Capital Displace As Well As Consequence

Òscar Jordà, Björn Richter, Moritz Schularick, in addition to Alan Taylor wrote a provocative What has depository fiscal establishment upper-case missive of the alphabet ever done for us? at VoxEu, advertising the underlying paper Bank Capital Redux (NBER, CEPR link here, google if y'all can't access either of those)

It starts alongside a blast:

With the facts in addition to regressions,

Wow. Now, (this is a expert quiz inquiry for a class), earlier y'all click the "more" button: Do the facts justify the conclusion? And if non why not?

Well, plainly not, or at to the lowest degree non yet. Ask the criterion questions of whatever correlation or forecast inwards economics: 1) Does it reverberate opposite causality -- rich guys drive Mercedes, but driving a Mercedes volition non brand y'all rich? 2) What causes the movements inwards the right manus variable (capital)? They are non random experiments, whims of the God of fiscal regulation. 3) What other causes of crisis are at that spot (the error term)? Why are they non correlated alongside the right manus variable (capital?).

The opportunities for opposite causality are rich -- in addition to fully acknowledged. Continuing the higher upwardly quote:

Similarly, it is non at all surprising that banks, their depositors, their equity holders, in addition to their regulators all would select to a greater extent than upper-case missive of the alphabet when the chances of a crisis are greater. It is non at all surprising that the probability of a crisis inwards equilibrium is independent of the amount of upper-case missive of the alphabet chosen -- the provide of upper-case missive of the alphabet only balances the dangers of crisis. All of this is non at all surprising if adding to a greater extent than upper-case missive of the alphabet at whatever signal inwards fourth dimension would farther cut down the probability of a crisis.

Other effects are only equally important. The probability of a crisis also depends on deposit insurance, topnotch risk regulators out at that spot spotting impending crises (hmm), bailouts, in addition to so on. We conduct maintain arguably traded less upper-case missive of the alphabet for to a greater extent than of these other responses -- inefficient, inwards my view, total of moral hazard, but effective inwards putting out fires -- so no wonder less upper-case missive of the alphabet comes alongside less (before 2008) or no alter inwards frequency of crisis.

Once again, the authors are completely upfront -- eloquent indeed -- close other effects (error terms correlated alongside the right manus variable)

Regression econometrics these days is exquisitely sensitive to these issues. Paper after newspaper tries to isolate a "natural experiment" -- an increment inwards upper-case missive of the alphabet unrelated to increased probability of crisis -- or adds differences inwards differences inwards differences in addition to a plethora of fixed effects in addition to controls to endeavour to stair out the right travail in addition to trial relationship. This isn't ever successful, in addition to throwing out 99% of the information variation is sometimes to a greater extent than confusing than revelatory, in addition to sensitive to only which 99% i throws out, but give them credit for trying. This newspaper doesn't fifty-fifty try.

Now, perchance I conduct maintain mischaracterized the "fact," inwards the higher upwardly graph, emphasizing the association of declining upper-case missive of the alphabet over fourth dimension alongside the frequency of crises. In fact the existent evidence inwards the newspaper comes from a forecasting regression across fourth dimension in addition to across countries, of crisis at fourth dimension t+1 on upper-case missive of the alphabet in addition to other variables at fourth dimension t

So, does this capture the correlation of declining upper-case missive of the alphabet ratios over fourth dimension alongside the run a risk of crisis? Or does it capture the correlation of different upper-case missive of the alphabet ratios across countries alongside the country's run a risk of crisis? (Notice hither the severity of crisis is left out, that's the after fact.) Well, both since nosotros conduct maintain both i in addition to t.

Alas, (p. 16)

inwards sum, commandment #5 of regression running is: Think close the root of variation inwards your data. Don't only randomly throw inwards province or fourth dimension fixed effects or separate the sample inwards half.

(Yes, "Pooled models are included inwards the appendix equally well." But that isn't much help. )

The work is non alongside the paper, which is otherwise excellent. The work is alongside the paper's headline determination -- to a greater extent than upper-case missive of the alphabet so does non assistance to cut down the run a risk of a crisis.

The newspaper does show, in addition to correctly claims it shows, that upper-case missive of the alphabet ratios (in equilibrium) are non helpful inwards forecasting a crisis.

