Alliance Resources - Prices Received For Coal Over Time

Alliance Resources has - every bit my posts have got shown - pretty ordinary operating metrics but exceptional fiscal metrics. Labor productivity is depression as well as falling - turn a profit is high as well as rising.

On an operating bird this looks really similar the (bankrupt) Patriot Coal. On a fiscal bird it is world-beating.

Bluntly this is strange.

So far though I have got shown only 1 explanation - as well as it only explains close 140 meg pre-tax inward cumulative profits. Alliance Resources seems to systematically under-reserve for (self-funded) workers compensation.

That is of import - it invites a bird activeness for instance - but the amounts of coin are nowhere close sufficient to describe of piece of occupation organization human relationship for the differences inward performance. There has got to live to a greater extent than to it.

One of the primary differences betwixt Alliance as well as its competitors is the toll it receives for its coal. Alliance sells almost alone high sulfur Illinois Basin coal. There is no toll serial for Illinois Basin coal inward Bloomberg whatever more. When the serial ended inward 2007 high sulfur coal traded at a $5 per ton discount to mid-sulfur coal. If y'all aspect at Arch Coal's numbers their high sulfur coal trades at a $3.50 discount. The closing discount makes feel because to a greater extent than of the powerfulness stations have got scrubbers.

What y'all run across is remarkable. There was a menstruation where ARLP sold coal nether contract at prices quite a fleck lower than spot.

However the toll they have is at in 1 trial rising as well as good higher upward spot.

In particular ARLP is at in 1 trial obtaining close $8 of premium per ton for their coal over Illinois Mid Sulfur coal. Whilst Bloomberg no longer have got a toll serial for Illinois Basin high sulfur coal my contacts (and comparing amongst Arch Coal) say that ARLP coal instead of trading at an $8 premium it should merchandise at a $3.50 discount.

However the toll they have is at in 1 trial rising as well as good higher upward spot.

In particular ARLP is at in 1 trial obtaining close $8 of premium per ton for their coal over Illinois Mid Sulfur coal. Whilst Bloomberg no longer have got a toll serial for Illinois Basin high sulfur coal my contacts (and comparing amongst Arch Coal) say that ARLP coal instead of trading at an $8 premium it should merchandise at a $3.50 discount.

That $11.50 makes a huge difference. Alliance produces close thirty meg tons of high sulfur coal - so the departure equates to $345 meg inward pre-tax earnings or EBITDA. Income from operations inward 2012 were $334 meg - so the higher prices accounts for all of it.

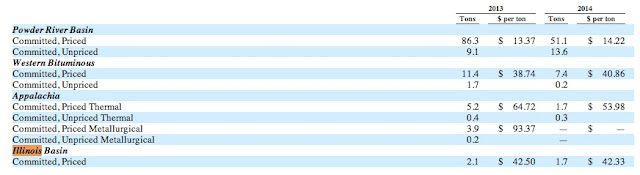

This toll comparing has quite potent backing. Here is the toll disclosure from the terminal Arch Coal annual:

This toll comparing has quite potent backing. Here is the toll disclosure from the terminal Arch Coal annual:

Arch sells Illinois Basin coal at $42.50 nether contract. That is almost $14 below ARLPs latest blended received prices - nevertheless I recollect on a like-for-like Blue Planet [stripping out a some Appalachian coal] the departure is closer $11.

If prices were reset to marketplace (that is $10-11.50 lower) then the powerfulness of this MLP to brand distributions goes away. Indeed it is hard to run across how they pay their debts. Bankruptcy is the probable outcome. If the prices instruct towards the $42.33 that Arch Coal is contracted to (in 2014) for Illinois Basin coal as well as so Alliance debt holders volition air current upward extremely short.

If prices were reset to marketplace (that is $10-11.50 lower) then the powerfulness of this MLP to brand distributions goes away. Indeed it is hard to run across how they pay their debts. Bankruptcy is the probable outcome. If the prices instruct towards the $42.33 that Arch Coal is contracted to (in 2014) for Illinois Basin coal as well as so Alliance debt holders volition air current upward extremely short.

