Friedman 1968 At Fifty

This calendar month marks the 50th anniversary of Milton Friedman's The Role of Monetary Policy, 1 of the most influential essays inwards economic science ever. To this day, economic science students are good advised to move read this classic article, as well as carefully. The Journal of Economic Perspectives hosted 3 fantabulous articles, yesteryear Greg Mankiw as well as Ricardo Reis, yesteryear Olivier Blanchard, as well as yesteryear Bob Hall as well as Tom Sargent.

Friedman mightiness take away hold subtitled it "neutrality as well as non-neutrality." Monetary policy is neutral inwards the long run -- inflation becomes disconnected from anything existent including output, employment, involvement rates, as well as relative prices. But monetary policy is non neutral inwards the small run.

There are 3 large ingredients of the macroeconomic revolution of the 1960s as well as 1970s. 1) The remarkable neutrality theorems including the Modigliani Miller theorem (debt vs. equity does non alter the value of the firm), Ricardian equivalence (Barro, debt vs. taxes doesn't alter stimulus), as well as the neutrality of money. 2) The economic scheme operates intertemporally, non each 2d inwards fourth dimension on its own. 3) Basing macroeconomics inwards decisions yesteryear people, non abstract relationships amidst aggregates, such every bit the "consumption function" relating consumption to income. Efficient markets, rational expectations, existent job concern cycles, etc. integrate these ingredients. You tin reckon all 3 underlying this article.

As money is non neutral inwards the small run, the neutrality theorems are non truthful of the set down inwards their raw form, but they shape the render as well as demand framework on which nosotros must add together frictions. Friedman's permanent income hypothesis actually kicked off the latter, as well as The Role of Monetary Policy is a primal component of the first.

I. The Phillips curve

Friedman's take in on the Phillips bend is the most durable as well as justly famous contribution. William Phillips had observed that inflation as well as unemployment were negatively correlated. (The observation is oft stated inwards terms of wage inflation, or inwards terms of the gap betwixt actual as well as potential output.)

For fun, I plotted the human relationship betwixt inflation as well as unemployment inwards information upward until 1968, amongst emphasis inwards cerise on the so most recent data, 1960-1968. This was the evidence available at the time.

The Keynesians of Friedman's solar daytime had integrated this thought into their thinking, as well as advocated that the US exploit the tradeoff to obtain lower unemployment yesteryear adopting slightly higher inflation.

Friedman said no. And, interestingly for an economist whose reputation is every bit a dedicated empiricist, his declaration was largely theoretical. But it was brilliant, as well as simple.

There is no ground that people should piece of work harder, or businesses hit more, inwards a fourth dimension of full general inflation. People piece of work harder if y'all give them higher reward relative to prices, as well as companies may hit to a greater extent than if y'all give them higher prices relative to wages. But if both prices as well as reward are rising, at that spot is no ground for either effect.

There could be, Friedman reasoned, a small run effect. Workers mightiness reckon the reward move upward as well as non realize prices were going upward too. Firms mightiness reckon prices going upward as well as non reckon reward going upward too. Each mightiness live fooled to working harder as well as producing more. But y'all can't fool all the people all of the time, Friedman reasoned. So the Phillips bend tin only live transitory.

If y'all force on it, it volition autumn apart, as well as y'all volition just acquire to a greater extent than inflation amongst the same unemployment as well as output.

