Effect Of A Charge Per Unit Of Measurement Hike Inwards A Sfc Model

The effects of charge per unit of measurement hikes on the economic scheme is an interesting subject. There is an instinctive consensus persuasion on what a charge per unit of measurement hike accomplishes, but the demonstration of why this should last so is much less clear. One of the entertaining properties of SFC models is that at to the lowest degree roughly of them human activity inward a agency that is contrary to the consensus.

In this article, I copy Model PC (Portfolio Choice) from Chapter four of Monetary Economics. It should last noted that this is the minute simplest type of model inward the book. The simulation results presented hither may non apply to to a greater extent than advanced models. (This is why the championship reads "In Influenza A virus subtype H5N1 SFC Models," too non the to a greater extent than definite "In SFC Models.") This simplicity could last viewed as the drive of the counter-intuitive results.

(Why non copy the to a greater extent than complex models inward the book? I am edifice my simulation framework, too developing algorithms to generate equations is non trivial. More complex models generate to a greater extent than complex errors, too so I get got been edifice upward the framework's trouble-shooting too debugging capabilities. I get got finished a lot of the quality-of-life improvements, too so I am inward seat to laid on the adjacent class of models, which are the uncomplicated opened upward economic scheme models of Chapter 6. I am next the trajectory of the mass as the code that generates the models is available, too so I tin sack calibrate my results against the EViews simulations.)

As shown inward the nautical chart at the top of the article, inward this simulation, in that place is an increment inward involvement rates inward 1960 -- from 2.5% to 3.5%. (The information are annual.) The economic scheme was inward a steady Earth earlier 1960, too so volition motion to a novel steady Earth inward answer to the rate

The nautical chart inward a higher house shows the impact of the charge per unit of measurement hike. From 1950-1960, national output (Y) was constant (at almost $106.5). One twelvemonth after the charge per unit of measurement hike (1961), national income rises. (The importance of the engagement of the modify inward output is discussed later.) It increases, until it converges towards a novel steady state.This model has no style towards growth. Like inward Model SIM, output is mainly driven yesteryear authorities consumption (G), which is constant at $20 throughout the entire simulation period.

The nautical chart inward a higher house gives a clue as to why output increases. Within Model PC, the family sector holds Treasury bills (of a one-year maturity, matching the fourth dimension step). The ascension of involvement rates inward 1960 leads to higher income, too thence higher consumption. There is a multiplier termination on these increment purchases, too so national output rises.

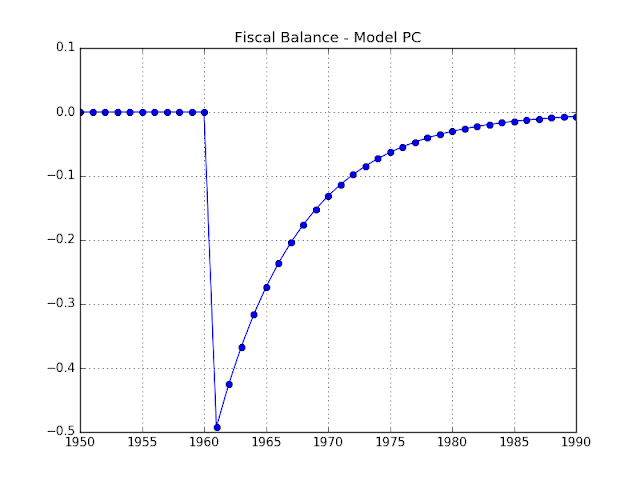

Finally, the nautical chart inward a higher house presents the government's financial balance. (This is equal to the primary residual less involvement costs.) Within this model, the financial residual equals:

Fiscal residual = (Taxes) - (Government Consumption) - (Interest cost) + (Central Bank dividend).

This model separates the cardinal depository financial establishment from the Treasury. The Treasury supplies the Treasury bills (duh!), too the cardinal depository financial establishment supplies

The cardinal depository financial establishment buys Treasury bills to provide the family sector alongside the amount of coin it desires. It generates a turn a profit on the Treasury nib holdings, which it at nowadays pays to the Treasury as a dividend. The goal termination is that the cyberspace cost of involvement for the Treasury is equal to the involvement charge per unit of measurement times the somebody sector's Treasury bill's holdings (which is just the same as if nosotros consolidated the Treasury too the cardinal bank).

In a SFC model without growth, the steady Earth authorities financial residual is $0, which nosotros meet during the 1950-1960 period. In 1961, the termination of the charge per unit of measurement hike shows upward inward a greater involvement bill, causing the financial deficit. However, increasing somebody sector activity raises the revenue enhancement take, too so the financial residual converges dorsum to $0.

