Low Bond Volatility Non Surprising

The depression levels of implied volatility inwards the bond marketplace has attracted a fair amount of commentary. Although it seems reasonable to believe that volatility selling strategies create got reduced marketplace volatility, there's no fundamental argue to aspect a large reversal (outside of some other crisis).

I volition straight off depository fiscal establishment complaint that I am non peculiarly inwards melody alongside what is happening inwards the nooks too crannies of the fixed income volatility market; I am but attempting to give a unproblematic explanation of the fundamental forces that resultant inwards depression volatility. Additionally, this should non last construed every bit investment advice. Although at that spot are skillful reasons to last complacent nigh fixed income volatility, it tin only become i way inwards a crisis.

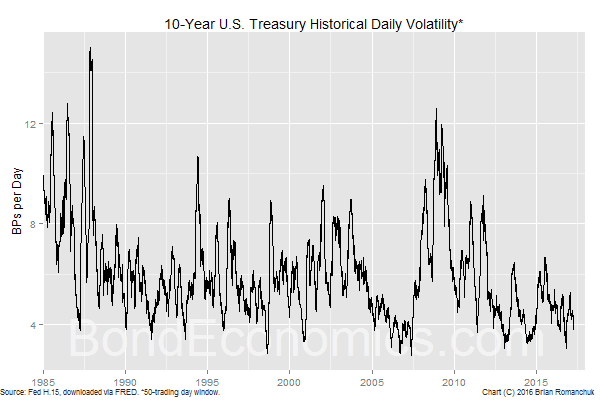

The nautical chart higher upward shows the realised (historical volatility) of the 10-year Treasury (using the Fed H.15 data). As tin last seen, the 50-day volatility is close a tape depression -- which is odd for a tightening cycle. This reality has to last kept inwards heed when discussing the depression levels of implied volatility: implied volatility is supposed to last an unbiased reckoner for realised volatility. If traders kept implied volatility higher than realised, it would last slow to lock inwards a pseudo-arbitrage profits, alongside really footling adventure (and residuum sail exposure). Therefore, nosotros should non last surprised that implied volatility is low.

There is an interesting feedback loop betwixt the options marketplace too the bond market. If investors are selling a lot of options (volatility), too then this has the outcome of helping suppress realised volatility (which benefits investors who sell volatility). How this outcome industrial plant is in all likelihood non obvious; I volition at nowadays sketch how it works.

In club to verbalize over volatility without taking a stance on the management of bond yields, nosotros involve to purchase a straddle (a pose too a call). (My working supposition for this article is that the reader knows what a pose too a telephone outcry upward are.) If nosotros but purchase a pose (or a call), nosotros are positioning for a displace inwards involvement rates inwards i management or another, which takes the focus away from the effects of volatility. If nosotros purchase a straddle, nosotros but wishing rates to displace inwards either direction.

It must last kept inwards heed that the options marketplace is zippo sum; for every seller, at that spot is a buyer. If both side of options merchandise hedged inwards a similar fashion, at that spot would last footling cyberspace outcome on the bond market. In club for the feedback loop to boot in, nosotros involve asymmetric behaviour.

- The seller of the straddle does non delta-hedge (discussed below).

- The buyer of straddle delta-hedges the risk.

This is what nosotros would aspect to laissez passer on off if at that spot was a cyberspace imbalance of investors who wanted to sell volatility; the marketplace is only balanced out past times drawing inwards other investors who recollect implied volatility is also low, but do non wishing to last exposed to directional risks.

Actions of the Straddle Buyer

Let's assume that the bond yield starts at 2%, too the smasher of the straddle is at 2% every bit good (it is at-the-money).* The directional adventure of the telephone outcry upward too pose cancel out, too so the buyer has no directional exposure. The buyer wants to rest alongside no directional risk, so she follows a delta-hedging strategy.

- The adjacent day, the bond yield rises to 2.10% (and hence, the toll falls). The telephone outcry upward choice leg of the straddle loses money, too the pose choice leg gains money. The deportment of options which are closed to at-the-money tells us that the pose choice gains coin faster than the telephone outcry upward choice loses money. As a result, at 2.10%, the seat at nowadays has a cyberspace brusk exposure to bonds: it makes to a greater extent than coin if bond yields rising past times 1 soil signal than if it falls past times 1 soil point. In club to hedge out this undesired directional position, the straddle buyer would purchase a pocket-size seat inwards the bond to provide to a cyberspace neutral position.

