Volatility Together With The Foursquare Rootage Of Time

An oldie exactly goodie.

From Six-Figure Investing, Mar. 10, 2017:

...MORE

From Six-Figure Investing, Mar. 10, 2017:

It’s non obvious (at to the lowest degree to me) that volatility theoretically scales alongside the foursquare origin of fourth dimension (sqrt[t]). For representative if the market’s daily volatility is 0.5%, hence the volatility for 2 days should endure the foursquare origin of 2 times the daily volatility (0.5% * 1.414 = 0.707%), or for a five hateful solar daytime stretch 0.5% * sqrt(5) = 1.118%.

This human relationship holds for ATM selection prices too. With the Black as well as Scholes model if an selection due to expire inwards xxx days has a toll of $1, hence the lx hateful solar daytime selection alongside the same hit toll as well as implied volatility should endure priced at sqrt (60/30) = $1 * 1.4142 = $1.4142 (assuming goose egg involvement rates as well as no dividends).

Underlying the sqrt[t] human relationship of fourth dimension as well as volatility is the supposition that stock marketplace returns follow a Gaussian distribution (lognormal to endure precise). This supposition is flawed (Taleb, Derman, as well as Mandelbrot lecture us on this), exactly full general practise is to assume that the sqrt[t] human relationship is unopen enough.

