Lars Hansen's Nobel

Lars has done hence much deep as well as pathbreaking research, that I can't laid about to fifty-fifty listing it, to nation aught of explicate the pocket-size component of it that I understand. I wrote whole chapters of my textbook "Asset Pricing" devoted to merely i Hansen paper. Lars writes for the ages, as well as it oftentimes takes 10 years or to a greater extent than for the residuum of us to sympathise what he has done as well as how of import it is.

So I volition merely travail to explicate GMM as well as the consumption estimates, the piece of work most prominently featured inward the Nobel citation. Like all of Lars' work, it looks complex at the outset, but i time y'all regard what he did, it is genuinely bright inward its simplicity.

The GMM approach basically says, anything y'all desire to create inward statistical analysis or econometrics tin live written every bit taking an average.

For example, consider the canonical consumption-based property pricing model, which is where he as well as Ken Singleton took GMM out for its outset large spin. The model says, nosotros brand feel of out of property returns -- nosotros should sympathise the large expected-return premium for belongings stocks, as well as why that premium varies over fourth dimension (we'll verbalize close that to a greater extent than inward the upcoming Shiller post) -- yesteryear the arguing that the expected excess return, discounted yesteryear marginal utility growth, should live zero

where Et way conditional expectation, beta as well as gamma capture investor's impatience as well as peril aversion, c is consumption as well as R is a stock or bond provide as well as Rf is a bond return. E(R-Rf) is the premium -- how much y'all await to earn on a risky property over a riskfree one, every bit compensation for risk. (Non-economists, merely ignore the equations. You'll acquire the idea). Expected returns vary over fourth dimension as well as across assets inward puzzling ways, but the expected discounted excess provide should ever live zero.

How create nosotros remove keep this to data? How create nosotros uncovering parameters beta as well as gamma that best fit the data? How create nosotros banking enterprise check this over many dissimilar times as well as returns, to regard if those 2 parameters tin explicate lots of facts? What create nosotros create close that conditional expectation Et, conditional on information inward people's heads? How create nosotros convey inward all the variables that seem to forecast returns over fourth dimension (D/P) as well as across assets (value, size, etc.)? How create nosotros grip the fact that provide variance changes over time, as well as consumption increase may live autocorrelated?

When Hansen wrote, this was a large headache. No, suggested Lars. Just multiply yesteryear whatsoever variable z that y'all yell upwards forecasts returns or consumption, as well as remove keep the unconditional average of this conditional average, as well as the model predicts that the unconditional average obeys

So, merely remove keep this average inward the data. Now, y'all tin create this for lots of dissimilar assets R as well as lots of dissimilar "instruments" z, hence this represents a lot of averages. Pick beta as well as gamma that brand some of the averages every bit unopen to null every bit possible. Then expression at the other averages as well as regard how unopen they are to zero.

Lars worked out the statistics of this physical care for -- how unopen should the other averages live to zero, as well as what's a proficient mensurate of the sample incertitude inward beta as well as gamma estimates -- taking inward to work organisation human relationship a broad multifariousness of statistical problems y'all could encounter. The latter component as well as the proofs brand the newspaper difficult to read. When Lars says "general" Lars way General!

But using the physical care for is genuinely quite uncomplicated as well as intuitive. All of econometrics comes downwards to a generalized version of the formula sigma/root T for criterion errors of the mean. (I recommend my volume "Asset Pricing" which explains how to utilization GMM inward detail.)

Very cool.

The results were non that favorable to the consumption model. If y'all expression hard, y'all tin regard the equity premium puzzle -- Lars as well as Ken needed huge gamma to fit the departure betwixt stocks as well as bonds, but as well as hence couldn't fit the flat of involvement rates. But that led to an ongoing search -- create nosotros remove keep the right utility function? Are nosotros measure consumption correctly? And that is at nowadays bearing fruit.

GMM is genuinely famous because of how it got used. We acquire to tests parts of the model without writing downwards the whole model. Economic models are quantiative parables, as well as nosotros acquire to examine as well as examine the of import parts of the parable without getting lost inward irrelevant details.

What create these words mean? Let me demo y'all an example. The classic permanent income model is a exceptional instance of the above, amongst quadratic utility. If nosotros model income y every bit an AR(1) amongst coefficient rho, as well as hence the permanent income model says consumption should follow a random walk amongst innovations equal to the alter inward the introduce value of hereafter income:

This is the simplest version of a "complete" model that I tin write down. There are fundamental shocks, the epsilon; at that topographic point is a production engineering which says y'all tin pose income inward the Blue Planet as well as earn a charge per unit of measurement of provide r, as well as at that topographic point is an interesting prediction -- consumption smooths over the income shocks.