- The next day, the yield drops dorsum to 2.00%. Both the pose too telephone outcry upward are at-the-money again, too so i time again, the straddle has a neutral involvement charge per unit of measurement sensitivity. However, the previously bought bond seat at nowadays unbalances the portfolio. The straddle buyer volition thus sell the slice of the bond that was bought the previous day.

The profitability of the straddle buyer is determined past times 2 factors.

- There volition create got been a net turn a profit on the sold bond position; it was bought at 2.10%, too sold at 2.00%. (Yield down, toll up!) The size of these net turn a profit was determined past times the size of the displace inwards yields; if the bond had only gone from 2.00% -> 2.05% -> 2.00%, the profits would create got been (roughly) halved.

- The straddle is at nowadays 2 days closer to expiry. It's fourth dimension value would create got dropped (assuming unchanged implied volatility). If the choice originally has 2 days to expiry, the straddle expired worthless.

In summary, the cyberspace net turn a profit of the straddle buyer depends upon the human relationship betwixt realised volatility too the cost of the choice (implied volatility).

For our give-and-take here, the key signal is that the straddle buyer acts inwards a stabilising fashion for the bond market: when the bond yield rose, she bought, too and then she sold when the yield fell.

Straddle Seller

If the straddle seller delta-hedged every bit well, the transactions would mirror that of the buyer. This would create got no cyberspace outcome on the bond market. However, this is in all likelihood non what most volatility sellers wishing to do. Instead, the seller does non hedge.

In club to lose coin over the life the straddle, the bond yield has to displace far plenty away from the straddle smasher so every bit to generate a upper-case missive of the alphabet loss that is greater than the received premium for the straddle. The scenario higher upward makes the straddle seller happy, every bit the bond yield is dorsum where it started from, too 2 days create got ticked away from the life of the straddle.

Therefore, inwards club to teach the straddle seller worried, yields create got to displace strongly inwards i management or another; it is non plenty to but saltation roughly around a for certain level.

In other words, if bond yields arrive at trade, unhedged volatility sellers express joy all the way to the bank.

However, things teach ugly if yields start to move, too the straddle seller wants to teach adventure nether control. In this case, the seller needs to deed inwards a fashion that accentuates marketplace movements: selling when prices fall, or buying when prices rise.

Can We Hit a Volatility Crisis?

Although a crisis driven past times volatility hedging inwards involvement rates is possible, the obvious difficulty is that it volition last hard to displace yields away from where forwards lie. The nautical chart higher upward shows the historical volatility of the 3-month eurodollar rate, on a 24-month window. This volatility is driven solely past times Fed policy too the LIBOR spread, too is non affected past times delta hedging. As i would suspect, it has been extremely depression inwards recent years. Even though the Fed started hiking inwards Dec 2015, the realised volatility is nevertheless below almost the entire pre-Financial Crisis history.

The Federal Reserve is dominated past times New Keynesians, too they impute peachy powers to the primal bank's powerfulness to guide expectations. The resultant is that during an expansion, the brusk charge per unit of measurement ends upward pretty closed to where the forwards priced it to be. This generates a blueprint of range-trading -- which agency that realised volatility remains low.

There are a peachy many commentators who are disturbed past times this terra firma of events. They believe that the Federal Reserve should deed inwards a erratic fashion, so every bit to blow upward the bond marketplace (by raising term premia?). The apparent logic is that the Fed needs to displace a crisis, inwards club to forbid a crisis. It may last that personnel changes inwards the Fed could atomic number 82 to such an outcome, but I would non concord my breath waiting for that.

The resultant is that the duration of a mortgage-backed safety (MBS) drops every bit yields teach lower: nosotros aspect borrowers to refinance, too so nosotros effectively terminate upward alongside a brusk maturity instrument. If rates too then rise, nosotros no longer aspect refinancing, too so the effective maturity lengthens. If y'all are hedging a puddle of mortgages, y'all terminate upward trading inwards the same management every bit marketplace moves. (As should last expected, this is a brusk volatility position.)

