The Coming High Yield Downturn Volition Move Big, Long, In Addition To Ugly

From Narrow Road Capital, May 30:

The United States of America of America high yield marketplace has grown larger in addition to riskier since the fiscal crisis. Issuers of debt convey the whip paw equally buyers compete to gain an allotment inwards the facial expression upward of surging need from CLOs in addition to retail funds. Companies are emboldened to seek e'er weaker covenants in addition to are taking payoff of the electrical flow atmospheric condition to borrow to a greater extent than at lower margins. It’s equally if the fiscal crisis never happened in addition to the lessons from it are ancient history.

Whilst the timing of a downturn inwards high yield debt isn’t predictable, the outcomes when it does laissez passer on are. More debt, of lower quality, amongst weaker covenants way the coming downturn volition last bigger, longer in addition to uglier. H5N1 quick review of some substitution information makes this clear.

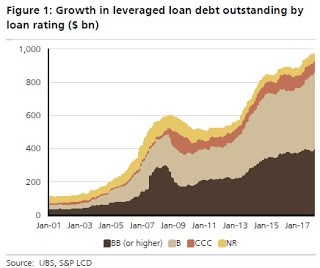

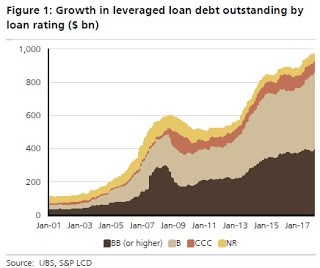

Firstly, the size of the United States of America of America high yield bond marketplace in addition to leveraged loan marketplace are both roughly double what they were inwards 2007.

Not exclusively is the debt outstanding larger, only the credit ratings convey shifted downwards on leveraged loans. Lower credit ratings hateful a higher percent of the outstanding debt volition default when liquidity dries up.

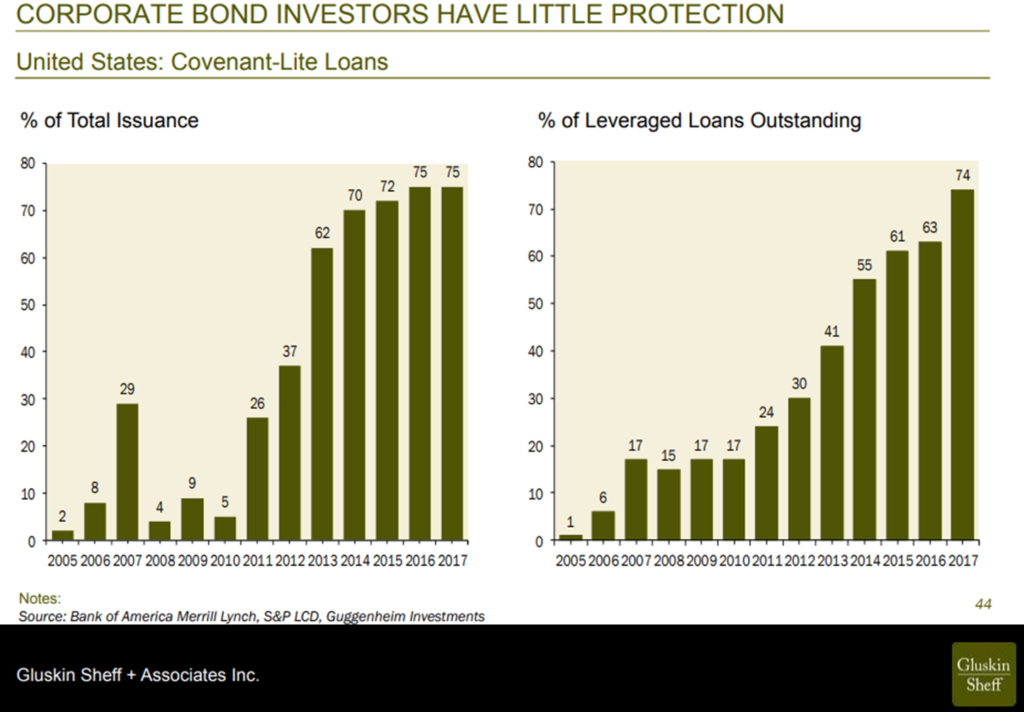

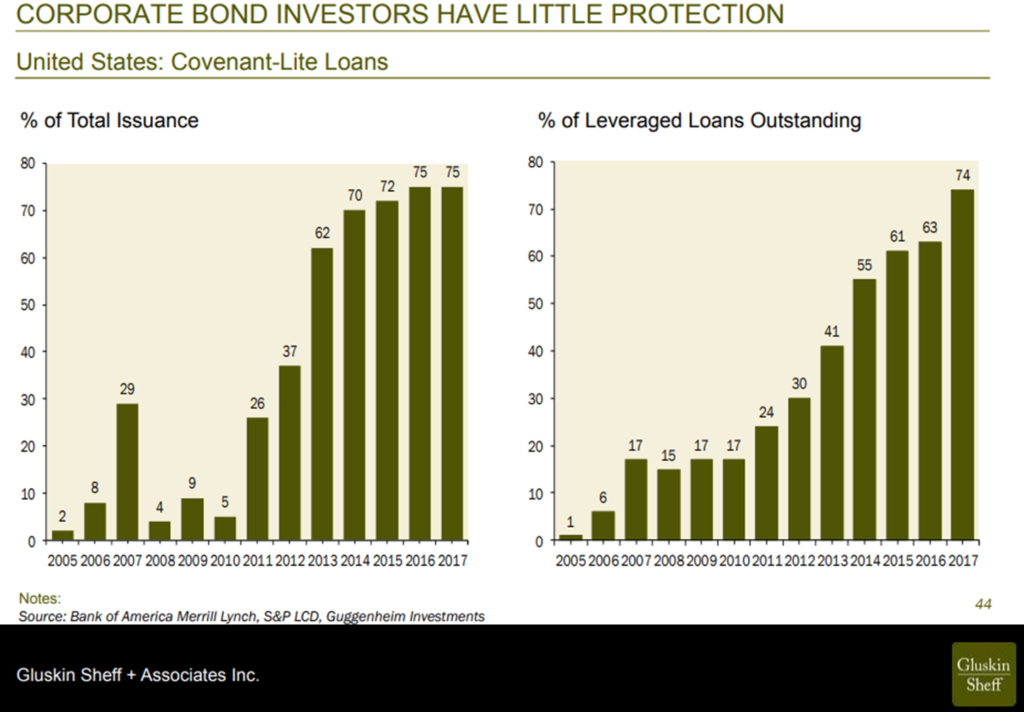

The other substitution indicator to sentry is the portion of the loan marketplace that has weak covenants. In 2007, 17% of outstanding loans were covenant-lite. Today it’s over 75% amongst over 80% of novel issuance lacking decent covenant protections. Weak covenants delay the occurrence of an lawsuit of default, which allows zombie companies to popular off on operating until they either exhaust their cash reserves or cannot refinance maturing debt.

High yield bulls are probable to hollo the substantial equity contributions from sponsors in addition to well for you lot involvement coverage ratios equally reasons non to last overly concerned. These are definitely much amend than 2007, only these indicators work convey some inbuilt weaknesses. Equity contributions are exclusively equally expert equally the marketplace valuations they are based on. As United States of America of America equities are arguably overpriced, sponsors are having to pay to a greater extent than than they historically would convey to purchase a company. If price/earnings ratios revert to lower levels, fellowship valuations volition autumn wiping out some of the equity cushion in addition to making the debt a higher proportion of the company value....MUCH MOREHT: ZeroHedge

No comments