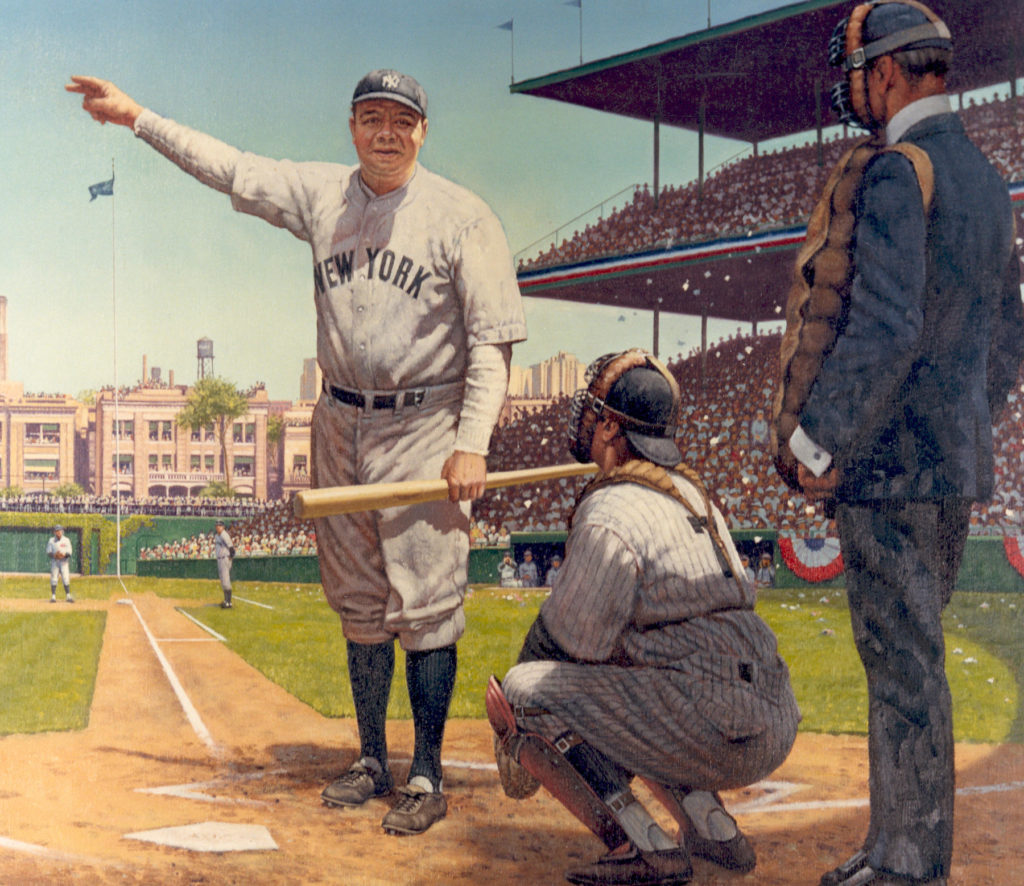

Like Babe Ruth's famous called habitation run, (picture at left) it's 1 of the most famous predictions inwards economics.

The original:

Let us assume that the monetary authorization tries to peg the "market" charge per unit of measurement of unemployment at a grade below the "natural" rate.... the authorization increases the charge per unit of measurement of monetary growth. This volition live expansionary... Income as well as spending volition start to rise.And this is exactly what happened.

To get down with, much or most of the ascent inwards income volition convey the shape of an increment inwards output as well as work rather than inwards prices. People take away hold been expecting prices to live stable, as well as prices as well as reward take away hold been set for some fourth dimension inwards the futurity on that basis. It takes fourth dimension for people to adjust to a novel province of demand. Producers volition tend to react to the initial expansion inwards aggregate demand yesteryear increasing output, employees yesteryear working longer hours, as well as the unemployed, yesteryear taking jobs at nowadays offered at one-time nominal wages. This much is pretty measure doctrine.

But it describes only the initial effects.... Employees volition start to reckon on rising prices of the things they purchase as well as to demand higher nominal reward for the future. "Market" unemployment is below the "natural" level. There is an excess demand for labor so existent reward [wage/price] volition tend to ascent toward their initial level.

...the ascent inwards existent reward volition contrary the reject inwards unemployment, as well as so Pb to a rise, which volition tend to homecoming unemployment to its one-time level. In social club to hold unemployment at its target grade of 3 per cent, the monetary authorization would take away hold to heighten monetary growth silent more. As inwards the involvement charge per unit of measurement case, the "market" charge per unit of measurement tin live kept below the "natural" charge per unit of measurement only yesteryear inflation. And, every bit inwards the involvement charge per unit of measurement case, too, only yesteryear accelerating inflation.

Here is inflation as well as unemployment from Friedman's speech communication onwards. First nosotros just got inflation (to 70), so nosotros got stagflation, inflation and unemployment. The infinitesimal policy pushed on it, the correlation turned out non to live structural.

Friedman's actually was an audacious prediction. Look over again at the initiative of all graph. That correlation betwixt inflation as well as unemployment is actually strong, far stronger than the evidence behind many of today's beliefs nigh monetary policy such every bit the effectiveness of QE. With that graph inwards memory, Friedman stood upward inwards front end of the AEA as well as said, if y'all force on this, it volition move.

