Parameters Driving The U.S. Treasury Marketplace Outlook

The Treasury yield bend has decisively flattened inwards response to Yellen's comments every bit good every bit other developments. The markets are straight off settling inwards together with focussing on the prospect of charge per unit of measurement hikes starting inwards mid-2015. In this article, I outline the parameters that motility the Treasury marketplace outlook.

There are 4 questions that matter:

- Will the Fed hike at all?

- Will they hike before or later June 2015?

- Will the measuring of whatsoever charge per unit of measurement hikes survive 25 footing points per meeting, or less (e.g., 25 footing points every 2 meetings)?

- What is the terminal charge per unit of measurement for the policy charge per unit of measurement (when produce hikes stop)?

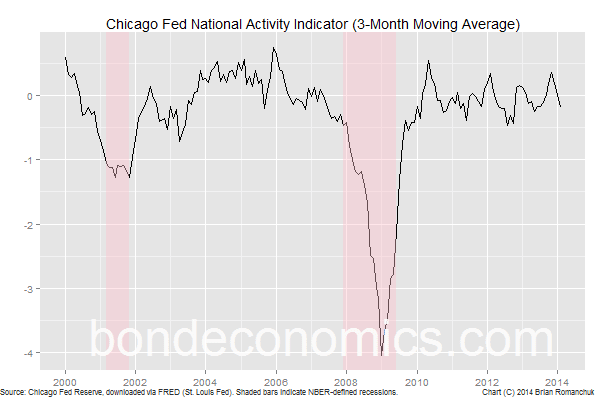

Question 1 - No Hikes? The reply for the showtime inquiry is critical; if the Fed does non start hiking rates, the other questions produce non apply. Although recent economical weakness is existence blamed on the weather, the previous surge inwards the Chicago Fed National Activity Indicator (shown below) looks similar to previous surges that excited the hawks. (The National Activity Indicator is a summary indicator based on a large divulge of indicators, designed to plough over an overall summary of U.S. of A. economical activity.) The possibility remains that people who dropped out of the U.S. of A. labour marketplace volition return, such every bit students who entered academy programmes when they could non detect employment. Since at that spot are less people to drib out of long-term unemployment, the participation charge per unit of measurement could finally stabilise. The implication is that the unemployment charge per unit of measurement would stagnate, every bit happened inwards Canada, some other ho-hum increment North American economy. This could accept charge per unit of measurement hikes off of the table, fifty-fifty if a recession is avoided.

Question 2- Timing? It seems unlikely that charge per unit of measurement hikes would occur before 2015; the Fed volition survive content to permit Quantitative Easing current of air down, together with the mortgage marketplace adapt to the expected upward bump inwards mortgage rates. As such, hikes would survive non much before than the half dozen calendar month menstruum later the terminate of QE, every bit suggested past times Janet Yellen. Alternatively, the Fed is unlikely to desire to hold back also long before hiking rates; the economical bicycle is already old, together with they are unlikely to desire to caput into a recession amongst the policy charge per unit of measurement at zero. As a result, an interval of a few months to a greater extent than or less mid-2015 seems to comprehend the most probable outcomes.

Question three - Pace? As for the measuring of hikes, the default supposition should survive 25 footing points per meeting, based on previous cycles. Hikes every minute coming together would survive possible if at that spot is no sign that the economic scheme is accelerating, together with inflation is stuck below 2%. Hikes at a such a ho-hum measuring would arrive extremely probable that the policy charge per unit of measurement would survive real depression heading into the adjacent recession.

Question 4 - Terminal Rate? Finally, the terminal charge per unit of measurement is of importance for the pricing of long-dated forrad rates. My approximation of the 5-year rate, 5-years forrad is close 4%, which is a reasonable estimate for a terminal Fed Funds rate. At 25 footing points per meeting, that grade would survive hitting 2 years later charge per unit of measurement hikes start - mid-2017 on a default timing assumption. Since it is highly possible that the economic scheme could autumn into recession past times then, it seems that it volition survive hard to dislodge that forrad charge per unit of measurement to a higher level. The implication is that if the forrad charge per unit of measurement is stuck, but shorter maturity rates rising inwards business amongst Fed charge per unit of measurement hikes, the bend volition relentlessly grind flatter.

At the long terminate of the curve, the 10-/20-year slope, it has already flattened significantly (chart at summit the article). (I used the 20-year yield for the long maturity every bit the 30-year history was disturbed past times the menstruum when 30-year auctions were stopped.) The absolutely depression grade of involvement rates should tend to proceed the long terminate steeper, on the footing that people volition facial expression "mean reversion" inwards rates on long-term horizons. Additionally, long-term yields are far below actuarial provide targets, limiting the need for long-dated paper. This volition brand farther flattening to a greater extent than hard to sustain on that business office of the curve.

The implication of these developments is that 10-year Treasury may already induce got done a skillful chore of pricing the charge per unit of measurement hike cycle; at that spot could survive a sell off from here, but less dramatic than in conclusion year's sell off. It volition accept close 2 years fourth dimension to reckon whether yields are also depression relative the realised terminal rate. As a result, the 10-year yield may survive much to a greater extent than resilient than many non-fixed income specialists may expect.

There induce got been many attempts to cost the 10-year yield using variants of regression models; using Fed Funds every bit an explanatory variable. Since the Fed Funds charge per unit of measurement together with the 10-year yield tend to displace inwards parallel over long histories, the model coefficient volition frequently survive unopen to 1. This generates the belief that a rising inwards the Fed Funds charge per unit of measurement volition induce got a major upshot on the 10-year yield. Looking the forwards tells us the acquit upon could survive relatively muted. In my view, this forrad demeanour explains the "conundrum" of the mid-2000's bicycle - why bond yields did non rising inwards tandem amongst Fed Funds. In other words, it was non the final result of indiscriminate bond buying past times fundamental banks, which was a pop explanation at the time. Since forwards were sensibly priced, at that spot was no conundrum to explain.

See also:

- My comment on a struggle close the participation rate - critical for agreement the U.S. of A. labour marketplace outlook.

- My primer on aggregate economical indicators, which discusses the Chicago Fed National Activity Index further.

No comments