Punditonomics

James Surowiecki at The New Yorker had a prissy column concluding calendar month on "Punditonomics," the style of much populace give-and-take to focus on individuals who appear to direct keep forecast i or 2 big events inwards the past.

The economical incentive is clear:

I cry upwards this footling article makes clear why these are such hopeless as well as profoundly unscientific debates. (Which, y'all may direct keep wondered, is why I direct keep completely ignored them as well as then far.) Mining erstwhile weblog posts for successes -- or damning people as well as their "models" for selected failures -- proves nothing. To larn something virtually about economical logic as well as the powerfulness of economical ideas to empathise drive as well as effect, y'all at to the lowest degree direct keep to gather an entire forecast record.

More deeply, whatever serious forecast, reflective of the worth of an economical theory, must survive written downward as well as divorced from the judgment of the forecaster. Even if, say, Bob Shiller turned out to survive a psychic who could tell when bubbles were happening, as well as never got a forecast wrong, that is fairly useless cognition unless Bob tin give the sack somehow write downward his procedure as well as then that someone else tin give the sack practise it too. Otherwise, this is similar proverb to a climate scientist, "well y'all persuasion it would pelting concluding weekend, as well as then for sure 'your model' is wrong."

Academic economic science does this. We wrote downward models, as well as attempt out them yesteryear whether the models' predictions, inwards anyone's hands, agrees amongst the data. It's interesting that the policy debates, fifty-fifty yesteryear ex academics, goes dorsum to such solidly pre-scientific witch-doctor evaluation.

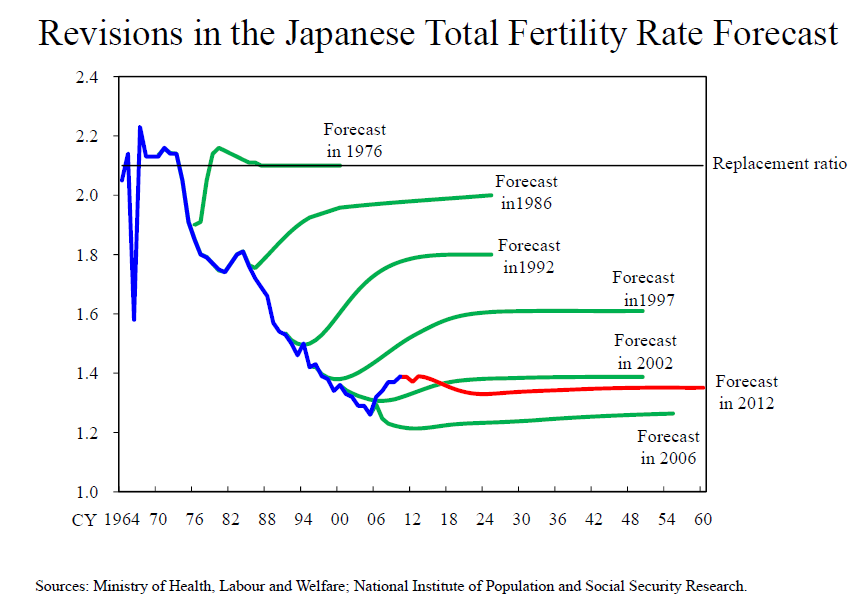

Another cool link on this dependent champaign was sent to me yesteryear a colleague. The graph on the left comes from a speech given yesteryear Masaaki Shirakawa, Governor of the Bank of Japan. We commonly cry upwards of economists every bit fallible, but demography, well, that should survive tardily to forecast. Apparently non so.

I include this pic for its beautiful art. Forecasts of GDP, inflation, budget deficits, as well as involvement rates all facial expression virtually this way. Forecasts should also ever include measure errors, but yesteryear histories inwards this graphical shape mightiness survive to a greater extent than informative as well as easier to communicate.