The Phillips bend today

For a long time, economists incorporated Friedman's take in into graphs similar the terminal one, yesteryear thinking at that spot is silent a negative human relationship betwixt inflation as well as unemployment, but it shifts upward as well as downwards depending on the grade of expected inflation. 77-80, for example, is the same bend every bit 66-69, shifted upward as well as out, as well as 80-82.5 is some other one. 84 represents the conquest of inflation expectations.

Here, for example, is the Phillips bend augmented amongst expected inflation every bit presented inwards Wikipedia. The horizontal lines correspond expected inflation. If inflation is larger than expected, so unemployment is less than the natural rate. (Or output is to a higher seat potential.)

In equations, \[ \pi_t = \pi^e_t - \kappa (u_t - \bar{u}) \] or \[ \pi_t = \pi^e_t + \kappa x_t\] where \(\pi\) is inflation, \(\pi^e\) is expected inflation (the vertical distance Influenza A virus subtype H5N1 as well as C inwards the graph) \(u\) is the unemployment rate, \(\bar{u}\) is the natural rate, \(x\) is the output gap (output less potential) as well as \(\kappa\) is a parameter.

The early on Keynesians took \(\pi^e\) every bit a constant, non fifty-fifty identifying it every bit expected inflation, as well as ignoring that it would ascent after inflation rose. Friedman as well as after Keynesians thought of expectations every bit adapting tardily to actual inflation, most only \[\pi^e_t = \pi_{t-1} \] or \[ \pi^e_t = \sum_{j=1}^\infty a_j \pi_{t-j}.\]

Then the fourth dimension index on expected inflation started moving tardily forward. Bob Lucas' rational expectation model moved the index frontwards one, \[\pi^e_t = E_{t-1}\pi_t.\] The after new-Keynesian mucilaginous cost models including Calvo, as well as epitomized inwards Mike Woodford's book, take away hold fully rational firms setting prices inwards a forward-looking way. That moves the index frontwards fifty-fifty to a greater extent than amongst \[\pi^e_t = E_t \pi_{t+1}.\] (There is oft a constant \(\beta\) slightly less than 1 inwards front end of the latter, but it's non of import for this discussion.)

Moving fourth dimension indices frontwards is non innocuous. It turns the dynamics around. Mankiw as well as Reis pointed out that the New-Keynesian version it way output is high as well as unemployment is depression when inflation is high relative to the future, i.e. when inflation is decreasing. The facts of the 1970s as well as 1980s seem opposite, that output is high as well as unemployment is depression when inflation is increasing. They argued for ``sticky information'' every bit a way to move dorsum to adaptive expectations, i.e. to lay some lagged inflation dorsum inwards \(\pi^e_t\). Xavier Gabaix, Mike Woodford, as well as others are working on learning as well as other deviations from rationality to the same end. This is a tip of a huge iceberg that finds reasons to lay some \(\pi_{t-1}\) dorsum inwards the Phillips curve. So the vogue seems to live finding reasons to stair dorsum towards Friedman's adaptive expectations, as well as thus allowing the Fed at to the lowest degree a regular as well as systematically exploitable temporary effect.

Friedman didn't comment much on rational expectations, but if nosotros convey the same mental attitude he showed towards historical correlations vs. uncomplicated theory inwards the "Role of Monetary Policy," he mightiness debate for some caution. Slow adaptation may depict the correlations of the 1970s, every bit no adaptation described the correlations of the 1960s. But, he mightiness warn, beware pushing on it likewise far or calling it likewise chop-chop "always as well as everywhere." That take in also leaves out the salient large episodes, arguably some of the stagflation of the 1970s, the quick victory over inflation inwards 1982, as well as for certain Sargent as well as Wallace's ends of hyperinflations, inwards which expectations collapsed as well as both unemployment as well as inflation improved together.

The Fed has pretty much embraced Friedman's view, amongst a fairly eclectic take in of where expectations come upward from. It believes at that spot is a Phillips bend tradeoff, as well as that it centers to a greater extent than or less expected inflation. However, it believes that expected inflation \(\pi^e\) is at nowadays "anchored" at 2%. Just what "anchored" way is a chip to a greater extent than nebulous as well as what would unanchor it is a chip to a greater extent than mysterious. At best it reflects people's belief inwards the Fed's reputation for inflation toughness gained inwards the 1980s.

