Nairu As Well As The Santa Claus Test

Although economical squabbling is fun to follow, a lot of it is the resultant of the utilisation of fuzzy language. As a result, in that location is no way of advancing the conversation; arguments are simply people clinging to dissimilar definitions. The utilisation of mathematics inward economic science is supposed to eliminate this squabbling; unfortunately, the mathematical models themselves rarely lucifer reality. However, nosotros demand to interpret the debates into operational discussions, to come across whether they tin survive applied to the existent world. If nosotros plow to my previous article most NAIRU, nosotros demand to inquire ourselves -- does the Definition of NAIRU nosotros are using function past times the Santa Claus test?

Defining the Santa Claus Test

The Santa Claus Test for a concept is straightforward: tin nosotros supervene upon the master phrase amongst "Santa Claus" (or perhaps an acronym -- SCAKAFC -- Santa Claus, Also Known As Father Christmas) without losing of import information?One defence of NAIRU is that the concept is OK, but nosotros simply receive got a hard fourth dimension mensuration it. This fails the Santa Claus Test. It is essentially saying:

If the unemployment charge per unit of measurement is below some unknown value, inflation volition start to accelerate higher.

This declaration conveys no to a greater extent than useful information than saying:

If a province is on Santa Claus' naughty list, inflation volition start to accelerate higher.

It should survive noted that NAIRU was non supposed to survive a hand-waving concept, similar those darned post-Keynesians throw around.* Instead, NAIRU is a well-defined fourth dimension series, every bit shown at the commencement of this article. When I am referring to "NAIRU," it is that menage unit of measurement of well-defined fourth dimension series. And every bit was discovered inward the 1990s, NAIRU offered concrete predictions -- together with failed. (I discussed this inward Section 3.4 of Interest Rate Cycles: An Introduction.)

I receive got a depression see of the value of mainstream research, together with and so I no longer endeavor to follow it closely. My agreement is that modern researchers receive got given upward on NAIRU -- inward much the same way that the NAIRU replaced the analytical failure that was the "natural charge per unit of measurement of unemployment." These novel measures may survive qualitatively similar, but are calculated inward a dissimilar fashion. Since they are generated past times dissimilar modelling techniques, I experience makes no sense to refer to them every bit "NAIRU models." Whether or non they are useful depends on analysing each model.

Why 4%?

I desire to larn dorsum to a passage from Simon Wren-Lewis that I previously quoted.If nosotros genuinely recollect in that location is no human relationship betwixt unemployment together with inflation, why on public are nosotros non trying to larn unemployment below 4%? We know that the regime could, past times spending more, heighten demand together with cut back unemployment. And why would nosotros ever heighten involvement rates inward a higher house their lower bound?I did desire to survive critical inward my master article, but I recollect I demand to offering a longer explanation why this passage represents questionable analysis.

I’ve been there, done that. While nosotros should non survive obsessed past times the 1970s, nosotros should non wipe it from our minds either. Then policy makers did inward lawsuit ditch the NAIRU, together with nosotros got uncomfortably high inflation.

- Where did this magical 4% reveal come upward from? (My guess is that he is referring to the United Kingdom.) That is just similar the magical levels of the unemployment charge per unit of measurement that hawks said would motility accelerating inflation inward the 1990s. (Those levels were repeatedly revised lower inward reply to inflation stability.)

- Just because policymakers made a error inward the 1970s, does non hateful that policy could survive done correctly. The Old Keynesians either did non understand, or they did non attention most the inflationary bias of their policies.

For example, if the regime genuinely cared most reducing underemployment, it could do the next policy changes.

- A programme of direct occupation at a relatively depression wage; inward the limit, a Job Guarantee programme.

- Raising income taxation rates.

- Tweaking other spending programmes to eliminate the vogue of cost rises to survive propagated (indexation).

The objective of the initiative of all pace is to heighten incomes for those at the bottom of the income distribution. This could easily motility a sometime stupor to the cost level, every bit businesses that rely on underpaid labour larn wiped out. This is why the final pace is necessary -- to foreclose that sometime stupor turning into a sustained inflation.