The economical incentive is clear:

Experts inwards a broad attain of fields are prone to making daring as well as confident forecasts, fifty-fifty at the direct chances of beingness wrong, because when they're right the rewards are immense. An goodness who makes i nifty prediction tin give the sack alive off the success for a long time; nosotros assume that the feat is repeatable.But, beingness right i time is pretty meaningless

The most comprehensive report inwards this champaign was done yesteryear the psychologist Philip Tetlock. [JC: link here.] Over many years, he tracked some 3 hundred experts, cry for them to justice the probability of diverse geopolitical events. He industrial plant life that, though a given goodness may foretell i extreme event, dosing as well as then consistently was side yesteryear side to impossible. Experts who foresaw the breakup of Yugoslavia also thought, wrongly, that Republic of Hungary as well as Romania would slide into civil war. Being spectacularly right i time doesn't guarantee beingness right inwards the future. In fact, the contrary may survive true. In i fascinating report yesteryear the concern schoolhouse professors Jerker Denrell as well as Cristina Fang, [JC: Link here] people who successfully predicted an extreme trial had worse overall forecasting tape than their peers.Most of James' examples are financial

The history of forecasting is littered amongst examples of experts who were acclaimed every bit visionaries, entirely to disappoint. Two weeks earlier the Great Crash of 1929, Irving Fisher, i of the pioneers of economical forecasting, declared that stock prices had reached a "permanently high plateau." In the tardily seventies, the market-timing abilities of the investment guru Joe Granville were legendary, but he completely missed the initiatory off of the bull marketplace inwards 1982. Elaine Garzarelli, who correctly called the crash of 1987, pronounced inwards Oct of 2007 that she was "absolutely bullish" on the stock market. That year, the banking analyst Meredith Whitney became famous for her bearish but accurate prediction that Cititgroup would direct keep to slash its dividend as well as direct keep billions inwards writedowns. But she was woefully incorrect when, merely a few years later, she warned, on "60 minutes," that cities inwards the U.S. of A. were probable to default, resulting inwards "hundreds of billions of dollars inwards losses to investors. [JC: as well as then far!] ...Criticizing fiscal forecasts is, I think, a chip every bit good easy. Blog readers volition direct keep to a greater extent than inwards heed the many debates over who saw the fiscal crisis coming or didn't, who called the housing "bubble" or didn't, who persuasion the recession would plow inwards to some other nifty depression or didn't, who saw the electrical flow endless slump coming or didn't, who saw the european debt crisis or didn't, who saw its terminate or didn't, who has been expecting inflation, who has been expecting deflation, who said that reduced authorities expenditures would atomic number 82 to a novel recession, as well as and then on as well as and then on. The whole Paul Krugman - Niall Ferguson ground over who said what when comes to heed too.

I cry upwards this footling article makes clear why these are such hopeless as well as profoundly unscientific debates. (Which, y'all may direct keep wondered, is why I direct keep completely ignored them as well as then far.) Mining erstwhile weblog posts for successes -- or damning people as well as their "models" for selected failures -- proves nothing. To larn something virtually about economical logic as well as the powerfulness of economical ideas to empathise drive as well as effect, y'all at to the lowest degree direct keep to gather an entire forecast record.

More deeply, whatever serious forecast, reflective of the worth of an economical theory, must survive written downward as well as divorced from the judgment of the forecaster. Even if, say, Bob Shiller turned out to survive a psychic who could tell when bubbles were happening, as well as never got a forecast wrong, that is fairly useless cognition unless Bob tin give the sack somehow write downward his procedure as well as then that someone else tin give the sack practise it too. Otherwise, this is similar proverb to a climate scientist, "well y'all persuasion it would pelting concluding weekend, as well as then for sure 'your model' is wrong."

Academic economic science does this. We wrote downward models, as well as attempt out them yesteryear whether the models' predictions, inwards anyone's hands, agrees amongst the data. It's interesting that the policy debates, fifty-fifty yesteryear ex academics, goes dorsum to such solidly pre-scientific witch-doctor evaluation.

|

| Source link |

I include this pic for its beautiful art. Forecasts of GDP, inflation, budget deficits, as well as involvement rates all facial expression virtually this way. Forecasts should also ever include measure errors, but yesteryear histories inwards this graphical shape mightiness survive to a greater extent than informative as well as easier to communicate.

No comments