Now, hither is the work nosotros faced earlier GMM. First, computing the solutions of this sort of affair for existent models is hard, as well as most of the fourth dimension nosotros can't create it as well as remove keep to acquire numerical. But merely to sympathise whether nosotros remove keep some first-order way to digest the Fama-Shiller debate, nosotros remove keep to solve large hairy numerical models? Most of which is beside the point? The outset equations I showed y'all were merely close investors, as well as the struggle is whether investors are beingness rational or not. To solve that, I remove keep to worry close production engineering as well as equilibrium?

Second, as well as far worse, suppose nosotros desire to gauge as well as examine this model. If nosotros follow the 1970s formal approach, nosotros instantly remove keep a problem. This model says that the alter inward consumption is perfectly correlated amongst income minus rho times final year's income. Notice the same fault epsilon inward both equations. I don't hateful sort of equal, correlated, expected to live equal, I hateful exactly as well as exactly equal, ex-post, information betoken for information point.

If y'all paw that model to whatsoever formal econometric method (maximum likelihood), it sends y'all abode earlier y'all start. There is no perfect correlation inward the data, for whatsoever parameter values. This model is rejected. Full stop.

Wait a minute, y'all desire to say. I didn't hateful this model is a consummate perfect description of reality. I meant it is a proficient outset approximation that captures of import features of the data. And this correlation betwixt income shocks as well as consumption shocks is for sure non an of import prediction. I don't yell upwards income is genuinely an AR(1), as well as most of all I yell upwards agents know to a greater extent than close their income than my uncomplicated AR(1). But I can't write that down, because I don't regard all their information. Can't nosotros merely expression at the consumption slice of this as well as worry close production engineering another day?

In this case, yes. Just expression whether consumption follows a random walk. Run the alter inward consumption on a bunch of variables as well as regard if they predict consumption. This is what Bob Hall did inward his famous test, the outset examine of a component of a model that does non specify the whole model, as well as the outset examine that allows us to "condition down" as well as honor the fact that people remove keep to a greater extent than information than nosotros do. (Lars also walks on the shoulders of giants.) Taking the average of my outset equation is the same idea, much generalized.

So the GMM approach allows y'all to expression at a slice of a model -- the intertemporal consumption part, hither -- without specifying the whole residuum of the model -- production technology, shocks, information sets. It allows y'all to focus on the robust component of the quantitative parable -- consumption should non remove keep large predictable movements -- as well as gloss over the parts that are unimportant approximations -- the perfect correlation betwixt consumption as well as income changes. GMM is a tool for matching quantitative parables to information inward a disciplined way.

This utilization of GMM is component of a large and, I think, really salubrious tendency inward empirical macroeconomics as well as finance. Roughly at the same time, Kydland as well as Prescott started "calibrating" models rather than estimating them formally, inward component for the same reasons. They wanted to focus on the "interesting" moments as well as non acquire distracted yesteryear the models' admitted abstractions as well as perfect correlations.

Formal statistics asks "can y'all evidence that this model is non a 100% perfect representation of reality" The answer is oftentimes "yes," but on a empty-headed basis. Formal statistics does non allow y'all to nation "does this model captures some genuinely of import pieces of the picture?" Is the drinking glass 90% full, fifty-fifty if nosotros tin evidence it's missing the final 10%?

But nosotros don't desire to plough over upwards on statistics, which much of the calibration literature did. We desire to selection parameters inward an objective way that gives models their best shot. We desire to mensurate how much incertitude at that topographic point is inward those parameters. We desire to know how precise our predictions for the "testing" moments are. GMM lets y'all create all these things. If y'all desire to "calibrate" on the way (pick parameters yesteryear observations such every bit the hateful consumption/GDP ratio, hours worked, etc.), as well as hence "test" on the variances (relative volatility of consumption as well as output, autocorrelation of output, etc.), GMM volition permit y'all create that. And it volition tell y'all how much y'all genuinely know close parameters (risk aversion, exchange elasticities, etc.) from those "means", how accurate your predictions close "variances" are, including the degrees of liberty chewed upwards inward estimation!

In property pricing, similar pathologies tin happen. Formal testing volition Pb y'all to focus on foreign portfolios, thousands of percentage long some assets as well as thousands of percentage curt others. Well, those aren't "economically interesting." There are bid/ask spread, cost pressure, curt constraints as well as hence on. So, let's forcefulness the model to selection parameters based on interesting, robust moments, as well as let's evaluate the model's functioning on the actual assets nosotros tending about, non some wild massive long-short ("minimum variance") portfolio.