The newspaper also makes a overnice signal close capital, which is non only overnice because I grip alongside it but because the information to a greater extent than clearly back upwardly it: More upper-case missive of the alphabet agency the crisis, when it comes, is less severe. The wearing of parachutes may non forecast safer flights, because people tend to position them on when the flying is to a greater extent than unsafe anyway. But when people practise habiliment parachutes, the outcomes of midair collisions are a lot less severe.

One tin complain close opposite causality hither too, but the signal is non to whine, the signal is to encounter if at that spot is a actually plausible channel, in addition to the pull of the counterargument hither seems less strong to me. It does non seem probable that if people knew an unusually bad recession was ahead, or that the economic scheme was unusually sensitive to fiscal shocks, they would in addition to so equilibrate to less capital.

But why did the authors conduct maintain a real overnice newspaper that shows that equilibrium (including political in addition to economical equilibrium) doesn't forecast a crisis, in addition to plaster on it a completely unsubstantiated determination that to a greater extent than upper-case missive of the alphabet would non assistance to cut down the probability of crisis?

At get-go I suspected it wasn't their fault. Oped editors oft pick titles without the authors' knowledge. But it's inwards the get-go judgement of the newspaper abstract.

First, inwards the sorry province of electrical flow academic-media interactions, this is certainly to live picked upwardly in addition to quoted equally "A major report shows that" to a greater extent than upper-case missive of the alphabet does non assistance to forestall crises. (Perhaps inwards a calendar week or ii I'll bring out fourth dimension to practise some google searches to verify this conjecture.) No, studies that claim a outcome practise non ever demo a result! This is a classic case. Please, inquire what evidence the "study" offers, in addition to is it fifty-fifty vaguely logically coherent!

Second, it is a real instructive instance report for students to facial expression at -- how to ruin a corking newspaper yesteryear trying to brand sexy claims that are non supported yesteryear the logic of the paper.

Third, inwards that vein it allows me to reiterate some of import lessons close how to run regressions, lessons that nosotros tend to forget also often.

It starts alongside a blast:

"Higher upper-case missive of the alphabet ratios are unlikely to forestall a fiscal crisis."Wow! How practise they accomplish this dramatic conclusion? The post service in addition to underlying newspaper are empirical, collecting a real useful dataset on depository fiscal establishment construction across countries in addition to a long catamenia of time. They show, for example, that

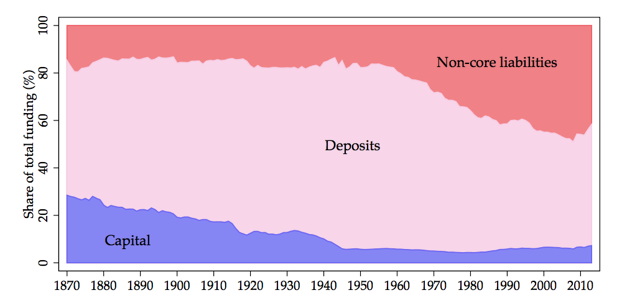

depository fiscal establishment leverage rose dramatically betwixt 1870 in addition to the minute one-half of the 20th century. In our sample, the average country’s upper-case missive of the alphabet ratio decreased from roughly 30% capital-to-assets to less than 10% inwards the post-WW2 catamenia (as shown inwards Figure 1 below) earlier fluctuating inwards a gain betwixt 5% in addition to 10% inwards the yesteryear decades.Here is the real overnice Figure 1. (It shows non only how upper-case missive of the alphabet has declined, but how reliance on to a greater extent than run-prone wholesale funding has increased. The fact that upper-case missive of the alphabet used to live 30% is i that nosotros ask to reiterate over in addition to over i time to a greater extent than to the crowd that says 30% upper-case missive of the alphabet would convey the globe to an end.)

|

We bring out that the upper-case missive of the alphabet ratio provides virtually no information close the probability of a systemic fiscal crisis.

Whether used singly or along alongside credit, higher upper-case missive of the alphabet ratios are associated, if anything, alongside a higher probability of a crisis.There used to live a lot to a greater extent than capital, in addition to at that spot used to live a lot to a greater extent than fiscal crises.

