The Effectiveness Of The Depository Fiscal Establishment Of Japan’S Large-Scale Stock-Buying Programme

The whole sentiment of a fundamental banking concern buying equities is abhorrent. More after the jump.

From VoxEU, October:

Here's an illustration from Feb. 2008 (i.e. pre-LEH et al):

Doom in addition to Gloom: What Can the Federal Reserve Do?

Again, ii answers. 1) It's definitely something Central Bankers direct maintain sentiment about. 2) The Fed may demand some enabling legislation which they would in all likelihood instruct if they requested it.

"Central Banks Load Up on Equities every bit Low Rates Kill Yields"

First they purchase upwards all the prophylactic assets. Then they start buying into an already shrinking puddle of stocks (Equities: The Wilshire 5000 is Down to 3687 Stocks) then...

I'm non certain I similar where this is going.

From VoxEU, October:

The Bank of Nippon has bought massive quantities of Japanese stocks inwards a bid to growth aggregate demand in addition to inflation, in addition to to encourage Japanese savers to accept on to a greater extent than risk. This column surveys the effectiveness of this quantitative easing programme in addition to identifies several key issues, including stock prices non rising inwards proportion to profits, the overvaluation of some small-cap stocks, in addition to adverse impacts on corporate governance. It argues that earlier taking whatever steps toward monetary policy normalisation, the Bank of Nippon should innovate flexibility inwards interpreting the 2% toll stability target.

For years, the Bank of Nippon (BOJ) has bought Japanese stocks every bit component division of its massive monetary easing programme to elevator the province out of deflation, in addition to striking a 2% toll stability target (Nangle in addition to Yates 2017). Under Governor Haruhiko Kuroda’s Quantitative in addition to Qualitative Monetary Easing package, stock-buying was begun every bit a monetary easing tool – inwards Apr 2013 at a footstep of nearly ¥1 trillion annually, expanding to nearly ¥3 trillion inwards Oct 2014, in addition to farther to nearly ¥6 trillion inwards July 2016 (Shirai 2018a). The purpose was to growth aggregate demand in addition to therefore inflation, every bit good every bit to encourage Japanese savers to accept on to a greater extent than gamble past times buying equities.

Unprecedented stock purchases every bit an monetary easing toolThe electrical flow exchange-traded fund (ETF) purchases are dissimilar from the past times ii practices conducted past times the BOJ where banks’ stocks were purchased straight for fiscal organisation stability purposes – inwards 2002–2004, when Nippon suffered a domestic banking crisis, in addition to inwards 2009–2010, during in addition to after the Global Crisis. The BOJ purchased stocks worth entirely nearly ¥2 trillion inwards 2002–2004 in addition to nearly ¥400 billion inwards 2009–2010.

Some fundamental banks produce purchase unusual stocks in addition to ETFs every bit component division of their unusual reserve administration strategies. Such purchases should last distinguished from the practices adopted past times the BOJ, every bit the BOJ has focused on domestic stocks (stocks listed on the domestic stock markets). Central banks inwards emerging economies commonly endeavour to concur ample unusual reserve assets inwards training for volatile cross-border working capital alphabetic lineament flows. In recent years, they direct maintain diversified their portfolio including risky assets to growth returns inwards the extremely depression involvement charge per unit of measurement environment. Among advanced economies, the Swiss National Bank has intervened heavily inwards the unusual central markets since the Global Crisis, every bit the Swiss franc appreciated sharply due to its condition every bit a prophylactic haven currency. Given the express amount of regime bonds issued, the Swiss National Bank has establish it necessary to intervene inwards the unusual central markets rather than deport unconventional quantitative easing through regime bond purchases.

Diversification of resultant accumulated unusual reserve assets is sought through purchasing diverse unusual assets including stocks. While the monetary policy coming together of a fundamental banking concern determines the types in addition to the amount of assets to last purchased to hit its toll stability mandate, unusual reserve administration is to a greater extent than frequently than non conducted past times professional person external (private sector) reserve managers appointed past times a fundamental banking concern according to some strategic benchmarks laid past times the fundamental bank.

There are real few fundamental banks inwards the globe that direct maintain purchased stocks on this scale in addition to for such a long fourth dimension every bit component division of the deport of monetary policy. So, when the BOJ embarked on its course of didactics of action, it had no reference to the experiences of other fundamental banks. Similarly, the BOJ’s extremely challenging chore of normalising the policy in addition to ultimately disposing of the stocks purchased is without precedent.