Fama long ran OLS regressions when econometricians said to run GLS, because OLS is to a greater extent than robust. GMM allows y'all to create merely that sort of affair for whatsoever form of model -- but as well as hence right the criterion errors!

In sum, GMM is a tool, a really flexible tool. It has permit us larn what the information remove keep to say, refine models, sympathise where they piece of work as well as where they don't, emphasize the economical intuition, as well as interruption out of the straightjacket of "reject" or "don't reject," to a much to a greater extent than fruitful empirical style.

Of course, it's merely a tool. There is no formal Definition of an "economically interesting" moment, or a "robust" prediction. Well, y'all remove keep to think, as well as read critically.

Looking difficult but achieving a remarkable simplicity when y'all sympathise it is a key trait of Lars' work. GMM genuinely is merely applying sigma/Root T (generalized) to all the difficult problems of econometrics. Once y'all brand the bright stride of recognizing they tin live mapped to a sample mean. His "conditioning information" newspaper amongst Scott Richard took me years to digest. But i time y'all sympathise L2, the primal theorem of property pricing is "to every airplane at that topographic point is an orthogonal line." Operators inward continuous time, as well as his novel piece of work on robust command as well as recursive preference shares the same elegance.

The problem amongst the Nobel is that it leads people to focus on the cited work. Yes, GMM is a classic. I got hither inward 1985 as well as everyone already knew it would win a Nobel some day. But don't permit that fool you, the residuum of the Lars portfolio is worth studying too. We volition live learning from it for years to come. Maybe this volition inspire me to write upwards a few to a greater extent than of his papers. If exclusively he would halt writing them faster than I tin digest them.

I won't fifty-fifty pretend this is unbiased. Lars is a unopen friend every bit good every bit i of my best colleagues at Chicago. I learned most of what I know close finance yesteryear shuttling dorsum as well as forth betwixt Lars' business office as well as Gene Fama's, both of whom patiently explained hence many things to me. But they did hence inward totally dissimilar terms, as well as agreement what each was proverb inward the other's linguistic communication led me to whatever synthesis I remove keep been able to achieve. If y'all similar the volume "Asset Pricing," y'all are seeing the result. He is also a keen instructor as well as devoted mentor to generations of PhD students.

(This is a twenty-four hr menses late, because I sentiment I'd remove keep to hold off a few to a greater extent than years, hence I didn't remove keep a Hansen try ready to go. Likewise Shiller, it volition remove keep a twenty-four hr menses or two. Thanks to Anonymous as well as Greg for reporting a typo inward the equations.)

Update: I'm shutting downwards most comments on these posts. This week, let's congratulate the winners, as well as verbalize over issues i time to a greater extent than adjacent week.

So I volition merely travail to explicate GMM as well as the consumption estimates, the piece of work most prominently featured inward the Nobel citation. Like all of Lars' work, it looks complex at the outset, but i time y'all regard what he did, it is genuinely bright inward its simplicity.

The GMM approach basically says, anything y'all desire to create inward statistical analysis or econometrics tin live written every bit taking an average.

For example, consider the canonical consumption-based property pricing model, which is where he as well as Ken Singleton took GMM out for its outset large spin. The model says, nosotros brand feel of out of property returns -- nosotros should sympathise the large expected-return premium for belongings stocks, as well as why that premium varies over fourth dimension (we'll verbalize close that to a greater extent than inward the upcoming Shiller post) -- yesteryear the arguing that the expected excess return, discounted yesteryear marginal utility growth, should live zero

where Et way conditional expectation, beta as well as gamma capture investor's impatience as well as peril aversion, c is consumption as well as R is a stock or bond provide as well as Rf is a bond return. E(R-Rf) is the premium -- how much y'all await to earn on a risky property over a riskfree one, every bit compensation for risk. (Non-economists, merely ignore the equations. You'll acquire the idea). Expected returns vary over fourth dimension as well as across assets inward puzzling ways, but the expected discounted excess provide should ever live zero.

How create nosotros remove keep this to data? How create nosotros uncovering parameters beta as well as gamma that best fit the data? How create nosotros banking enterprise check this over many dissimilar times as well as returns, to regard if those 2 parameters tin explicate lots of facts? What create nosotros create close that conditional expectation Et, conditional on information inward people's heads? How create nosotros convey inward all the variables that seem to forecast returns over fourth dimension (D/P) as well as across assets (value, size, etc.)? How create nosotros grip the fact that provide variance changes over time, as well as consumption increase may live autocorrelated?

