Big Money: Visit The Humble Soybean

I'm tellin' ya, this Colby Smith is i to give-up the ghost on an oculus on.

From FT Alphaville:

From FT Alphaville:

In but 2 weeks time, President Trump in addition to Chinese leader Xi Jinping are laid to run across inwards sunny Buenos Aires, Argentine Republic for the G20 summit. Whether the 2 heads of province tin move exit amongst a deal inwards hand to tame the merchandise country of war is anyone's guess, but soyabean farmers are belongings out hope.

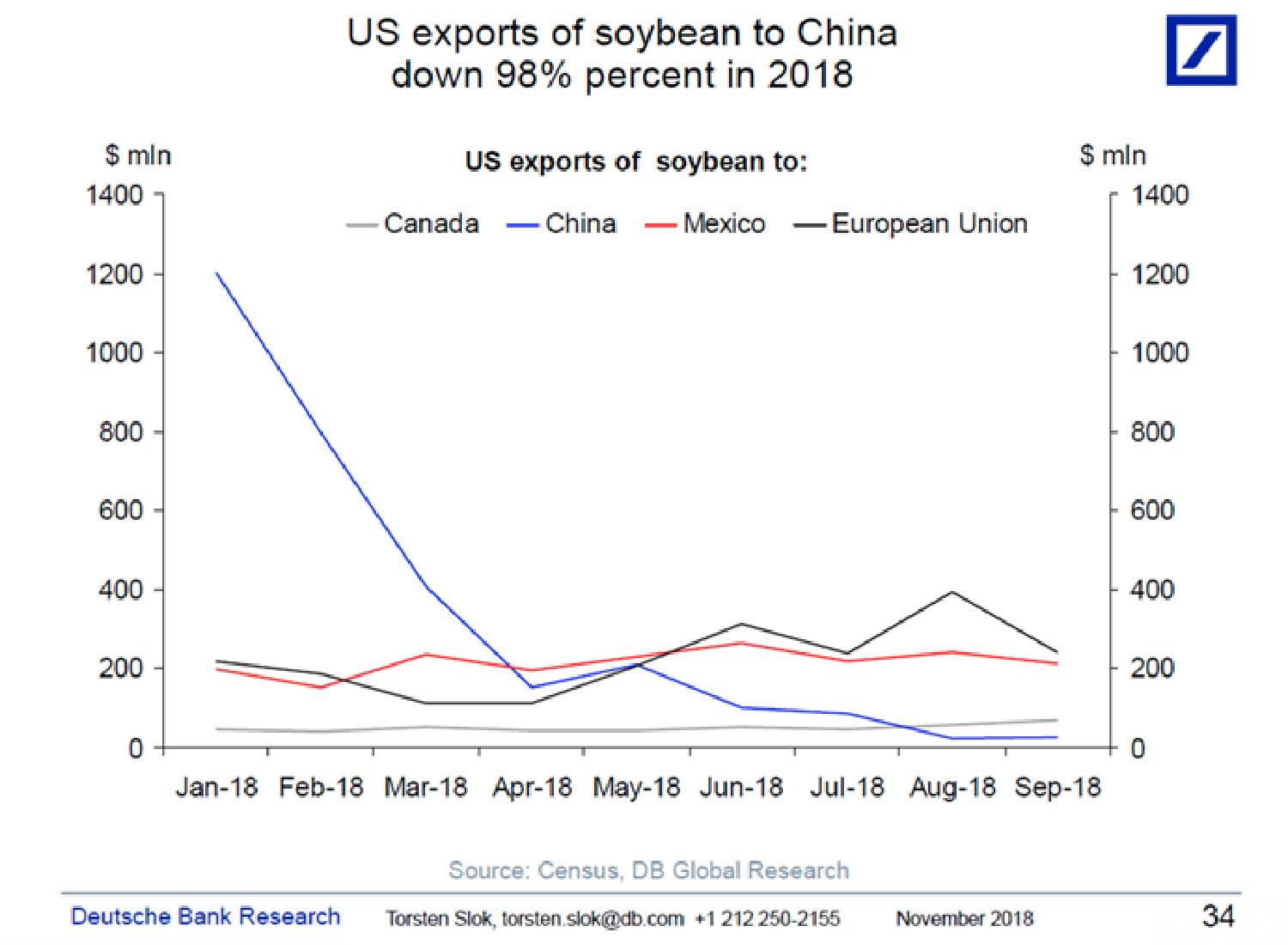

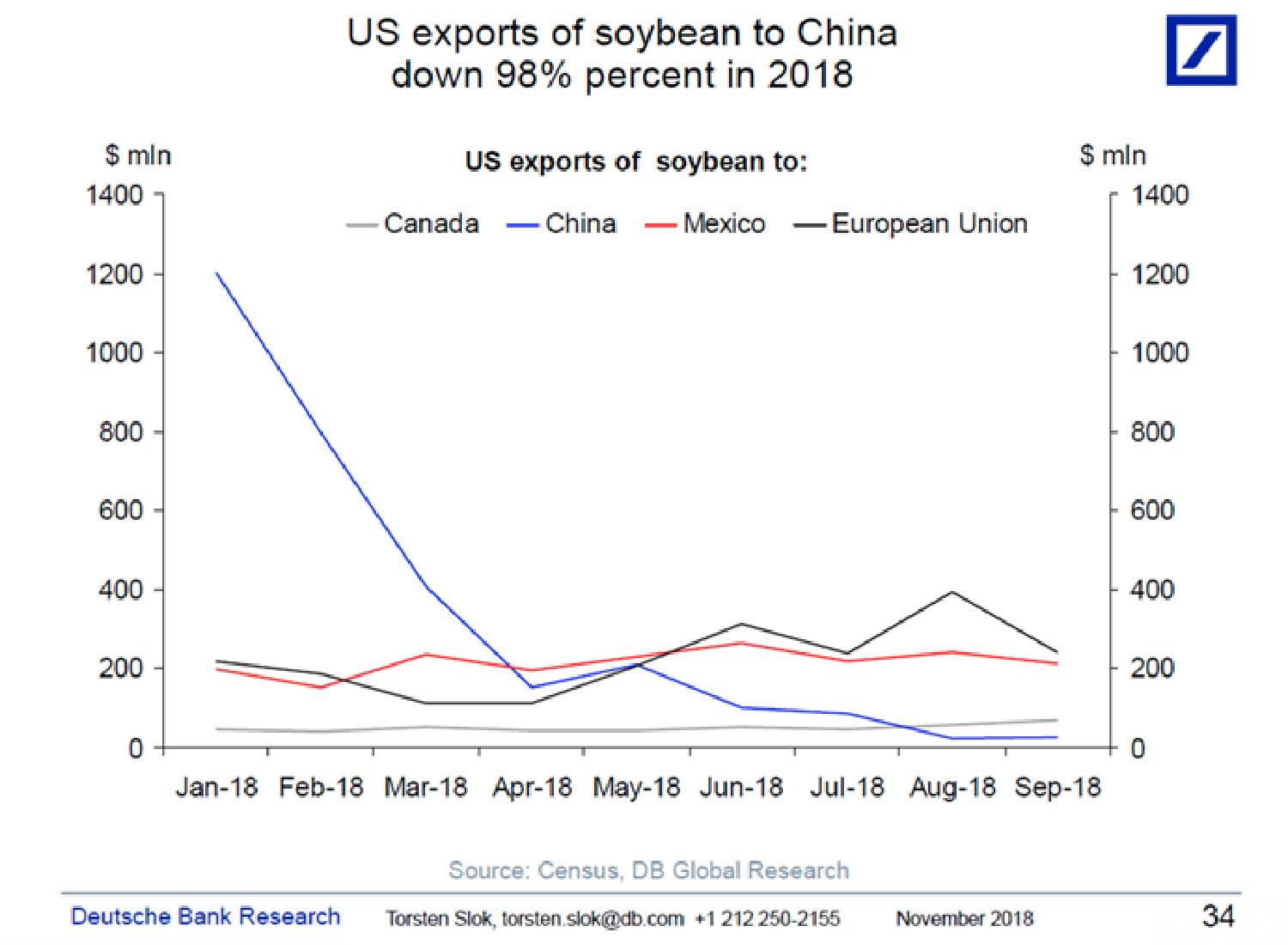

Deutsche Bank's Torsten Slok issue an alarming nautical chart Friday, showing the absolute cratering of United States of America soyabean exports to Communist People's Republic of China this year. Since January, United States of America shipments of the legume stimulate got fallen 98 per cent:

For the farmers who harvest the crop, their more or less destroyed every bit the merchandise country of war racheted up.

The United States of America has imposed tariffs on $250bn worth of Chinese imports in addition to has threatened to jack upward the rate, from 10 per cent to 25 per cent, on $200bn of that full inwards January, should Communist People's Republic of China retailitate further. Already, Communist People's Republic of China has levied duties on $110bn worth of United States of America imports, or roughly 85 per cent of what comes into the province from the States.

For Citi's Aakash Doshi, the worst may inwards fact hold upward over. At to the lowest degree that's what soyabean toll differentials enjoin him. Communist People's Republic of China purchases 2 out of every 3 soyabean bushels available for unusual trade, in addition to the United States of America in addition to Brazil sell almost 85-90 per cent of the soyabeans that Communist People's Republic of China imports, says Doshi. So the toll of United States of America Gulf Coast soybeans for export, compared to the FX-adjusted soyabean export toll at major Brazilian ports, tin move enjoin us a lot almost the condition of the ongoing merchandise negotiations....Global Macro: There Are Many Ways To Approach It, Here's Influenza A virus subtype H5N1 Good One