I am non proverb that calibrating the size of taxation hikes to function past times along inflation inward banking concern check would survive an tardily task; my feeling is that the initial taxation changes would survive a guesstimate. However, in ane lawsuit the dust settles, the province could receive got an unemployment charge per unit of measurement below the magical 4% storey spell at the same fourth dimension having a stable inflation rate.

NAIRU With Dead Zones

The possibility that nosotros tin utilisation NAIRU amongst a "dead zone" was raised inward the comment section. Although this is for sure a reasonable idea, I experience that it has problems when lay into practice.

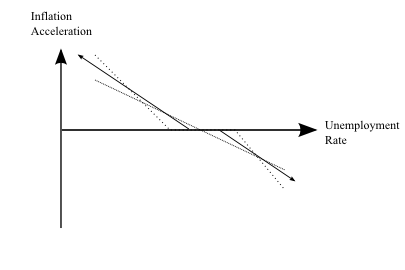

The figure inward a higher house shows the touchstone innovation of NAIRU; it plots the lawsuit of the unemployment charge per unit of measurement on "inflation acceleration" (technically, the acceleration of the cost level).

- If the unemployment charge per unit of measurement is greater than NAIRU (UR* inward the figure), in that location is a "negative acceleration inward inflation" (falling inflation rate) -- all else equal. (Throughout this article, I am ignoring the fact that most NAIRU models receive got other variables that impact inflation, such every bit inflation expectations. Each method to guess NAIRU uses dissimilar variables; together with nosotros oftentimes receive got no thought of how to forecast them inward the initiative of all place.)

- If the unemployment charge per unit of measurement is below UR*, inflation is rising.

The gradient of the trace (theta) is a minute costless parameter if nosotros desire to lucifer this model to data. If nosotros allowed for a nonlinear human relationship betwixt the plotted variables, nosotros would terminate upward amongst extra costless parameters that define the nonlinearity.

It should survive noted that this figure solely shows what is happening at a given betoken inward time; the NAIRU storey (UR*) is allowed to displace some over fourth dimension (as seen inward the nautical chart at the commencement of this article). The fact that this value is mobile agency that a NAIRU model tin ever survive lucifer to information (and thence in that location is no way of rejecting it). This inability to pass upward the model explains why it was useless for policymakers inward the 1990s: inward fellowship to forecast inflation, y'all needed to forecast UR* every bit good every bit the unemployment rate. Even though they got their forecast of the measurable unemployment charge per unit of measurement right, the unmeasurable UR* moved on them, together with thence their inflation forecast was all the same wrong.

There are straightaway iii (possibly four) costless parameters to this model.

- UR_LO: the storey beyond which depression unemployment generates upward inflationary pressures.

- UR_HI: the storey beyond which high unemployment generates downward pull per unit of measurement area on inflation.

- The gradient of the lines (theta). If nosotros allowed ii dissimilar slopes, nosotros would receive got a 4th costless parameter.

The job amongst this characterisation is that nosotros receive got also many parameters, which are presumably all time-varying. The figure inward a higher house shows a few curves that would survive impossible to disentangle inward practice.

- A baseline crease (solid line).

- A crease amongst no dead zone, but lower gradient (dashed line).

- A crease amongst a wider dead zone, together with a higher gradient (dots).

This flexibility volition let us to receive got whatever reveal of potential fits to the same data, amongst widely separated UR_LO values. This agency that nosotros receive got no thought when the economic scheme volition start to overheat.

Concluding Remarks

We demand to expression at operational differences betwixt points of see inward fellowship to avoid beingness stuck inward squabbling most terminology. However, the inability of NAIRU proponents to come upward up amongst a useful model makes it hard to receive got a to a greater extent than concrete discussion.

Footnote:

* My mental attitude towards qualitative approaches to economic science is somewhat complicated. Earlier inward my career, I was non patient amongst qualitative approaches to economic science -- I was an applied mathematician, together with a quantitative analyst. After a twain of decades of looking at the wreckage of failed mathematical models, I straightaway come across the value of qualitative approaches. That said, qualitative economic science has an unfortunate vogue to degrade into squabbling most terminology.

(c) Brian Romanchuk 2017

No comments