Gavekal: Bubble 3.0: The Upside Of Downside (Chapter 7)

Not ch. 7 of the United States of America bankruptcy code, rather,the latest inwards the multi-part Evergreen Gavekal exposition.

From Evergreen Gavekal, Nov 30:

From Evergreen Gavekal, Nov 30:

...The hurting before the gain.

Because I’ve been inwards the investment trouble concern longer than a lot of EVA readers accept been alive, I tin strength out personally attest that bull markets are much to a greater extent than fun than bear markets. On that point, this bull has been stomping for so long that many fiscal professionals accept never seen a deep in addition to lasting bear market. Recently, I met alongside a brilliant immature broker from 1 of the leading Wall Street firms who has been “in the business” for 5 ½ years. He was shrewd plenty to acknowledge he had no thought what it would live similar to live through a serious marketplace seat decline, in addition to he was also wise plenty to realize he would accept to—possibly sooner than later.

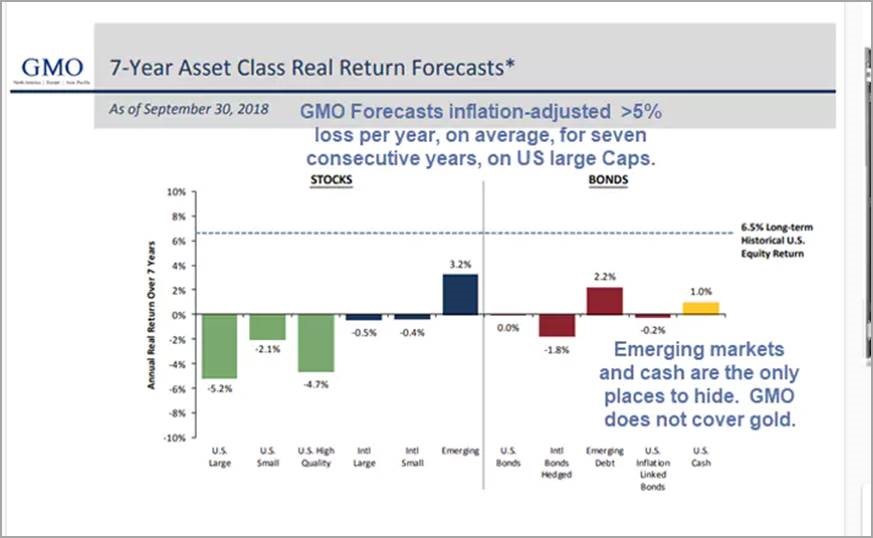

Previous EVAs accept oft cited the long-term render forecasts past times the Boston-based coin administration giant, GMO. As the S&P has steadily risen from undervalued dorsum inwards 2009 to fairly valued past times 2012 to overvalued past times 2014 to extraordinarily pricey past times the summertime of this year, GMO has methodically lowered their render expectations over the side past times side vii years. The argue you lot should attention nigh what GMO has to say on this discipline is because they accept 1 of the finest forecasting records in, in 1 trial again, “the business”.

Per the below chart, their forecast through 2025 is rather sobering reading. Even though these are real, or after-inflation, numbers the implications, if they’re right, are enormous. This is peculiarly truthful for the tens of millions of Baby Boomers who need to live on the fruits of their portfolios.

Source: GMO equally of 9/30/2018

As you lot tin strength out see, what they are projecting is anything but fruitful. Essentially, alongside a 50/50 mix of United States of America stocks in addition to bonds, GMO is looking for unopen to a 2 ½% average annual negative return, inclusive of inflation.

One of Warren Buffett’s classic adages, “Be fearful when others are greedy in addition to greedy when others are fearful” is predicated upon a crucial in addition to rather obvious notion: you lot need to accept cash on-hand to capitalize on others’ fears. But often, people driblet dead besides complacent during blast times in addition to allow their working capital alphabetic quality to rest inwards investment sectors, areas, or property classes that are means beyond their sell-by date. Moreover, in that location is a rigid in addition to highly destructive vogue to displace funds from underperforming vehicles into the hottest areas which so sets the phase for actual losses in 1 trial the sky-rocketing sector, style, or stock inevitably succumbs to the laws of gravity.