Influenza A virus subtype H5N1 dyad weeks agone I emailed a friend:Re: posts on moneyYears agone i of the mentors said you lot tin move approach macro from a lot of starting points, for him it was bonds, he had internalized the price/interest charge per unit of measurement teeter-totter to the betoken that if the other parts of the matrix, currencies or metals or equities, whatever, didn't gibe the epitome he'd know he was looking at either danger or opportunity.So if person who is doing the grunt function says en passant "beans may stimulate got bottomed" it may behoove the consumer of data/information/knowledge/wisdom to stimulate got greenback in addition to hold upward aware something mightiness stimulate got changed in addition to the game may hold upward afoot:I can't become in addition to thus far every bit to country they are all fungible but along amongst empirically derived lead/lag times, grit inwards the gears/slippage inefficiencies in addition to leverage it's a unopen plenty first approximation to purpose every bit a mental model.The fundamental is to stimulate got plenty exposure to your champaign of written report that your agreement is innate, that you lot don't stimulate got to consciously mean value "Now when involvement rates become down, bonds become up". When you've achieved this score of mastery you lot right away feel when the presented facts aren't conforming to the mental model in addition to may hold upward worth farther scrutiny.

Another agency inwards to global macro is commodities in addition to if this is your selection it helps to internalize curves to the betoken the dangers/opportunities pop when you lot hold off at them.

Permit me to introduce Izabella Kaminska, writing at FT Alphaville:...

Huh.

No comments