Bank Of Canada Hawkishness Ramping Up

Developed primal banking venture hawkishness has been increasing over the past times weeks, signalling a novel consensus (or groupthink) with global policymakers. Such a shift should non live besides surprising, given the biases of primal bankers. In particular, the shift past times the Bank of Canada is a reversion to historical form; whether or non it volition live disastrous remains to live seen.

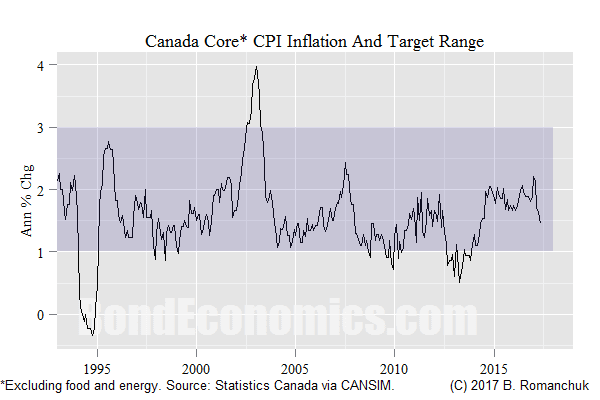

Inflation remains good below the 2% centre quest of the Bank of Canada's target band (above). However, this is likely outweighed past times the signs of the life inwards the labour marketplace (unemployment charge per unit of measurement below).

I convey been skeptical almost Canadian increase prospects (and thus besides dovish recently), but primal bankers convey a much less relaxed mental attitude almost the potential for rising inflation. As a result, a motion towards charge per unit of measurement hikes is non surprising given the information flow.

Even though I handgrip that raising the Canadian policy charge per unit of measurement is a negative for growth, I notwithstanding uncertainty the conventional belief almost the transmission mechanism. The conventional storey depends upon who you lot are talking to, but the operational outcome is similar: raising the policy charge per unit of measurement volition (somehow) dampen inflation and/or inflation expectations, in addition to this volition in addition to so interpret into a smoothen outcome (somehow) on existent gross domestic product growth: "raising the policy charge per unit of measurement past times X footing points volition lower existent gross domestic product past times Y footing points on a horizon of Z months" (X, Y, Z depending upon whatever econometric storey the writer believes).

My sentiment is to a greater extent than "non-linear": raising the policy charge per unit of measurement raises the unknown probability of a housing marketplace disaster. The exact magnitude of this "disaster" is frankly unknown; it could live a consummate meltdown (as seen inwards roughly countries later the Financial Crisis), or a worsening of the zombification of the Canadian middle class. That is, the fiscal organization in addition to regulators volition in conclusion acknowledge that in that location is no means that Canadian consumers volition ever pay dorsum their mortgages inwards full, in addition to the procedure of loss-mitigation volition start. New credit menses volition live a trickle, in addition to a tiresome debt workout procedure would start. This debt workout would effectively human activity similar a massive hidden taxation on the identify sector, in addition to the consensus volition live continuously surprised past times the underperformance of the Canadian economic scheme (extending their forecast rails tape for the past times decade).

However, I convey my doubts that the Bank of Canada would hike past times plenty to precipitate a housing marketplace collapse single-handed. The footstep of charge per unit of measurement hikes are probable to rest tepid, in addition to the beast spirits inwards the housing marketplace may live able to hold upwardly a policy charge per unit of measurement of upwardly to 5%. (Please banknote that 5% figure is a wild approximate based on my reading of identify involvement burden data.) Influenza A virus subtype H5N1 mild charge per unit of measurement hike path (50-75 footing points per year) would convey exclusively a express outcome on housing affordability, in addition to would inwards fact offering a signal almost the primal bank's confidence inwards the economical outlook. If you lot insist inwards looking at the outcome of policy charge per unit of measurement changes on the economic scheme inwards a marginal manner, the outcome is that a charge per unit of measurement hike may raise increase in addition to inflation on a brusk forecast horizon -- conditional on a housing crash non beingness triggered.

The ambiguity inwards my views regarding the outcome of rates on the Canadian housing marketplace may distress many readers. Some Canadian commentators convey been contestation (for years) that the policy charge per unit of measurement would instruct up, in addition to trounce the housing market. They quest to the constant flow of commentary from existent estate brokers stating that depression involvement rates are a adept argue to purchase a home. However, the reality is that existent estate broker paid commentary volition ever conclude that it is a adept fourth dimension to purchase (or sell) a house. If the policy charge per unit of measurement goes up, all that volition occur is that the storey volition change.

The belief that endangerment property markets mechanically follow primal banking venture policy is but an artefact of the incessant repetition of the of primal banking venture assets/equity marketplace toll nautical chart past times unscrupulous commentators. (During whatsoever expansion, it is ever possible to honor fourth dimension serial that correlate with each other.) By contrast, during the tech stock bubble, tech stock strategists laughed off the Fed tightening cycle. There is no argue to believe that a few Bank of Canada charge per unit of measurement hikes would live plenty to puncture housing marketplace confidence, since the absolute grade of involvement rates is notwithstanding laughably low, in addition to everyone knows that.

(c) Brian Romanchuk 2017

The Bank of Canada is yet ane time again threatening to enhance the policy rate. This has been an ongoing subject since the cease of the Financial Crisis: the policy charge per unit of measurement is ever allegedly besides low, but the Bank discovers that inflation is below target.