If y'all are worried nigh rising yields, the MBS marketplace should non last also much of a line of piece of job organisation if implied volatility is low. The depression implied volatility agency that the discounted odds of a refinancing is already low, too so the effective duration of the MBS is already quite long. This is dissimilar the province of affairs when mortgage hedging was a large bargain inwards the market, which features large moves into too out of refinancing arrive at for mortgage portfolios. Any mortgage hedging that mightiness occur would last dwarfed past times the involve for funds to purchase bonds to encounter actuarial liabilities.

The only existent scare story is that nosotros create got a large rally inwards bonds, inwards which instance refinancing mightiness i time once to a greater extent than matter.

The Federal Reserve is dominated past times New Keynesians, too they impute peachy powers to the primal bank's powerfulness to guide expectations. The resultant is that during an expansion, the brusk charge per unit of measurement ends upward pretty closed to where the forwards priced it to be. This generates a blueprint of range-trading -- which agency that realised volatility remains low.

There are a peachy many commentators who are disturbed past times this terra firma of events. They believe that the Federal Reserve should deed inwards a erratic fashion, so every bit to blow upward the bond marketplace (by raising term premia?). The apparent logic is that the Fed needs to displace a crisis, inwards club to forbid a crisis. It may last that personnel changes inwards the Fed could atomic number 82 to such an outcome, but I would non concord my breath waiting for that.

Mortgage Market

The mortgage marketplace is ever skillful for generating wonkish-sounding stories nigh adventure inwards fixed income. The argue why American conventional mortgage-backed securities are skillful for volatility is that the mass of them are 30-year amortising instruments, alongside an embedded telephone outcry upward choice -- homeowners are largely gratis to refinance at lower rates. (Such consumer-friendly mortgages do non be inwards most other developed countries.)The resultant is that the duration of a mortgage-backed safety (MBS) drops every bit yields teach lower: nosotros aspect borrowers to refinance, too so nosotros effectively terminate upward alongside a brusk maturity instrument. If rates too then rise, nosotros no longer aspect refinancing, too so the effective maturity lengthens. If y'all are hedging a puddle of mortgages, y'all terminate upward trading inwards the same management every bit marketplace moves. (As should last expected, this is a brusk volatility position.)

If y'all are worried nigh rising yields, the MBS marketplace should non last also much of a line of piece of job organisation if implied volatility is low. The depression implied volatility agency that the discounted odds of a refinancing is already low, too so the effective duration of the MBS is already quite long. This is dissimilar the province of affairs when mortgage hedging was a large bargain inwards the market, which features large moves into too out of refinancing arrive at for mortgage portfolios. Any mortgage hedging that mightiness occur would last dwarfed past times the involve for funds to purchase bonds to encounter actuarial liabilities.

The only existent scare story is that nosotros create got a large rally inwards bonds, inwards which instance refinancing mightiness i time once to a greater extent than matter.

Concluding Remarks

Although it is fun to imagine potential crises, the rates marketplace is in all likelihood non going to last the source of problems. As always, the primary risks revolve roughly unsound lending practices.Technical Appendix

My implied volatility charts demo the normal volatility, which measures volatility inwards a publish of soil points per fourth dimension catamenia (day, month, year). It is calculated past times the criterion divergence of yield changes over the trading window. An alternative is to limited log-normal volatility, where the volatility is expressed every bit a per centum of the grade of yields. (This is similar to how volatility is defined for equity prices.) Fixed income models tin create got to a greater extent than flexible behaviour, for instance lying betwixt these 2 cases.In a depression charge per unit of measurement environment, log-normal volatility is problematic, too so my charts are reasonable. However, people who believe that rates are closer to log-normal inwards deportment mightiness debate that the rates volatility is overstated at the start of the fourth dimension catamenia (since the absolute grade of yields was higher, too so volatility should last scaled down).

Footnote:

* I am skipping a lot of the details that would last needed for choice pricing; I am non fifty-fifty giving the maturity of the bond. Purists would depository fiscal establishment complaint that what matters is the frontward yield, too non the spot yield. The embedded supposition inwards this instance is that the frontward too spot yield are the same, which is non that far off most of the time.

(c) Brian Romanchuk 2017

No comments