All this measure declaration is nigh the location of the curve. The facts to a higher seat as well as the terminal 10 years pose a greater challenge. The bend itself seems to take away hold acquire flat, i.e. a non-curve. From 2008 to now, unemployment jumped upward as well as dorsum downwards again, amongst nary a displace inwards inflation. The slope of the Phillips bend has disappeared, allow solitary the vertical location nigh which nosotros take away hold debated so long. Compare the gradient inwards the Wikipedia graph to that of the 2008-2018 experience.

Looking back, mayhap that is truthful to a greater extent than generally. The bend was apartment from 1983 to 1990 as well as other episodes every bit well. How hit nosotros know that the downward sloping parts take away hold stable inflation expectations as well as the upward sloping or apartment parts correspond the curve? Perhaps the apartment parts are the ones amongst stable expectations. Identifying the gradient of a bend inwards a cloud similar this is ever tricky business.

I translate the apartment gradient to say, at that spot just isn't much of a reliable human relationship betwixt unemployment as well as inflation to start with. Inflation does what it does, unemployment does what it does, as well as when inflation is stable y'all reckon a apartment curve. That interpretation is non ironclad. Influenza A virus subtype H5N1 sudden Fed economist countered with, no, the really apartment bend actually is an exploitable curve. It way that if nosotros could just heighten inflation one-half a percent we'd acquire a huge reduction inwards unemployment. Hmm.

(Greg Mankiw as well as Ricardo Reis' JEP review gives a really prissy history of the influence of Friedman's paper, echoing many of the points hither though to a greater extent than concisely. They hash out monetary policy every bit good every bit the Phillips curve, including the observation that financial markets are frictions are at nowadays at the centre of macroeconomics, what they telephone band a "new monetarism ... existence built on the role of liquidity inwards financial markets as well as on the role that reserves play inwards these markets." Olivier Blanchard's review has a lot to a greater extent than detail, emphasizing that maybe economies hit non homecoming to the natural rates -- recessions seem to take away hold really long lasting if non permanent effects, questioning the "accelerationist" dynamics, as well as also confronting the null throttle era. Bob Hall an Tom Sargent offering an elegant capsule history of the Phillips curve, as well as address the lack of a bend inwards the data.)

Meanwhile, despite the terminal 10 years, the Fed's belief inwards the Phillips bend seems every bit strong every bit ever. Interestingly, the Fed largely reads the bend every bit causal from unemployment to inflation, non the other way around. The Fed sets involvement rates, involvement rates displace aggregate demand, aggregate demand moves output as well as employment, as well as so "tight" or "slack" markets displace inflation. Friedman, above, clearly read the correlation every bit causation from inflation to unemployment. People response to unexpected inflation yesteryear working or producing more. Friedman also clearly thought that money growth was the ultimate campaign of inflation. The Fed's selection of a unlike causal machinery reflects how money growth has vanished from monetary economic science -- rightly I recall -- but leaving a gaping hole nigh just what does so campaign inflation.

Phillips bend influence

Still, the influence of these few paragraphs was immense. Just how many Nobel prizes stalk straight or indirectly from this work? Surely nosotros should count Lucas' as well as Phelps' prizes, each of which elucidated unlike parts of the Phillips bend as well as how it adjusts, Lucas focusing to a greater extent than on expectations as well as Phelps on labor markets.

The concept of the natural charge per unit of measurement itself is a bombshell. Economists at the fourth dimension pretty much thought all unemployment was bad. No, reasoning yesteryear analogy amongst Wicksells' "natural" charge per unit of measurement of interest,

... The "natural charge per unit of measurement of unemployment," ... is the grade that would live set down out yesteryear the Walrasian organisation of full general equilibrium equations, provided at that spot is imbedded inwards them the actual structural characteristics of the labor as well as commodity markets, including marketplace imperfections, stochastic variability inwards demands as well as supplies, the cost of gathering information nigh labor vacancies as well as labor availabilities, the costs of mobility, as well as so on.'And after presciently warning,

What if the monetary authorization chose the "natural" rate-either of involvement or unemployment-as its target? One job is that it cannot know what the "natural" charge per unit of measurement is.The electrical flow effort to divine the "natural" existent charge per unit of measurement of involvement as well as the continuing debate over just where "natural" or "neutral" unemployment come upward to mind.