The one-period delay inward the reaction to the charge per unit of measurement hike (1961 versus the hike inward 1960) reflects the fact that nosotros produce non get got a continuous-time model. You exclusively larn the higher involvement income when the Treasury nib matures.

(As a technical note, the mass too the simulation I run uses a deposit involvement convention, too non a discount nib pricing convention. In a model where the involvement charge per unit of measurement is fixed yesteryear the cardinal bank, in that place is no economical divergence betwixt these formalisms. The deposit convention is a lot easier to piece of job with.)

Discussion of Results

Model PC is like to Model SIM -- it is driven yesteryear financial policy. However, what matters is the entire financial balance, too non simply the primary balance. In fact, the primary residual increased during the shock.If nosotros followed the fairly measure persuasion that the opinion of financial policy is determined yesteryear the primary financial balance, nosotros would goal upward believing that financial policy tightened. This is on top of presumably tighter monetary policy, as represented yesteryear higher involvement rates too a smaller coin provide (not shown; volition speak over inward an article on portfolio allocation).

(The agency out of this apparent puzzle is to realise that the opinion of financial policy is laid yesteryear the score of authorities consumption too revenue enhancement rates; the score of the primary residual offers us real picayune information.)

In other words: increasing the charge per unit of measurement of involvement increases full authorities spending, too in that place is a multiplier termination that passes through to national output.

Although interesting, it raises roughly awkward questions. Should cardinal banks last raising rates chop-chop inward a bid to increment national income?

I am going to duck that debate, but I wishing to betoken out how these simulation results offering an incomplete picture.

- There is no modelling of the cost score inside the model. Interest charge per unit of measurement policy is commonly assumed to last tightly linked to inflation trends.

- This model does non contain longer-term authorities debt. Long-term bonds endure uppercase losses as a termination of rising yields; higher involvement income volition exclusively exhibit upward as bonds mature.

- There may last farther uppercase losses on other financial assets too existent estate.

- The family sector's consumption role is independent of involvement rates. (Only portfolio allotment is affected.)

- Wealth is unequally distributed; the households alongside large financial property holdings may get got a below-average propensity to eat out of involvement income.

- There is no fixed investment (or fifty-fifty inventory investment) inside the model. Fixed investment is presumably sensitive to involvement rates.

To what extent these simulation results are misleading, I would mainly focus on the terminal betoken (fixed investment). The relative importance of these factors versus the termination of higher nominal family income on spending is an empirical affair that I produce non facial expression to resolve here.

Technical Comments On the Python SFC Models Framework

Development is continuing, too I am at nowadays inward a seat to inquire others for their feedback. The framework is increasingly easier to piece of job with. At present, beingness able to copy the simplest models from Monetary Economics is non going to print people. However, it should last straightforward to progress through the other models, making the framework improve positioned to last used as a didactics tool or for enquiry purposes.

- One of the novel features is hidden inward the inward a higher house figures. I get got adapted the solver to guess an initial steady Earth ("equilibrium") numerically. This eliminates the extremely messy procedure of setting initial atmospheric condition inward SFC models (which becomes increasingly complex as nosotros add together variables).

- The exclusively economical functionality added was the portfolio allotment framework. I volition clit this later.

- Debugging back upward was greatly expanded, partly to bargain alongside the problems I clit below.

I also get got the mightiness to validate model outputs against expected results. I exercise this to as component subdivision of unit of measurement tests, which allow me to cheque that changes to code produce non suspension functionality.

This validation surprisingly slowed me downwards when testing Model PC. I used spreadsheet simulations (from sfc-models.net) to provide baseline results. However, I was unable to replicate them. It took roughly time, but the spreadsheets look to last slightly incorrect. (This is a rather mutual theme for spreadsheet-based analysis.) The clue that tipped me off to the problems alongside the spreadsheet is that national income changed inward the same current as the involvement charge per unit of measurement rise, too non the current later. The exclusively other variables that should modify inward the start current of the charge per unit of measurement hike are the residual canvass entries that modify as a termination of the family portfolio shift; however, portfolio shifts produce non generate income. (Unless nosotros insert a financial sector that skims income off of portfolio shifts...)

I switched to the EViews models available on sfc-models.net to larn a to a greater extent than robust baseline model output to match.

I switched to the EViews models available on sfc-models.net to larn a to a greater extent than robust baseline model output to match.

(c) Brian Romanchuk 2017

No comments