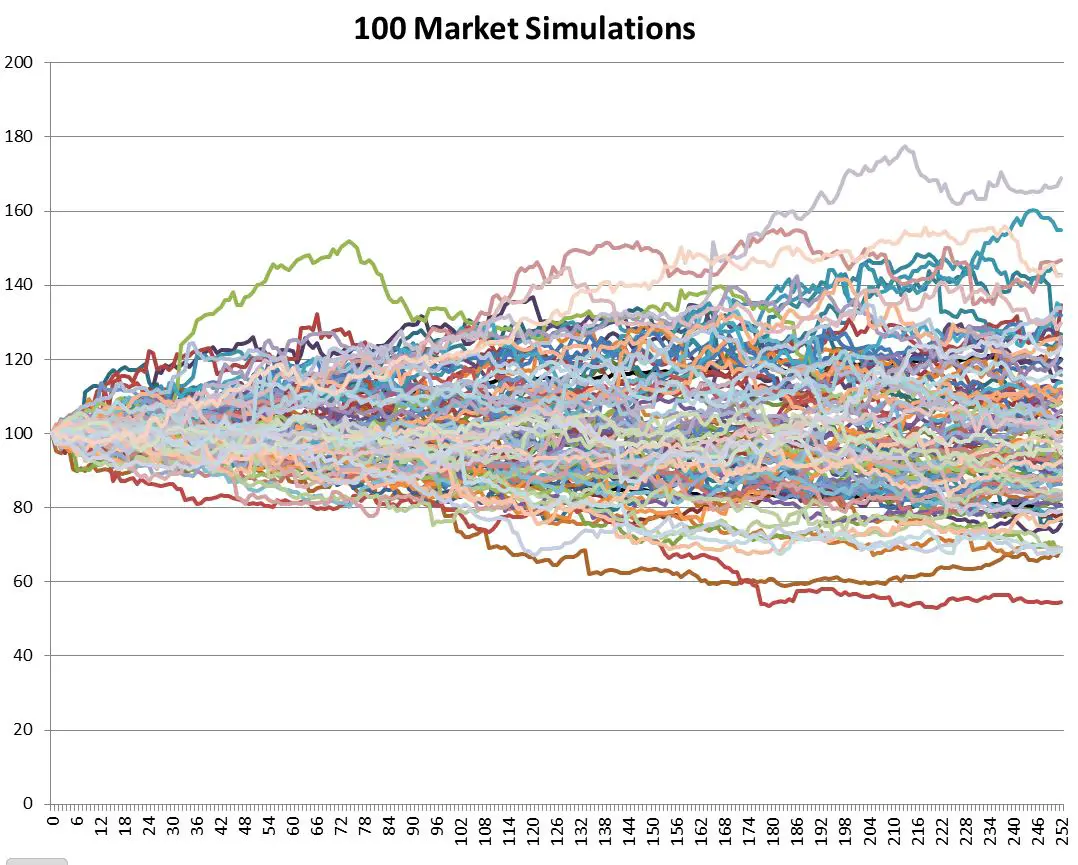

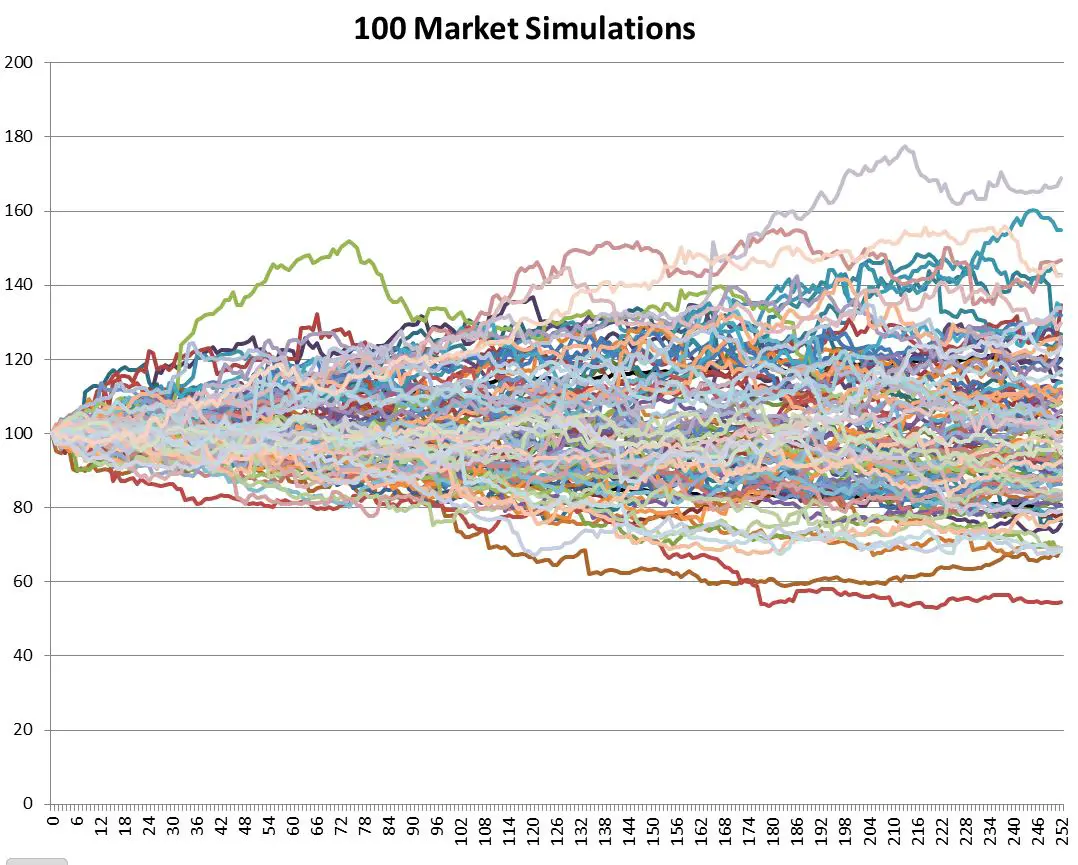

I decided to examine this human relationship using actual S&P 500 data. Using an Excel based Monte-Carlo simulation1 I modeled 700 independent stock markets, each starting alongside their index at 100 as well as trading continuously for 252 days (the typical position out of USA trading days inwards a year). For each hateful solar daytime as well as for each marketplace I randomly picked an S&P 500 provide for a hateful solar daytime somewhere betwixt January 2, 1950 as well as May 30, 2014 as well as multiplied that provide addition 1 times the previous day’s marketplace result. I hence made a pocket-size correction past times subtracting the average daily provide for the entire 1950 to 2014 catamenia (0.0286%) to compensate for the upward climb of the marketplace over that fourth dimension span. Plotting 100 of those markets on a nautical chart looks similar this:

Notice the outliers inwards a higher house 160 as well as below 60.