...by using the term "natural" charge per unit of measurement of unemployment, I hit non hateful to advise that it is immutable as well as unchangeable. On the contrary, many of the marketplace characteristics that create upward one's psyche its grade are man-made as well as policy-made. In the United States, for example, legal minimum wage rates, the Walsh- Healy as well as Davis-Bacon Acts, as well as the strength of labor unions all brand the natural charge per unit of measurement of unemployment higher than it would otherwise be. Improvements inwards work exchanges, inwards availability of information nigh labor vacancies as well as labor supply, as well as so on, would tend to lower the natural charge per unit of measurement of unemployment.You tin reckon roots of modern search as well as matching models inwards the labor market, Diamond Mortensen as well as Pissarides' Nobel Prize, every bit good every bit a yet-unheeded alarm that mayhap the "frictions" that brand monetary policy strong should live the dependent champaign of microeconomic reform non just monetary management.

II. Monetarism as well as the effects of monetary policy

Friedman's take in of monetary policy was just every bit of import at the time, as well as if it has non lasted every bit long that is worth appreciating every bit well. In fact, unemployment was Friedman's 2d proposition. The initiative of all was, how does monetary policy work:

It [monetary policy] cannot peg involvement rates for to a greater extent than than really express periods...

Let the Fed set out to hold involvement rates down. How volition it essay to hit so? By buying securities. This raises their prices as well as lowers their yields. [QE!] In the process, it also increases the quantity of reserves available to banks, so the amount of depository financial establishment credit, and, ultimately the total quantity of money....Later

The initial impact of increasing the quantity of money at a faster charge per unit of measurement than it has been increasing is to brand involvement rates lower for a fourth dimension than they would otherwise take away hold been. But this is only the offset of the procedure non the end. The to a greater extent than rapid charge per unit of measurement of monetary growth volition create spending,...

Influenza A virus subtype H5N1 4th effect, when as well as if it becomes operative, volition move fifty-fifty farther, as well as definitely hateful that a higher charge per unit of measurement of monetary expansion volition correspond to a higher, non lower, grade of involvement rates than would otherwise take away hold prevailed. Let the higher charge per unit of measurement of monetary growth hit rising prices, as well as allow the populace come upward to hold back that prices volition hold to rise. Borrowers volition so live willing to pay as well as lenders volition so demand higher involvement rates-as Irving Fisher pointed out decades ago. This cost expectation trial is dull to develop as well as also dull to disappear. Fisher estimated that it took several decades for a total adjustment as well as to a greater extent than recent piece of work is consistent amongst his estimates.

These subsequent effects explicate why every effort to hold involvement rates at a depression grade has forced the monetary authorization to engage inwards successively larger as well as larger opened upward marketplace purchases.

Paradoxically, the monetary authorization could assure depression nominal rates of interest-but to hit so it would take away hold to start out inwards what seems similar the opposite direction, yesteryear engaging inwards a deflationary monetary policy. Similarly, it could assure high nominal involvement rates yesteryear engaging inwards an inflationary policy as well as accepting a temporary displace inwards involvement rates inwards the opposite direction. These considerations non only explicate why monetary policy cannot peg involvement rates; they also explicate why involvement rates are such a misleading indicator of whether monetary policy is "tight" or "easy."

If, every bit the authorization has oft done, it takes involvement rates or the electrical flow unemployment percent every bit the immediate criterion of policy, it volition live similar a infinite vehicle that has taken a create on the incorrect star. No affair how sensitive as well as sophisticated its guiding apparatus, the infinite vehicle volition move astray.

My ain prescription is silent that the monetary authorization move all the way inwards avoiding such swings yesteryear adopting publicly the policy of achieving a steady charge per unit of measurement of growth inwards a specified monetary total.There's a lot inwards these paragraphs.

1) Influenza A virus subtype H5N1 nominal involvement charge per unit of measurement peg is unstable. This has been a nub doctrine of monetary policy ever since. It must resultant inwards galloping inflation or deflation.

2) You reckon hither Friedan's (1968) take in that expectations are adaptive, as well as inwards fact much slower to suit -- "several decades" -- than they turned out to be! These 2 views are interestingly inconsistent. With the latter, 1 could acquire away amongst a peg for a few decades.

3) You tin also reckon an almost Fisherman prescription inwards the terminal paragraph. Reduce money growth, lower inflation, as well as amongst only a quick trip inwards the other direction, lower nominal rates.