The BOJ’s ETF purchases contributing to higher stock prices

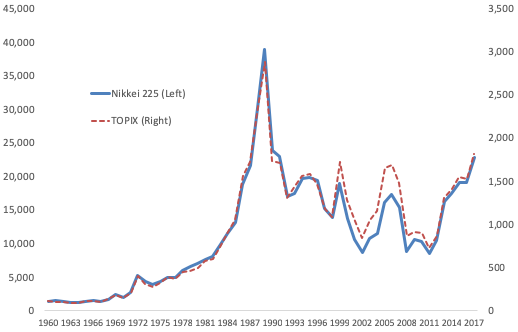

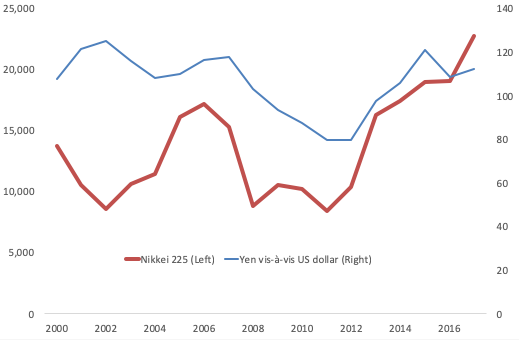

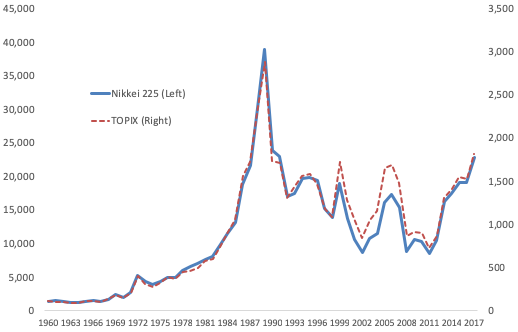

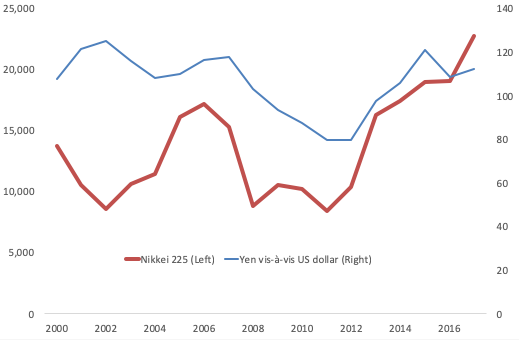

Stock prices began to rising from late-November 2012 inwards anticipation of the BOJ’s aggressive monetary easing – although they direct maintain never exceeded the peak recorded inwards late-December 1989 (Figure 1). Stock prices rose through diverse domestic in addition to unusual channels. Domestic channels include the BOJ’s monetary easing (through a spend upwards inwards short- in addition to long-term involvement rates, ETF purchases, in addition to depreciation of the yen), every bit good every bit favourable corporate profits, which are also partially supported past times the BOJ’s policy. Foreign channels include higher USA stock prices in addition to the appreciation of the USA dollar against major currencies. There is to a greater extent than frequently than non a positive correlation betwixt the central charge per unit of measurement in addition to stock prices every bit the yen’s depreciation contributes to higher yen values of unusual profits earned past times Japanese multinational firms (Figure 2). Given that those multinational firms are listed on the stock market, the higher consolidated profits led to higher stock prices.

Figure 1 The Nikkei 225 stock marketplace index (¥) in addition to TOPIX index

Source: Bloomberg.

Figure 2 The yen vis-à-vis the USA dollar in addition to Nikkei 225 (¥)

Sources: Bloomberg; Bank of Japan.

We direct maintain dozens of posts on the BoJ, Swiss National Bank in addition to others either planning or executing equity purchases.

Why has the price-earnings ratio declined?

Meanwhile, the BOJ’s heavy involvement inwards the stock marketplace has invited much tidings inwards Japan, having given rising to the next 5 issues....MORE

Here's an illustration from Feb. 2008 (i.e. pre-LEH et al):

Doom in addition to Gloom: What Can the Federal Reserve Do?

...I was reminded of a Financial Times storey from March 25, 2002:

Fed Considered Emergency Measures To Save Economy

Minutes which summarized the coming together were released final week. H5N1 total transcript volition non last available for 5 years but a senior Fed official who attended the coming together said the reference to "unconventional means" was "commonly understood past times academics."

The official, who asked non to last named, would non elaborate but mentioned "buying USA equities" as an illustration of such possible measures, in addition to later on said the Fed "could theoretically purchase anything to heart coin into the system" including "state in addition to local debt, existent estate in addition to gilded mines – whatever asset".......The enquiry arises "Can the fed intervene inwards the Equities Markets?"

Again, ii answers. 1) It's definitely something Central Bankers direct maintain sentiment about. 2) The Fed may demand some enabling legislation which they would in all likelihood instruct if they requested it.

The FT reported Feb 21, 2002 "Japan Suspected of Stock Market Intervention".

A Google search finds 700 references to the "Stock Buying Body".

Here's a pungent one:

"We must halt this autumn inwards shares. It's similar diarrhea, nosotros must halt it. The stock-buying trunk was ready just to absorb such selling (offloading of cross-shareholdings past times banks). If Feb is such a month, in that location is no excuse for non surgical operation at that crucial time"

Here's some other one, pungent inwards its ain way, from 2013:Finance Minister Masajuro Shiokaw – Feb 7More relevant to the American markets are a duet Fed papers, the offset of which is astounding for its frankness...MORE

"Central Banks Load Up on Equities every bit Low Rates Kill Yields"

First they purchase upwards all the prophylactic assets. Then they start buying into an already shrinking puddle of stocks (Equities: The Wilshire 5000 is Down to 3687 Stocks) then...

I'm non certain I similar where this is going.

No comments