advantages – notably keeping higher generation inwards depression light, less sensitivity to angle of low-cal – together with most importantly – lower cost.

My view was that lower cost would create upward one's heed almost everything. Solar modules are fundamentally a commodity – together with whilst the low-light advantages were existent – they could easily live overwhelmed yesteryear cost.

I together with so made an assertion – which I did non dorsum – that the cost construction of wafer-based cells volition live competitive against CdTe (First Solar) cells when the polysilicon toll gets depression enough.

Most – but non all – of the kick-back I have got received is based unopen to this cost construction issue. This falls into 2 camps. Firstly they assert that I have got the cost structures of the competitors wrong. Secondly they property that First Solar volition cut costs plenty to offset the payoff that wafer-module-manufacturers instruct from lower silicon prices.

The other kick-back I have got received is on the sales-and-marketing department. First Solar has – according to customers – yesteryear far the best sales force. “They are a machine!” First Solar they think that this volition allow First Solar to move good for longer than I powerfulness anticipate. Moreover they idea First Solar’s average selling toll would stay high because FSLR has presold a lot of modules to solvent utility scale operators – notably EDF inwards France.

In this post I examine these issues with the aim of getting my ain thoughts direct (and hopefully invoking to a greater extent than kick-back from to a greater extent than people that are smarter than me).

A cost model for polysilicon producers

Polysilicon has several disadvantages vis CdTe technology. First the materials are to a greater extent than expensive (wafers are thicker than sparse film) – but but as importantly the manufacturing procedure is much to a greater extent than complicated. At First Solar drinking glass goes into the flora together with comes out – virtually 3 hours afterwards – as an almost consummate module. Human involvement is minimal. Wafers all the same require to a greater extent than manufacturing – they are sawn – they have got breakage rates – they are laced with wires to behavior the electricity away – together with they are “assembled”. Manufacturing cost are higher.

That said nosotros tin create a unproblematic cost model for wafer manufacturing from comments made yesteryear competitors. YingLi – a Chinese module maker – made the next comment inwards their fourth quarter conference call:

In the 4th quarter, our non-polysilicon costs including depreciation farther decreased to $0.76 per watt from $0.81 per watt inwards the 3rd quarter together with $0.86 per watt inwards the 2nd quarter together with $0.90 per watt inwards the firstly quarter of 2009. This decrease demonstrates our rigid R&D capabilities, together with execution capabilities to continuously improve the yield rate, champaign conversion efficiency charge per unit of measurement together with operational efficiency.Now YingLi is a goodness (meaning depression cost) Chinese producer. It has terrible blended costs – but that is because it purchased silicon at high prices together with its blended silicon costs are also high. But these costs exercise non seem incorrect relative to competitors. [Inventory problems are surprisingly mutual inwards the manufacture as people hoarded polysilicon to avoid excessively high spot prices together with injure upward with huge inventories as the toll collapsed.] The affair that is most notable virtually this is how fast the non-silicon costs have got been falling – the sequence yesteryear quarter is 90c, 86c, 81c, 76c. This is roughly 4c per watt per quarter. It is of course of study impossible to know how far this volition go along to autumn – diminishing returns to engineering scientific discipline together with manufacturing reports volition eventually occur. But for the minute nosotros tin accept 76c and falling fairly fast (roughly 4c per quarter) as the non-silicon costs for diverse manufacturers. [Contra: slide 8 inwards Suntech’s latest quarterly presentation gives a much lower non-silicon price. That slide is so “out-there” different I tend to dismiss it – though if anyone has a clear explanation I would similar it.]

The blended cost of polysilicon continuously decreased yesteryear the mid-teens inwards the 4th quarter. I would similar to emphasize in i lawsuit again that Yingli has instantly provided long-term (inaudible) provisions to write-down inventory costs or polysilicon prepayments the challenging 4th quarter of 2008.

Solar wafers used to require vii grams of silicon per watt. Some manufacturers run at virtually 6.2 grams of silicon per watt – with 180 micron silicon. Applied Materials verbalize virtually lxxx micron thick silicon wafers – though silicon utilisation for those wafers is non reduced yesteryear 80/140 because wire saw (kern) losses are similar regardless of wafer thickness. Also as wafers instruct thinner they have got higher breakage rates (and the incentive to cutting wafers thinner is lower as silicon prices fall).