If in that location is a devil-like beingness at operate inwards the fiscal world, 1 of his nastiest tricks is making the most unsafe (i.e., grossly over-priced) property classes aspect irresistibly attractive. Often, these slices of the investment universe accept been generating outrageous returns for several years. The activity inwards tech stocks dorsum inwards the belatedly 1990s was a graphic, though long ago, illustration of this. More recently, it has been the relentless rising inwards the S&P 500, alongside nary a unmarried downward twelvemonth for nearly a decade. (As I write these words, inwards belatedly Nov of 2018, this streak is inwards jeopardy. However, there’s all the same a practiced run a risk nosotros volition run into 10 consecutive up-years inwards the United States of America stock marketplace seat for the kickoff fourth dimension inwards recorded history—going all the means dorsum to when shares were traded nether a Buttonwood tree inwards New York shortly after the Revolutionary War.)

Bull markets, especially when they are peculiarly powerful and/or long-lasting, create a province of affairs where investors driblet dead afraid to sell. We humans accept been programmed over the eons to pursue activities which render an immediate vantage in addition to avoid those that range near-term hurting or disappointment. That reality has helped us endure endless adversities (why it is nosotros maintain voting for our feckless politicians would seem to live an exception to this rule). It goes against every helix of our deoxyribonucleic acid to push clitoris out of an activity that’s earning coin fifty-fifty when wisenheimers similar this writer trot out a copious collection of charts in addition to graphs to present that the S&P 500 circa belatedly 2018 is dangerously inflated.

Thus, inwards a way, late-stage bull markets driblet dead similar an elaborate con job. Perhaps some older readers of this newsletter mightiness recollect the entertaining cinema from the early on 1970s, starring Paul Newman in addition to Robert Redford, “The Sting”. Messrs. Newman in addition to Redford played thoroughly likeable con men who came upward alongside an elaborate scheme to bilk a rich criminal offence boss, played past times Robert Shaw. The commutation to making their ploy operate was to permit their score win. Once he banked a bunch of tardily money, he was ripe for the plucking.

And so it goes alongside investors. When we’re sitting on years in addition to years of double-digit gains, nosotros driblet dead convinced that: A) the marketplace seat is condom in addition to B) the high returns volition continue. As I’ve written before, inwards these situations investors human activity equally though the lavish profits they’ve “earned” inwards recent years are somehow securely inwards the bank. They lose sight of the historical fact that returns during late-stage bull markets are nigh equally lasting equally a politician’s drive promises. In reality, those gains tend to live wiped away almost overnight in addition to the to a greater extent than inflated the marketplace seat has become, the to a greater extent than years of “in the bank” gains are all of a abrupt repossessed.

Frankly, most of the foregoing has fallen on deaf ears—until recently, that is, starting inwards early on Oct to live specific. While no 1 could rightfully telephone telephone what happened inwards Oct of this twelvemonth a crash, or fifty-fifty a crashette, it nonetheless has catalyzed some serious repricing of risk. Additionally, it got me in 1 trial once to a greater extent than thinking dorsum to some other October, 31 years ago.

Flash crash flashback.

As noted inwards before Bubble 3.0 chapters, the 1987 crash was the kickoff fourth dimension that computers played a starring purpose inwards a major marketplace seat collapse. Since then, of course, we’ve seen a set out of those computer-driven cliff dives, although they’ve been express to, hence far, the “flash crash” variety. These now-you-see-them, now-you-don’t panics happened inwards 2010, 2011, in addition to 2015. In the latter instance, during August of that year, 1 ironically classified “low-volatility” ETF plunged 43% inwards less than an hour!!!

Today, equally nosotros all know, or at to the lowest degree nosotros should, computer- or algorithm-based trading is dominant to a far greater grade than it was inwards 1987. Estimates are that these forthwith stand upward for 80% to 90% of New York Stock Exchange volumes. What is less good understood is that these systems mostly don’t travail to anticipate the future, equally fiscal markets typically accept inwards the past.