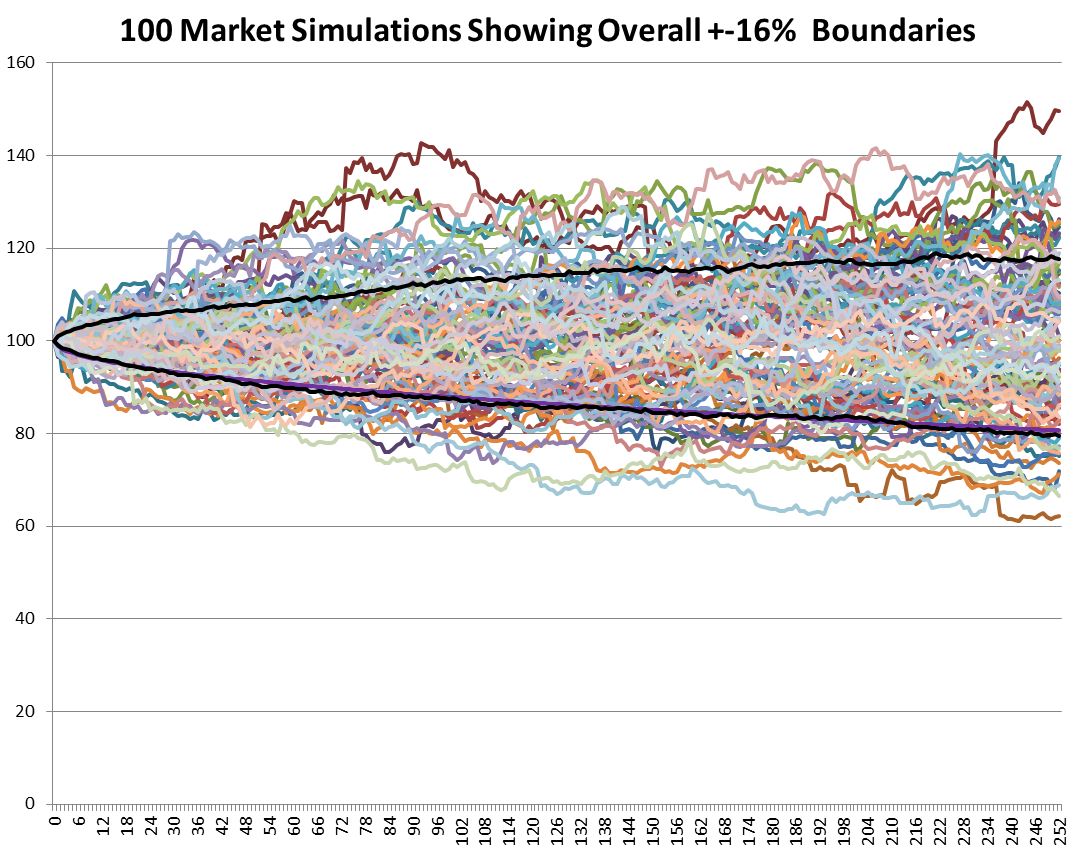

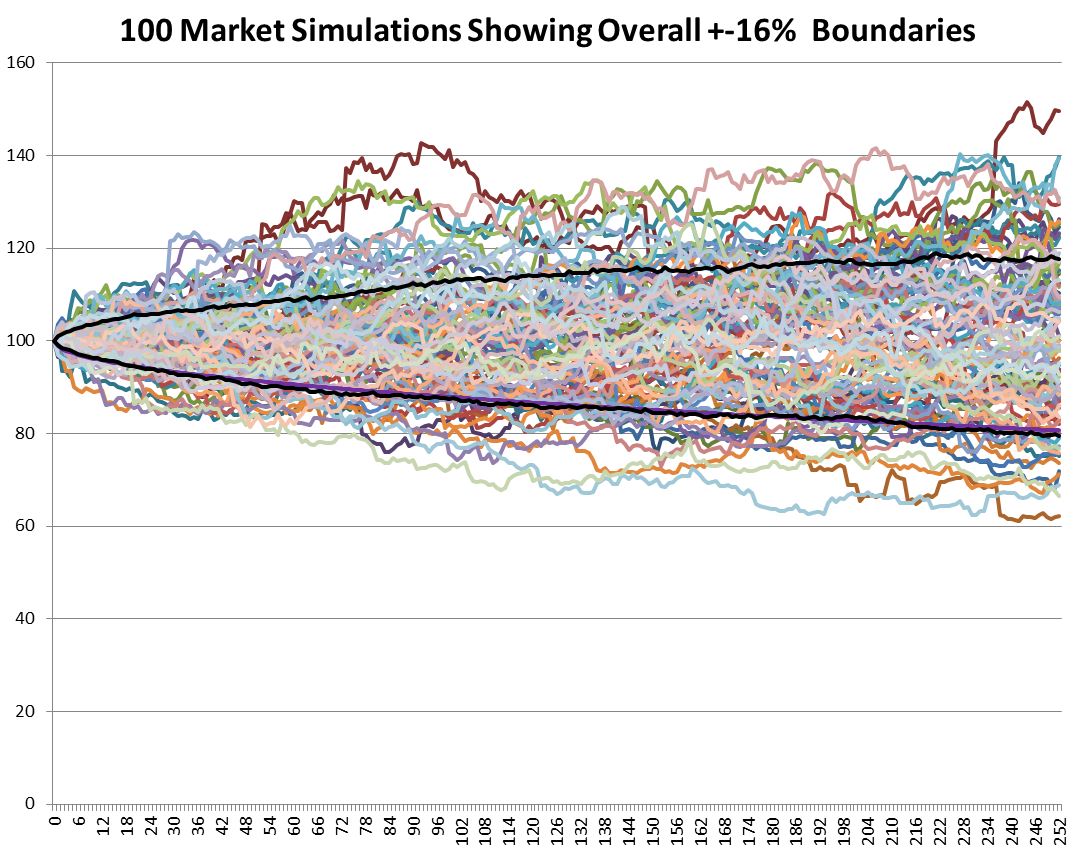

Volatility is unremarkably defined every bit beingness 1 criterion divergence of the information set, which translates into a plus/minus percent attain that includes 68% of the cases. I used 2 handy Excel functions: large(array,count) as well as small(array,count) to provide the boundary outcome betwixt the upper 16% as well as the residual of the results as well as the lowest 16% for the total 700 markets beingness simulated. The 16% comes from splitting the remaining 32% exterior the boundaries into a symmetrical upper as well as lower half.

Those results are plotted every bit the dark lines below.

...MORE

No comments