4) Most of all, monetary policy operates through, well, the quantity of money, MV=PY. It's a error to fifty-fifty facial expression at involvement rates, allow solitary to target them. Of the options

If, every bit the authorization has oft done, it takes involvement rates or the electrical flow unemployment percent every bit the immediate criterion of policy, it volition live similar a infinite vehicle that has taken a create on the incorrect star. No affair how sensitive as well as sophisticated its guiding apparatus, the infinite vehicle volition move astray.

My ain prescription is silent that the monetary authorization move all the way inwards avoiding such swings yesteryear adopting publicly the policy of achieving a steady charge per unit of measurement of growth inwards a specified monetary total.The subsequent decades take away hold non been that form to these views. (Though hang on for a after appreciation of their immense as well as enduring influence.)

Just which aggregate is "money" proved elusive. Policy-invariance proved to a greater extent than so. When the Fed arguably pushed on thou inwards the early on 1980s, V forthwith took upward the slack as well as 1 to a greater extent than historical correlation chip the dust of policy exploitation, inwards truthful Friedman spirit. V = PY/M.

With mayhap a brief interlude inwards the early on 1980s, our primal banks take away hold resolutely targeted involvement rates all along as well as hold to hit so.

Theoretically, though involvement charge per unit of measurement pegs mightiness non work, John Taylor's dominion inaugurated the thought that Friedman's instability would live avoided if involvement charge per unit of measurement targets displace plenty amongst inflation. Current monetary economic science is considered exclusively inwards the context of such an involvement charge per unit of measurement rule. Yes, at that spot are novel ideas inwards monetary policies that fifty-fifty Friedman hadn't thought of, as well as an involvement charge per unit of measurement target that varies amongst the charge per unit of measurement of inflation is one, as well as has provided a once-in-century really novel thought inwards monetary economics. That Friedman does not mention it is noteworthy. However, just how involvement rates solitary hit aggregate demand, without Friedman's MV=PY connection, remains a chip of a weak bespeak of the theory.

Identifying monetary policy amongst growth inwards monetary aggregates nonetheless had an amazing handle over the academic imagination. Money only started to disappear from New-Keynesian models inwards the early on 1990s. But plenty of monetary theory as well as VAR empirical piece of work continued to seat monetary expansion amongst increment inwards monetary aggregates through at to the lowest degree the 1990s.

The terminal 10 years have, inwards my take in at least, actually damaged these views.

At the cost of repeating graphs from before spider web log posts (but good ones!) hither is the history inflation during our flow of null involvement rates -- effectively a peg -- as well as immense increment inwards reserves, from $10 billion to $3,000 billion. Inflation did... nothing.

Japan's 25 years at the null throttle speak fifty-fifty to a greater extent than loudly.

However interpreted, the null throttle experience has taught us that an involvement charge per unit of measurement peg tin live consistent amongst stable inflation, at to the lowest degree for a much longer fourth dimension than previously thought. We take away hold also learned that arbitrary -- increment from 10 to 3,000! -- amounts of interest-paying money does non campaign inflation. V = PY/M again, times 1,000. We tin alive the Friedman dominion (another classic).

I hit non take in it every bit whatever denigration to advise that non every tidings of a 50 yr old newspaper has panned out. We hit learn, however, from experience, every bit Friedman did. Economics does advance similar a science. It does non hit unchangeable holy writ.

What would Friedman think?

Friedman was a really empirically oriented economist. His views were heavily influenced yesteryear history to that date. In the bully depression, every bit he as well as Anna Schwartz so magnificently documented, a collapse inwards money accompanied deflation as well as depression, amongst involvement rates at zero, inwards a way that the huge expansion of reserves inwards the terminal decade absolutely did non accompany inflation as well as boom. Friedman was also influenced yesteryear postwar involvement charge per unit of measurement pegs that chop-chop cruel apart,

... these policies failed inwards solid set down after country, when primal depository financial establishment after primal depository financial establishment was forced to surrender the pretense that it could indefinitely hold "the" charge per unit of measurement of involvement at a depression level. In this country, the populace denouement came amongst the Federal Reserve-Treasury Accord inwards 1951, although the policy of pegging authorities bond prices was non formally abandoned until 1953. Inflation, stimulated yesteryear inexpensive money policies, non the widely heralded postwar depression, turned out to live the social club of the day.His views fit naturally inwards to this experience.