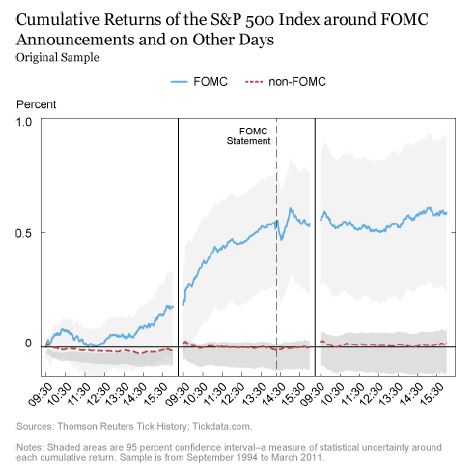

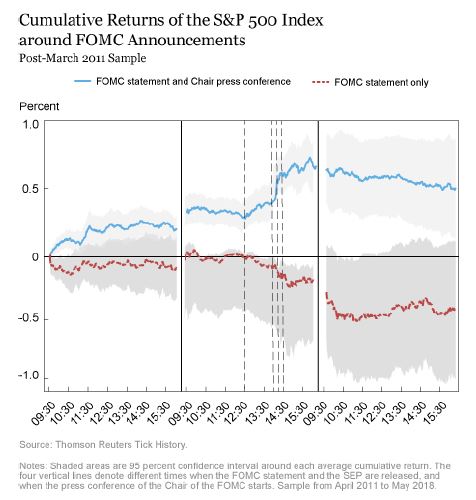

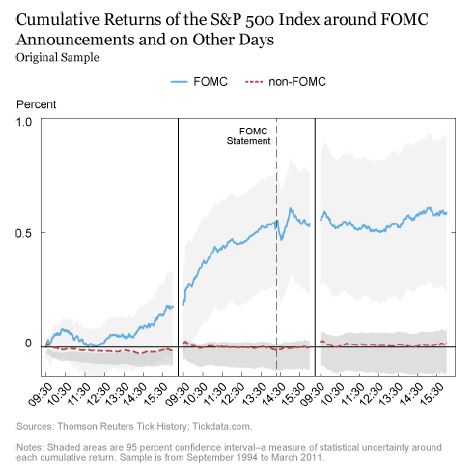

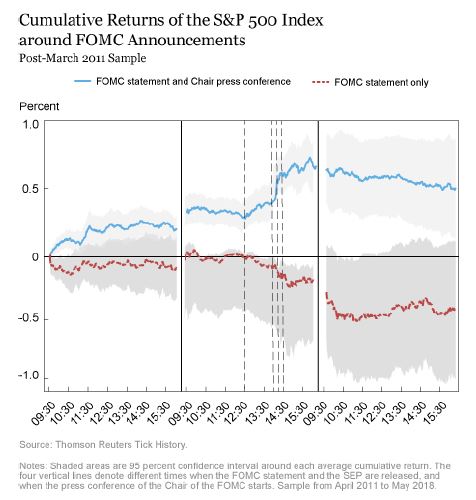

For example, if certainly words inwards Fed press releases accept led to marketplace seat rallies, the same human relationship is projected past times the machines to plow over off again. One fascinating factoid inwards this regard is how much to a greater extent than the marketplace seat has risen, similar 80% of all returns, on Fed press conference days—even if those brought charge per unit of measurement hikes—than it has the residuum of the time. But don’t inquire me to explicate why. My alone insight is that it only shows that perhaps the alone strength driving the stock marketplace seat these days that is to a greater extent than powerful than the “algos” in addition to computers is the Fed.

Source: Liberty Street Economics equally of 11/26/2018

This is definitely non how markets formerly behaved. As the celebrated economist Paul Samuelson in 1 trial quipped, the stock marketplace seat at 1 fourth dimension had discounted ix of the final v recessions. In my opinion, the enormity of this shift has non been fifty-fifty unopen to fully appreciated. Most investors, inwards my view, driblet dead along to believe the market’s discounting machinery is largely unchanged. Yet, equally my shrewd partner Louis Gave--founder of the acclaimed institutional query theater Gavekal---has repeatedly pointed out, this is decidedly non the case. Rather than a marketplace seat driven past times myriad individuals spending endless hours analyzing economic, corporate, in addition to geopolitical information, most of the movements these days are caused past times the means inwards which computers react to electrical current word events. This is non to say query isn’t all the same conducted but rather that it is overwhelmed past times computerized-trading and, of course, passive investing.

It’s mutual noesis that the active investing community has been losing hundreds of billions, if non trillions, to its passive counterparts over the past times 2 decades. The nautical chart below makes that abundantly clear, courtesy of Ned Davis, founder of his eponymous firm....MORE

No comments