Its likely fair plenty to utilisation 6.5 grams of silicon per watt as the right number for modeling a silicon wafer module producer. The 6.5 grams is falling together with inwards 5 years it may live 5 grams (if AMAT manages to sell to a greater extent than of their kit). Ok – but at 6.5g (or 0.0065 kg) per watt together with so the cost construction is slow to model…

YingLi cost per watt (in cents) = 76 (less whatever efficiency they instruct from manufacturing improvements) addition silicon toll (in cents per kg) * 0.0065.Now I am going to accept a wild stab at what the number volition live yesteryear June 30. My guess is that spot silicon volition live $40 per kg together with the 76c volition live reduced to say 71 cents (which is silent falling but yesteryear less than the 4c per quarter which the cost has fallen). This gives a cost per watt yesteryear the middle of this twelvemonth of 97 cents. Polysilicon costs go below the magic dollar per watt!

Obviously this is highly dependent on the silicon toll – a $20 silicon toll would brand the cost 13c per watt cheaper – say 84 cents per watt. Influenza A virus subtype H5N1 $100 silicon toll takes cost per watt to $1.41.

Cost is also dependent on YingLi (and presumably the other commodity panel makers) getting efficiencies inwards the production of modules although at a reasonable clip – though as noted, I model a charge per unit of measurement below the historic charge per unit of measurement of cost improvement.

[I should discovery hither that Trina Solar – some other Chinese manufacturer – gives their non-silicon costs at 78c per watt – 2c to a greater extent than expensive than YingLi inwards the 4th quarter. Trina’s cost reductions are also virtually 4c per quarter… See page 8 of their quarterly presentation.]

This cost model is fraught. The accounting of many of the Chinese players is hard to decipher. One mortal I have got talked to suggests that most other players are way higher upward 78c per watt inwards non-silicon costs (although contest volition instruct them at that spot or forcefulness them out of work concern replaced yesteryear people who are at that level). They idea YingLi would live at 70c yesteryear the terminate of 2010. Against this the same mortal idea my grams per watt was also high (suggesting 6 grams per watt based on 180 micron thick wafers) together with they idea that YingLi would live at 5.5 grams per watt yesteryear the terminate of the year. This is to a greater extent than or less a launder – with wafer costs a niggling lower than my jurist but base of operations costs winding upward a fleck higher. Again all of this stuff is fraught – together with although these broad numbers are non controversial the terminate competitiveness of First Solar is surprisingly sensitive to fine differences inwards base of operations cost together with silicon costs of their competitors.

What is the cost construction of First Solar?

First Solar has set out ambitious plans to increment the efficiency of their cells together with to farther cut costs. I exercise non desire to go through those inwards item – but I think nosotros tin extract 2 key charts from the last presentation. First slide thirteen – which has the cost per watt falling silent – but at decreasing rates. The cost-per-watt has fallen yesteryear 1-2 cents per quarter for the final yoke of quarters (versus 3-5 cents for the non-silicon costs at YingLi).

Then at that spot is the less-specific presentation from their “roadmap” (see slide 14) which shows their 2014 target cost per watt.

I wishing I understood how all of these gains were probable to live achieved – but they think they tin instruct to 52-63 cents per watt yesteryear the terminate of 2014. However – for the minute I assume that they tin encounter their cost target together with instruct to 58c per watt (a reasonable midpoint) yesteryear the terminate of 2014.

That cost per watt reduction is 26c over sixteen quarters – or 1.625 cents per quarter – roughly the charge per unit of measurement at which costs have got been falling historically.

Figuring that the were at 84c per watt during the 4th quarter of 2009 – together with they are reducing costs yesteryear 2c per watt per quarter (that is a niggling faster than historic together with slightly faster than their roadmap) costs volition live virtually 80c per watt per quarter yesteryear the June quarter of this year.

A raw cost comparing – with the toll of silicon beingness the chief variable

With the trusty spreadsheet I tin hit a reasonable cost-per-watt comparison…