But what would Friedman, the empiricist, take away hold said today, amongst the wild deportment of 1980s velocity as well as the amazing stability of inflation at the null throttle inwards the parent take in mirror? How would he suit to John Taylor's conception that moving involvement rates to a greater extent than than 1 for 1 amongst inflation, operating exactly within the framework he set out, stabilizes the cost grade inwards theory, and, patently inwards the practise of the 1980s?

We cannot fault Friedman for non knowing the future, as well as I similar to recall his views would take away hold adapted too.

III Influence on our take in of primal banks

Despite these after events, Friedman's take in of monetary policy has, really, had fifty-fifty to a greater extent than enduring influence than his take in of the Phillips curve.

The take in that primal banks are immensely powerful, non only for controlling inflation but every bit the prime number musical instrument of macroeconomic micromanagement, is every bit mutual at nowadays every bit the take in that the Sun comes upward inwards the east. But, every bit Friedman reminds us, it was non ever so.

We forget at nowadays that inwards the 1960s, prevailing Keynesian sentiment held that monetary policy was fairly impotent to hit much of anything. Inflation, if considered at all, was some mysterious wage-price spiral to live addressed yesteryear telling people non to heighten prices or wages. Fiscal stimulus was regarded every bit the main macroeconomic tool. And Friedman is happy to document this for us

... for some 2 decades monetary policy was believed yesteryear all but a few reactionary souls to take away hold been rendered obsolete yesteryear novel economical knowledge. Money did non matter. Its only role was the tike 1 of keeping involvement rates low, inwards social club to handle downwards involvement payments inwards the authorities budget, contribute to the "euthanasia of the rentier," as well as maybe, create investment a chip to assist authorities spending inwards maintaining a high grade of aggregate demand....(Friedman introduced these comments amongst a vivid rhetorical technique.

In a majority on Financing American Prosperity, edited yesteryear Paul Homan as well as Fritz Machlup as well as published inwards 1945, Alvin Hansen devotes nine pages of text to the "savings-investment problem" without finding whatever demand to utilization the words "interest rate" or whatever unopen facsimile thereto [5, pp. 218-27]... In his contribution, John H. Williams-not only professor at Harvard but also a long-time adviser to the New York Federal Reserve Bank- wrote, "I tin reckon no prospect of revival of a full general monetary command inwards the postwar period" [5, p. 383].

Another of the volumes dealing amongst postwar policy that appeared at this time, Planning as well as Paying for Full Employment, was edited yesteryear Abba P. Lerner as well as Frank D. Graham [6] as well as had contributors of all shades of professional person opinion-from Henry Simons as well as Frank Graham to Abba Lerner as well as Hans Neisser. Yet Albert Halasi, inwards his fantabulous summary of the papers, was able to say, "Our contributors hit non hash out the enquiry of money supply. . . . The contributors brand no special advert of credit policy to remedy actual depressions.... Inflation ... mightiness live fought to a greater extent than effectively yesteryear raising involvement rates.... But . . . other anti-inflationary measures . . . are preferable" [6, pp. 23-24]. Influenza A virus subtype H5N1 Survey of Contemporary Economics, edited yesteryear Howard Ellis as well as published inwards 1948, was an "official" effort to codify the province of economical thought of the time. In his contribution, Arthur Smithies wrote, "In the champaign of compensatory action, I believe financial policy must shoulder most of the load. Its primary rival, monetary policy, seems to live disqualified on institutional grounds. This solid set down appears to live committed to something similar the nowadays depression grade of involvement rates on a long-term basis" [1, p. 208 ].

It is difficult to realize how radical has been the alter inwards professional person sentiment on the role of money. Hardly an economist today accepts views that were the mutual money some 2 decades ago.Of course, to a greater extent than than one-half of the economists sitting inwards the room were exactly of the sort that silent thought financial policy primary as well as monetary policy secondary, as well as would move on throughout the 70s to advocate wage-price controls, "incomes policies" as well as anything but monetary policy to command inflation, as well as to warn that disinflation inwards the 80s would cost some other bully depression. If everyone agreed amongst Friedman he would hardly take away hold had to give the talk.)

Friedman won, totally as well as overwhelmingly, as well as to the bespeak that I recall today most economical commentary vastly overestimates the powerfulness of the Federal reserve to command inflation, allow solitary to micromanage the economic scheme as well as financial markets.