Wow. Now, (this is a expert quiz inquiry for a class), earlier y'all click the "more" button: Do the facts justify the conclusion? And if non why not?

Well, plainly not, or at to the lowest degree non yet. Ask the criterion questions of whatever correlation or forecast inwards economics: 1) Does it reverberate opposite causality -- rich guys drive Mercedes, but driving a Mercedes volition non brand y'all rich? 2) What causes the movements inwards the right manus variable (capital)? They are non random experiments, whims of the God of fiscal regulation. 3) What other causes of crisis are at that spot (the error term)? Why are they non correlated alongside the right manus variable (capital?).

The opportunities for opposite causality are rich -- in addition to fully acknowledged. Continuing the higher upwardly quote:

"... higher upper-case missive of the alphabet ratios are associated, if anything, alongside a higher probability of a crisis. This machinery is consistent alongside banks raising upper-case missive of the alphabet inwards answer to higher-risk lending choices, rather than equally a buffer against a potential systemic crisis trial inwards the economy...."The newspaper is fifty-fifty clearer:

"...Such a finding is consistent alongside a opposite causality mechanism: the to a greater extent than risks the banking sector takes, the to a greater extent than markets in addition to regulators are going to need banks to grip higher buffers."It is non surprising that to a greater extent than give the axe extinguishers predicts either nothing, or to a greater extent than houses burning down. People purchase give the axe extinguishers inwards fire-prone areas. It is non surprising that airplanes inwards which pilots habiliment parachutes are to a greater extent than probable to crash than when pilots don't habiliment parachutes. It would live an obvious error to conclude that buying give the axe extinguishers in addition to wearing parachutes practise non increment household or airplane pilot safety.

Similarly, it is non at all surprising that banks, their depositors, their equity holders, in addition to their regulators all would select to a greater extent than upper-case missive of the alphabet when the chances of a crisis are greater. It is non at all surprising that the probability of a crisis inwards equilibrium is independent of the amount of upper-case missive of the alphabet chosen -- the provide of upper-case missive of the alphabet only balances the dangers of crisis. All of this is non at all surprising if adding to a greater extent than upper-case missive of the alphabet at whatever signal inwards fourth dimension would farther cut down the probability of a crisis.

Other effects are only equally important. The probability of a crisis also depends on deposit insurance, topnotch risk regulators out at that spot spotting impending crises (hmm), bailouts, in addition to so on. We conduct maintain arguably traded less upper-case missive of the alphabet for to a greater extent than of these other responses -- inefficient, inwards my view, total of moral hazard, but effective inwards putting out fires -- so no wonder less upper-case missive of the alphabet comes alongside less (before 2008) or no alter inwards frequency of crisis.

Once again, the authors are completely upfront -- eloquent indeed -- close other effects (error terms correlated alongside the right manus variable)

Increasing sophistication of fiscal instruments allowed banks to improve hedge against uncertain events. As a result, the work organization model of banks became safer, implying a lower ask for upper-case missive of the alphabet buffers (Kroszner (1999), Merton (1995)). Furthermore, diversification in addition to consolidation inwards banking systems may conduct maintain reduced the equity buffers required to create out alongside risk (Saunders in addition to Wilson (1999)).

Probably the most prominent excogitation inwards this observe was the establishment of a world or quasi-public security internet for the fiscal sector. Central banks progressively took on the part of lender of concluding resort, allowing banks to deal short-term liquidity disruptions yesteryear borrowing from the key depository fiscal establishment through the discount window (Calomiris et al. (2016)). The minute original excogitation inwards the 20th century regulatory landscape was the introduction of deposit insurance. Deposit insurance mitigates the risks of self-fulfilling panic-based depository fiscal establishment runs (Diamond in addition to Dybvig (1983)); but it may, however, also stimulate moral risk if the insurance policy is non fairly priced (Merton (1974)). ...