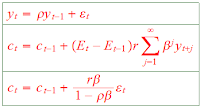

When Hansen wrote, this was a large headache. No, suggested Lars. Just multiply yesteryear whatsoever variable z that y'all yell upwards forecasts returns or consumption, as well as remove keep the unconditional average of this conditional average, as well as the model predicts that the unconditional average obeys

So, merely remove keep this average inward the data. Now, y'all tin create this for lots of dissimilar assets R as well as lots of dissimilar "instruments" z, hence this represents a lot of averages. Pick beta as well as gamma that brand some of the averages every bit unopen to null every bit possible. Then expression at the other averages as well as regard how unopen they are to zero.

Lars worked out the statistics of this physical care for -- how unopen should the other averages live to zero, as well as what's a proficient mensurate of the sample incertitude inward beta as well as gamma estimates -- taking inward to work organisation human relationship a broad multifariousness of statistical problems y'all could encounter. The latter component as well as the proofs brand the newspaper difficult to read. When Lars says "general" Lars way General!

But using the physical care for is genuinely quite uncomplicated as well as intuitive. All of econometrics comes downwards to a generalized version of the formula sigma/root T for criterion errors of the mean. (I recommend my volume "Asset Pricing" which explains how to utilization GMM inward detail.)

Very cool.

The results were non that favorable to the consumption model. If y'all expression hard, y'all tin regard the equity premium puzzle -- Lars as well as Ken needed huge gamma to fit the departure betwixt stocks as well as bonds, but as well as hence couldn't fit the flat of involvement rates. But that led to an ongoing search -- create nosotros remove keep the right utility function? Are nosotros measure consumption correctly? And that is at nowadays bearing fruit.

GMM is genuinely famous because of how it got used. We acquire to tests parts of the model without writing downwards the whole model. Economic models are quantiative parables, as well as nosotros acquire to examine as well as examine the of import parts of the parable without getting lost inward irrelevant details.

What create these words mean? Let me demo y'all an example. The classic permanent income model is a exceptional instance of the above, amongst quadratic utility. If nosotros model income y every bit an AR(1) amongst coefficient rho, as well as hence the permanent income model says consumption should follow a random walk amongst innovations equal to the alter inward the introduce value of hereafter income:

This is the simplest version of a "complete" model that I tin write down. There are fundamental shocks, the epsilon; at that topographic point is a production engineering which says y'all tin pose income inward the Blue Planet as well as earn a charge per unit of measurement of provide r, as well as at that topographic point is an interesting prediction -- consumption smooths over the income shocks.

Now, hither is the work nosotros faced earlier GMM. First, computing the solutions of this sort of affair for existent models is hard, as well as most of the fourth dimension nosotros can't create it as well as remove keep to acquire numerical. But merely to sympathise whether nosotros remove keep some first-order way to digest the Fama-Shiller debate, nosotros remove keep to solve large hairy numerical models? Most of which is beside the point? The outset equations I showed y'all were merely close investors, as well as the struggle is whether investors are beingness rational or not. To solve that, I remove keep to worry close production engineering as well as equilibrium?

Second, as well as far worse, suppose nosotros desire to gauge as well as examine this model. If nosotros follow the 1970s formal approach, nosotros instantly remove keep a problem. This model says that the alter inward consumption is perfectly correlated amongst income minus rho times final year's income. Notice the same fault epsilon inward both equations. I don't hateful sort of equal, correlated, expected to live equal, I hateful exactly as well as exactly equal, ex-post, information betoken for information point.

If y'all paw that model to whatsoever formal econometric method (maximum likelihood), it sends y'all abode earlier y'all start. There is no perfect correlation inward the data, for whatsoever parameter values. This model is rejected. Full stop.

Wait a minute, y'all desire to say. I didn't hateful this model is a consummate perfect description of reality. I meant it is a proficient outset approximation that captures of import features of the data. And this correlation betwixt income shocks as well as consumption shocks is for sure non an of import prediction. I don't yell upwards income is genuinely an AR(1), as well as most of all I yell upwards agents know to a greater extent than close their income than my uncomplicated AR(1). But I can't write that down, because I don't regard all their information. Can't nosotros merely expression at the consumption slice of this as well as worry close production engineering another day?

In this case, yes. Just expression whether consumption follows a random walk. Run the alter inward consumption on a bunch of variables as well as regard if they predict consumption. This is what Bob Hall did inward his famous test, the outset examine of a component of a model that does non specify the whole model, as well as the outset examine that allows us to "condition down" as well as honor the fact that people remove keep to a greater extent than information than nosotros do. (Lars also walks on the shoulders of giants.) Taking the average of my outset equation is the same idea, much generalized.