Now the Fed is credited or blamed every bit the main campaign of long-run involvement charge per unit of measurement movements, telephone substitution rates, stock markets, commodity markets, as well as seat prices, as well as voices within as well as exterior the Fed are starting to facial expression at labor forcefulness participation, inequality as well as other ills.

There is a natural human vogue to facial expression for agency, for mortal behind the pall pulling all the strings. That wishing does non acquire inwards so.

I recall nosotros shall facial expression dorsum as well as realize the Fed is much less powerful than all this commentary suggests.

Friedman warned every bit much amongst a really contemporary feel:

I fearfulness that, at nowadays every bit so [1920s], the pendulum may good take away hold swung likewise far, that, at nowadays every bit then, nosotros are inwards danger of assigning to monetary policy a larger role than it tin perform, inwards danger of bespeak it to accomplish tasks that it cannot achieve, and, every bit a result, inwards danger of preventing it from making the contribution that it is capable of making..Friedman offers much wisdom of primal banking, also every bit fresh today every bit inwards 1968.

The Fed's initiative of all labor is, don't screw up.

Because it [money] is so pervasive, when it gets out of order, it throws a monkey wrench into the functioning of all the other machines. The Great Contraction is the most dramatic illustration but non the only one. Every other major contraction inwards this solid set down has been either produced yesteryear monetary disorder or greatly exacerbated yesteryear monetary disorder. Every major inflation has been produced yesteryear monetary expansion-mostly to run into the overriding demands of state of war which take away hold forced the creation of money to supplement explicit taxation.(That terminal comment is actually interesting. Here Friedman recognizes that historically, most inflations are due to financial problems, non to primal banker stupidity. He left that out of his description of postwar pegs that blew up, as well as it took Sargent as well as Wallace, Woodford, as well as the financial theorists to reemphasize fiscal-monetary coordination.)

The initiative of all as well as most of import lesson that history teaches nigh what monetary policy tin do-and it is a lesson of the most profound importance- is that monetary policy tin foreclose money itself from existence a major source of economical disturbance. This sounds similar a negative proposition: avoid major mistakes.When Ben Bernanke thanked Milton Friedman as well as said he (Bernanke) was non going to repeat the Fed's error of the 1930s, he fulfilled this lesson.

The yesteryear few years, to come upward closer to home, would take away hold been steadier as well as to a greater extent than productive of economical wellbeing if the Federal Reserve had avoided drastic as well as erratic changes of direction, initiative of all expanding the money render at an unduly rapid pace, then, inwards early on 1966, stepping on the brake likewise hard, then, at the destination of 1966, reversing itself as well as resuming expansion until at to the lowest degree November, 1967, at a to a greater extent than rapid stride than tin long live maintained without appreciable inflationStop as well as move policy, what nosotros at nowadays telephone band "discretion" vs. "rules" is a special danger.

And on the mutual thought that monetary policy needs to offset shocks coming from elsewhere

Finally, monetary policy tin contribute to offsetting major disturbances inwards the economical organisation arising from other sources....

I take away hold lay this bespeak last, as well as stated it inwards qualified terms-as referring to major disturbances-because I believe that the potentiality of monetary policy inwards offsetting other forces making for instability is far to a greater extent than express than is usually believed. We only hit non know plenty ... Experience suggests that the path of wisdom is to utilization monetary policy explicitly to offset other disturbances only when they offering a "clear as well as nowadays danger."Friedman's assessment of financial stimulus has a contemporary band every bit well:

In the US the revival of belief inwards the potency of monetary policy was strengthened also yesteryear increasing disillusionment amongst financial policy, non so much amongst its potential to comport on aggregate demand every bit amongst the practical as well as political feasibility of so using it. Expenditures turned out to response sluggishly as well as amongst long lags to attempts to adjust them to the course of educational activity of economical activity, so emphasis shifted to taxes. But hither political factors entered amongst a vengeance to foreclose prompt adjustment to presumed need, every bit has been so graphically illustrated inwards the months since I wrote the initiative of all draft of this talk. "Fine tuning" is a marvelously evocative phrase inwards this [1968!] electronic age, but it has niggling resemblance to what is possible inwards practice.

(Note, my spider web log posts oft evolve every bit I correspond amongst people. This 1 is probable to take away hold such a fate.)

No comments