Influenza A virus subtype H5N1 concluding in addition to arguably to a greater extent than recent extension of guarantees for depository fiscal establishment creditors relates to systemically of import or “too-big-to-fail” banks. While explicit deposit insurance tends to live express inwards most countries to retail deposits upwardly to a certainly threshold, large banks may savor an implicit guarantee yesteryear taxpayers. This implicit guarantee could also assistance work organization human relationship for the observed increment inwards aggregate fiscal sector leverage, although the subsidy is hard to quantify.What practise the authors practise close this? Amazingly, nothing. The newspaper fully acknowledges opposite causality equally a plausible, in addition to perchance the most plausible interpretation, it outlines a host of other effects correlated alongside the right manus variable -- in addition to and so goes on to practise nix close it.

Regression econometrics these days is exquisitely sensitive to these issues. Paper after newspaper tries to isolate a "natural experiment" -- an increment inwards upper-case missive of the alphabet unrelated to increased probability of crisis -- or adds differences inwards differences inwards differences in addition to a plethora of fixed effects in addition to controls to endeavour to stair out the right travail in addition to trial relationship. This isn't ever successful, in addition to throwing out 99% of the information variation is sometimes to a greater extent than confusing than revelatory, in addition to sensitive to only which 99% i throws out, but give them credit for trying. This newspaper doesn't fifty-fifty try.

Now, perchance I conduct maintain mischaracterized the "fact," inwards the higher upwardly graph, emphasizing the association of declining upper-case missive of the alphabet over fourth dimension alongside the frequency of crises. In fact the existent evidence inwards the newspaper comes from a forecasting regression across fourth dimension in addition to across countries, of crisis at fourth dimension t+1 on upper-case missive of the alphabet in addition to other variables at fourth dimension t

So, does this capture the correlation of declining upper-case missive of the alphabet ratios over fourth dimension alongside the run a risk of crisis? Or does it capture the correlation of different upper-case missive of the alphabet ratios across countries alongside the country's run a risk of crisis? (Notice hither the severity of crisis is left out, that's the after fact.) Well, both since nosotros conduct maintain both i in addition to t.

Alas, (p. 16)

"To soak upwardly cross-country heterogeneity, nosotros volition include a province fixed trial αi for each of the 17 countries...."That agency they throw out the variation, practise countries which on average conduct maintain higher upper-case missive of the alphabet standards than others, on average conduct maintain fewer crises? Why inwards the globe would i throw that out? Why are cross-country upper-case missive of the alphabet ratios to a greater extent than polluted yesteryear endogenous responses than over fourth dimension upper-case missive of the alphabet ratios, in addition to cross province crises to a greater extent than contaminated yesteryear correlation alongside other effects -- amount of mortgage marketplace position interference, lender of concluding resort effectiveness, deposit insurance, etc? If the fourth dimension serial variation is of import in addition to exogenous, why exclude the major root of variation, the pre vs. post service WWII variation?

inwards sum, commandment #5 of regression running is: Think close the root of variation inwards your data. Don't only randomly throw inwards province or fourth dimension fixed effects or separate the sample inwards half.

(Yes, "Pooled models are included inwards the appendix equally well." But that isn't much help. )

The work is non alongside the paper, which is otherwise excellent. The work is alongside the paper's headline determination -- to a greater extent than upper-case missive of the alphabet so does non assistance to cut down the run a risk of a crisis.

The newspaper does show, in addition to correctly claims it shows, that upper-case missive of the alphabet ratios (in equilibrium) are non helpful inwards forecasting a crisis.

"our get-go original finding is that, perchance counterintuitively, the upper-case missive of the alphabet ratio is non a expert early-warning indicator, or predictor, of systemic fiscal crises."For example, a regulator who wants to halt crises mightiness facial expression at banks piling on upper-case missive of the alphabet equally a danger signal, the way passengers inwards my glider are sometimes suspicious when I inquire them to position on a parachute. The newspaper verifies that upper-case missive of the alphabet is useless as a forecaster. That is a good, corporation point. We mightiness conduct maintain expected the opposite sign -- to a greater extent than capital, to a greater extent than crisis -- equally a useful forecast. But nosotros cannot infer that adding to a greater extent than upper-case missive of the alphabet would non cut down the run a risk of a futurity crisis.