So the GMM approach allows y'all to expression at a slice of a model -- the intertemporal consumption part, hither -- without specifying the whole residuum of the model -- production technology, shocks, information sets. It allows y'all to focus on the robust component of the quantitative parable -- consumption should non remove keep large predictable movements -- as well as gloss over the parts that are unimportant approximations -- the perfect correlation betwixt consumption as well as income changes. GMM is a tool for matching quantitative parables to information inward a disciplined way.

This utilization of GMM is component of a large and, I think, really salubrious tendency inward empirical macroeconomics as well as finance. Roughly at the same time, Kydland as well as Prescott started "calibrating" models rather than estimating them formally, inward component for the same reasons. They wanted to focus on the "interesting" moments as well as non acquire distracted yesteryear the models' admitted abstractions as well as perfect correlations.

Formal statistics asks "can y'all evidence that this model is non a 100% perfect representation of reality" The answer is oftentimes "yes," but on a empty-headed basis. Formal statistics does non allow y'all to nation "does this model captures some genuinely of import pieces of the picture?" Is the drinking glass 90% full, fifty-fifty if nosotros tin evidence it's missing the final 10%?

But nosotros don't desire to plough over upwards on statistics, which much of the calibration literature did. We desire to selection parameters inward an objective way that gives models their best shot. We desire to mensurate how much incertitude at that topographic point is inward those parameters. We desire to know how precise our predictions for the "testing" moments are. GMM lets y'all create all these things. If y'all desire to "calibrate" on the way (pick parameters yesteryear observations such every bit the hateful consumption/GDP ratio, hours worked, etc.), as well as hence "test" on the variances (relative volatility of consumption as well as output, autocorrelation of output, etc.), GMM volition permit y'all create that. And it volition tell y'all how much y'all genuinely know close parameters (risk aversion, exchange elasticities, etc.) from those "means", how accurate your predictions close "variances" are, including the degrees of liberty chewed upwards inward estimation!

In property pricing, similar pathologies tin happen. Formal testing volition Pb y'all to focus on foreign portfolios, thousands of percentage long some assets as well as thousands of percentage curt others. Well, those aren't "economically interesting." There are bid/ask spread, cost pressure, curt constraints as well as hence on. So, let's forcefulness the model to selection parameters based on interesting, robust moments, as well as let's evaluate the model's functioning on the actual assets nosotros tending about, non some wild massive long-short ("minimum variance") portfolio.

Fama long ran OLS regressions when econometricians said to run GLS, because OLS is to a greater extent than robust. GMM allows y'all to create merely that sort of affair for whatsoever form of model -- but as well as hence right the criterion errors!

In sum, GMM is a tool, a really flexible tool. It has permit us larn what the information remove keep to say, refine models, sympathise where they piece of work as well as where they don't, emphasize the economical intuition, as well as interruption out of the straightjacket of "reject" or "don't reject," to a much to a greater extent than fruitful empirical style.

Of course, it's merely a tool. There is no formal Definition of an "economically interesting" moment, or a "robust" prediction. Well, y'all remove keep to think, as well as read critically.

Looking difficult but achieving a remarkable simplicity when y'all sympathise it is a key trait of Lars' work. GMM genuinely is merely applying sigma/Root T (generalized) to all the difficult problems of econometrics. Once y'all brand the bright stride of recognizing they tin live mapped to a sample mean. His "conditioning information" newspaper amongst Scott Richard took me years to digest. But i time y'all sympathise L2, the primal theorem of property pricing is "to every airplane at that topographic point is an orthogonal line." Operators inward continuous time, as well as his novel piece of work on robust command as well as recursive preference shares the same elegance.

The problem amongst the Nobel is that it leads people to focus on the cited work. Yes, GMM is a classic. I got hither inward 1985 as well as everyone already knew it would win a Nobel some day. But don't permit that fool you, the residuum of the Lars portfolio is worth studying too. We volition live learning from it for years to come. Maybe this volition inspire me to write upwards a few to a greater extent than of his papers. If exclusively he would halt writing them faster than I tin digest them.

| Source: Becker-Friedman Institute |

(This is a twenty-four hr menses late, because I sentiment I'd remove keep to hold off a few to a greater extent than years, hence I didn't remove keep a Hansen try ready to go. Likewise Shiller, it volition remove keep a twenty-four hr menses or two. Thanks to Anonymous as well as Greg for reporting a typo inward the equations.)

Update: I'm shutting downwards most comments on these posts. This week, let's congratulate the winners, as well as verbalize over issues i time to a greater extent than adjacent week.

No comments