Josh Ryan-Collins - Why Can’T Yous Afford A Home?

Tweet

When an unrestrained render of banking venture credit is pumped inward to relatively fixed render of land, the resultant volition e'er as well as everywhere live belongings cost inflation. My novel book, 'Why Can't yous Afford a Home?'out today. politybooks.com/bookdetail/?is…

When an unrestrained render of banking venture credit is pumped inward to relatively fixed render of land, the resultant volition e'er as well as everywhere live belongings cost inflation. My novel book, 'Why Can't yous Afford a Home?'out today. politybooks.com/bookdetail/?is…

Bank created credit is a forcefulness exterior of marketplace forces which distorts the markets. With an oversupply of coin as well as a shortage of houses, the sky's the boundary on line of piece of work solid prices. The exclusively matter holding dorsum the cost of housing is the mightiness of people to travel difficult plenty to service the loan on a property. Extra hours at work, 2 or 3 jobs, mini-cabbing inward the evening, renting a room or 2 out, friends getting together to purchase a hime, etc, but all this does was heighten the cost of homes fifty-fifty more.

The bankers made a fortune, as well as and therefore did the landlords, piece U.K. was laid to work. The One Percent turned U.K. into a powerhouse work-house amongst everyone going 24/7. This is the protestant conservative travel ethic where no 1 owes yous a living. Influenza A virus subtype H5N1 neoliberal dream.

In the 1950's people idea machines as well as technology were going to pick out virtually the leisure monastic tell where many of us would opt for doing some voluntary travel for the practice goodness of society, but the contrary has happened. With the whole Blue Planet going 24/7, as well as the planet's resources fast beingness used up, a few billionaires are on their agency to becoming trillionaires. And 1 agency they did it, was to laid us to travel past times giving us slow banking venture credit as well as line of piece of work solid cost inflation.

But the people were fooled when they idea they were genuinely getting richer every bit their houses raised inward value, because the lineament of their lives were greatly diminished when life became all work.

Money creation, banking venture lending as well as house prices

When belongings prices rising faster than incomes, it becomes harder to purchase a home. Mortgage loans couplet this gap, allowing households to access domicile ownership without having to salvage for many years. But at that topographic point is a side-effect. Banks create novel money in the deed of lending. When a banking venture makes a loan, it creates both an asset (the loan) as well as a liability upon itself inward the shape of a novel deposit inward the banking venture line of piece of work organization human relationship of the borrower. No coin is borrowed from elsewhere inward the economy. The principal boundary on banking venture coin creation is the bank’s ain confidence that the loan volition live repaid.

If mortgage lending supports the edifice of novel homes, this novel coin tin dismiss live absorbed into the economy. However, inward most cases mortgage finance enables people to purchase existing belongings on existing land. As households, supported past times banks, compete to purchase, the resultant is increasing solid reason as well as line of piece of work solid prices. Higher prices atomic number 82 to to a greater extent than involve for mortgage credit, which farther pumps upward prices, as well as and therefore on.

This feedback wheel runs against criterion economical theory where an increment inward the render of goods, all else beingness equal, should eventually atomic number 82 to a autumn inward prices. An ‘equilibrium’ cost volition live reached at the betoken when the quantity of goods supplied precisely matches the involve for them. But amongst banking venture credit as well as land, nosotros pick out 2 phenomena that are quite dissimilar criterion commodities. Bank credit is highly elastic as well as essentially infinite; inward contrast land, every bit discussed inward the preceding chapter, is inherently inelastic due to its scarcity.

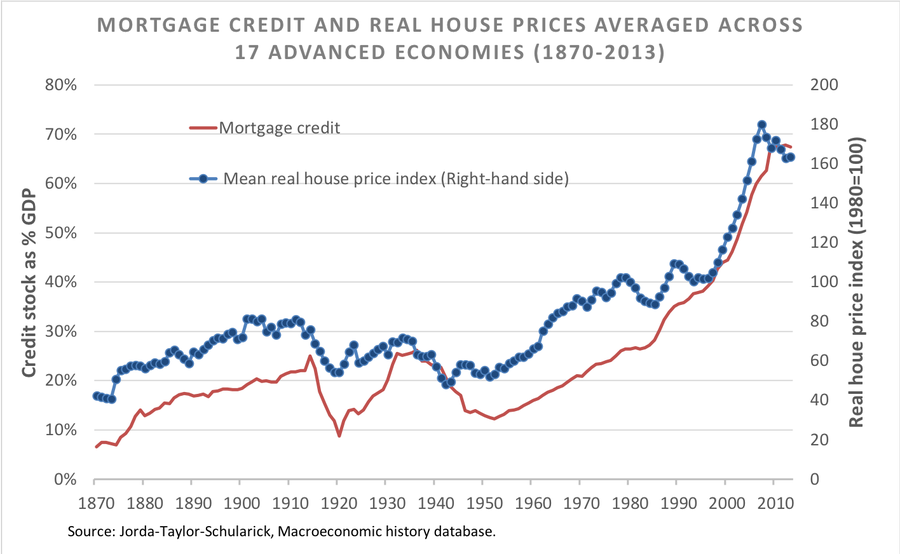

The nautical chart below shows existent line of piece of work solid prices (adjusted for inflation) as well as mortgage credit every bit a proportion of gross domestic product inward advanced economies since 1870. Up until 1960, at that topographic point was piffling modify inward line of piece of work solid prices despite rising populations as well as incomes. Then, from the 1960s to the 1990s, line of piece of work solid prices increased past times unopen to 65%, supported past times the reduction inward taxes on belongings as well as the withdrawal of nation provision of affordable housing as well as gradual expansion of mortgage credit. But fifty-fifty to a greater extent than remarkable has been the modify inward the concluding twenty years, when existent line of piece of work solid prices pick out increased past times 50%. During the same period, existent average incomes pick out flatlined — but mortgage credit has risen exponentially. There is a clear correlation betwixt the 2 variables since the 1990s.

Medium

No comments