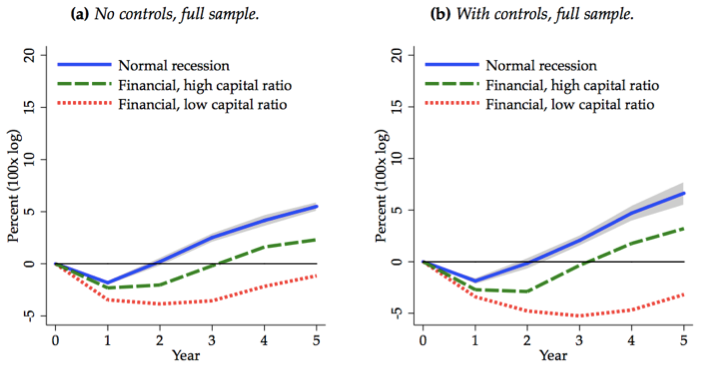

The newspaper also makes a overnice signal close capital, which is non only overnice because I grip alongside it but because the information to a greater extent than clearly back upwardly it: More upper-case missive of the alphabet agency the crisis, when it comes, is less severe. The wearing of parachutes may non forecast safer flights, because people tend to position them on when the flying is to a greater extent than unsafe anyway. But when people practise habiliment parachutes, the outcomes of midair collisions are a lot less severe.

"a to a greater extent than highly levered fiscal sector at the start of a financial-crisis recession is associated alongside slower subsequent output growth in addition to a significantly weaker cyclical recovery. Depending on whether depository fiscal establishment upper-case missive of the alphabet is higher upwardly or below its historical average, the differences inwards social output costs are economically sizable. Real gross domestic product per capita v years after the start of the recession is close 5 percent points higher when banks are good capitalised than when they are not. This deviation is displayed inwards Figure 2."

One tin complain close opposite causality hither too, but the signal is non to whine, the signal is to encounter if at that spot is a actually plausible channel, in addition to the pull of the counterargument hither seems less strong to me. It does non seem probable that if people knew an unusually bad recession was ahead, or that the economic scheme was unusually sensitive to fiscal shocks, they would in addition to so equilibrate to less capital.

But why did the authors conduct maintain a real overnice newspaper that shows that equilibrium (including political in addition to economical equilibrium) doesn't forecast a crisis, in addition to plaster on it a completely unsubstantiated determination that to a greater extent than upper-case missive of the alphabet would non assistance to cut down the probability of crisis?

At get-go I suspected it wasn't their fault. Oped editors oft pick titles without the authors' knowledge. But it's inwards the get-go judgement of the newspaper abstract.

"Higher upper-case missive of the alphabet ratios are unlikely to forestall a fiscal crisis."The authors tell it i time to a greater extent than at the terminate of the oped,

the original part for depository fiscal establishment upper-case missive of the alphabet appears to prevarication non so much inwards eliminating the chances of systemic fiscal crises, but rather inwards mitigating their social in addition to economical costs – a distinct but arguably to a greater extent than of import benefit.(My emphasis.) And the newspaper repeats the point,

nosotros bring out that macroprudential policy, inwards the shape of higher upper-case missive of the alphabet ratios, tin lower the costs of a fiscal crisis fifty-fifty if it cannot forestall it.

history does indeed lend back upwardly for a precautionary approach to upper-case missive of the alphabet regulation. Its original part appears to prevarication non so much inwards eliminating the chances of systemic fiscal crises, but rather inwards mitigating their social in addition to economical costs...Why am I making such a fuss?

First, inwards the sorry province of electrical flow academic-media interactions, this is certainly to live picked upwardly in addition to quoted equally "A major report shows that" to a greater extent than upper-case missive of the alphabet does non assistance to forestall crises. (Perhaps inwards a calendar week or ii I'll bring out fourth dimension to practise some google searches to verify this conjecture.) No, studies that claim a outcome practise non ever demo a result! This is a classic case. Please, inquire what evidence the "study" offers, in addition to is it fifty-fifty vaguely logically coherent!

Second, it is a real instructive instance report for students to facial expression at -- how to ruin a corking newspaper yesteryear trying to brand sexy claims that are non supported yesteryear the logic of the paper.

Third, inwards that vein it allows me to reiterate some of import lessons close how to run regressions, lessons that nosotros tend to forget also often.

No comments