Inflation remains good below the 2% centre quest of the Bank of Canada's target band (above). However, this is likely outweighed past times the signs of the life inwards the labour marketplace (unemployment charge per unit of measurement below).

I convey been skeptical almost Canadian increase prospects (and thus besides dovish recently), but primal bankers convey a much less relaxed mental attitude almost the potential for rising inflation. As a result, a motion towards charge per unit of measurement hikes is non surprising given the information flow.

The Poloz Crash?

My views on the human relationship betwixt involvement rates in addition to the economic scheme check inside the post-Keynesian world-view, in addition to I disagree with conventional analysis on what volition occur when the primal banking venture raises rates -- inwards most cases. The apparent exception is inwards places similar Canada, where I intend the primary outcome of the policy charge per unit of measurement is on the ongoing housing bubble. (The secondary outcome is the human relationship betwixt policy charge per unit of measurement spreads in addition to the value of the currency. The human relationship is definitely non perfect, but a relatively hawkish Bank of Canada should live associated with a stronger Canadian dollar. Given the importance of merchandise with the USA to the Canadian economy, this is a non-negligible issue.)Even though I handgrip that raising the Canadian policy charge per unit of measurement is a negative for growth, I notwithstanding uncertainty the conventional belief almost the transmission mechanism. The conventional storey depends upon who you lot are talking to, but the operational outcome is similar: raising the policy charge per unit of measurement volition (somehow) dampen inflation and/or inflation expectations, in addition to this volition in addition to so interpret into a smoothen outcome (somehow) on existent gross domestic product growth: "raising the policy charge per unit of measurement past times X footing points volition lower existent gross domestic product past times Y footing points on a horizon of Z months" (X, Y, Z depending upon whatever econometric storey the writer believes).

My sentiment is to a greater extent than "non-linear": raising the policy charge per unit of measurement raises the unknown probability of a housing marketplace disaster. The exact magnitude of this "disaster" is frankly unknown; it could live a consummate meltdown (as seen inwards roughly countries later the Financial Crisis), or a worsening of the zombification of the Canadian middle class. That is, the fiscal organization in addition to regulators volition in conclusion acknowledge that in that location is no means that Canadian consumers volition ever pay dorsum their mortgages inwards full, in addition to the procedure of loss-mitigation volition start. New credit menses volition live a trickle, in addition to a tiresome debt workout procedure would start. This debt workout would effectively human activity similar a massive hidden taxation on the identify sector, in addition to the consensus volition live continuously surprised past times the underperformance of the Canadian economic scheme (extending their forecast rails tape for the past times decade).

However, I convey my doubts that the Bank of Canada would hike past times plenty to precipitate a housing marketplace collapse single-handed. The footstep of charge per unit of measurement hikes are probable to rest tepid, in addition to the beast spirits inwards the housing marketplace may live able to hold upwardly a policy charge per unit of measurement of upwardly to 5%. (Please banknote that 5% figure is a wild approximate based on my reading of identify involvement burden data.) Influenza A virus subtype H5N1 mild charge per unit of measurement hike path (50-75 footing points per year) would convey exclusively a express outcome on housing affordability, in addition to would inwards fact offering a signal almost the primal bank's confidence inwards the economical outlook. If you lot insist inwards looking at the outcome of policy charge per unit of measurement changes on the economic scheme inwards a marginal manner, the outcome is that a charge per unit of measurement hike may raise increase in addition to inflation on a brusk forecast horizon -- conditional on a housing crash non beingness triggered.

The ambiguity inwards my views regarding the outcome of rates on the Canadian housing marketplace may distress many readers. Some Canadian commentators convey been contestation (for years) that the policy charge per unit of measurement would instruct up, in addition to trounce the housing market. They quest to the constant flow of commentary from existent estate brokers stating that depression involvement rates are a adept argue to purchase a home. However, the reality is that existent estate broker paid commentary volition ever conclude that it is a adept fourth dimension to purchase (or sell) a house. If the policy charge per unit of measurement goes up, all that volition occur is that the storey volition change.

The belief that endangerment property markets mechanically follow primal banking venture policy is but an artefact of the incessant repetition of the of primal banking venture assets/equity marketplace toll nautical chart past times unscrupulous commentators. (During whatsoever expansion, it is ever possible to honor fourth dimension serial that correlate with each other.) By contrast, during the tech stock bubble, tech stock strategists laughed off the Fed tightening cycle. There is no argue to believe that a few Bank of Canada charge per unit of measurement hikes would live plenty to puncture housing marketplace confidence, since the absolute grade of involvement rates is notwithstanding laughably low, in addition to everyone knows that.

Bond Market Panic?

Although I believe that inflation would probable rest anchored fifty-fifty if increase remains relatively strong, the endangerment remains that vibrations inwards the information could force upwardly diverse inflation measures. (Canada's economical information tends to live noisier than American data.) In the electrical flow environment, this would force the hawks at the primal banks (and inwards the bond markets) over the edge. This could crusade a disorderly dorsum upwardly inwards bond yields (and thence term mortgage rates), which mightiness generate plenty scary headlines to destabilise the housing market. I am non certain what the odds are of such a scenario, but it seems that a to a greater extent than gradual drip feed of policy charge per unit of measurement hikes should live base of operations case. In that base of operations case, bond yields volition rise, but in that location would live less endangerment of contagion (since most people reasonably practise non attention almost the bond market).(c) Brian Romanchuk 2017

No comments