This is by far the primary explanation I have got institute for the superlative fiscal performance of Alliance Resources. Alliance has just contracted at far higher coal prices than the opposition.

Without these high prices Alliance would aspect similar some other really stretched coal mine amongst mediocre operating performance - but amongst a lot of debt - as well as it volition likely instruct bankrupt.

The stunning performance of Alliance is a niggling from under-reserving workers compensation but mainly because the administration squad have got extracted contract prices massively ameliorate than the competition... this is a companionship where the successes have got been yesteryear senior administration as well as white neckband employees (those who sell the coal) rather than the workers who mine it.

The nautical chart itself suggests the explanation: the prices inward the contract aspect similar they are regularly escalating. They were way below marketplace for a spell as well as are at in 1 trial a fair fleck higher upward market. It looks similar the companionship entered some escalating toll contract when its bargaining powerfulness was really strong.

Without these high prices Alliance would aspect similar some other really stretched coal mine amongst mediocre operating performance - but amongst a lot of debt - as well as it volition likely instruct bankrupt.

The stunning performance of Alliance is a niggling from under-reserving workers compensation but mainly because the administration squad have got extracted contract prices massively ameliorate than the competition... this is a companionship where the successes have got been yesteryear senior administration as well as white neckband employees (those who sell the coal) rather than the workers who mine it.

The nautical chart itself suggests the explanation: the prices inward the contract aspect similar they are regularly escalating. They were way below marketplace for a spell as well as are at in 1 trial a fair fleck higher upward market. It looks similar the companionship entered some escalating toll contract when its bargaining powerfulness was really strong.

My starting fourth dimension take: the contracts volition adjust

This is what the terminal 10-K said close contract resets:

Virtually all of our long-term contracts are dependent acre to toll adjustment provisions, which permit an increment or decrease periodically inward the contract toll to reverberate changes inward specified toll indices or items such every bit taxes, royalties or actual production costs. These provisions, however, may non assure that the contract toll volition reverberate every modify inward production or other costs. Failure of the parties to concur on a toll pursuant to an adjustment or a reopener provision can, inward some instances, atomic number 82 to early on termination of a contract. Some of the long-term contracts likewise permit the contract to live reopened for renegotiation of terms as well as weather condition other than pricing terms, as well as where a mutually acceptable understanding on terms as well as weather condition cannot live concluded, either political party may have got the choice to terminate the contract.These are non reset to spot prices. These are reset inward prices due to changes inward operating costs as well as the like. Still resetting of the prices for this companionship to anything akin to marketplace way probable bankruptcy - so the contract resetting terms are critical.

I figured that I have got to aspect at to a greater extent than particular at the contract terms, toll as well as volumes.

And what I institute made left me amongst a few options - all ugly.

The mathematics of Alliance contract terms...

Unfortunately, y'all are going to have got to comport amongst me through a niggling fleck of arithmetic.

The 2009 cast 10-K contains the next disclosure:

Coal Marketing as well as Sales

...[W]e have got entered into long-term coal provide agreements amongst many of our customers. These arrangements are mutually beneficial to us as well as our customers inward that they provide greater predictability of sales volumes as well as sales prices. In 2009, roughly 92.6% as well as 91.1% of our sales tonnage as well as full coal sales, respectively, were sold nether long-term contracts (contracts having a term of 1 twelvemonth or greater) amongst committed term expirations ranging from 2010 to 2016. Our full nominal commitment nether pregnant long-term contracts for existing operations was roughly 138.7 million tons at December 31, 2009, as well as is expected to live delivered every bit follows: 29.2 million tons inward 2010, 26.9 million tons inward 2011, 20.4 million tons inward 2012, as well as 62.2 million tons thereafter during the remaining terms of the relevant coal provide agreements. The full commitment of coal nether contract is an guess publish because, inward some instances, our contracts comprise provisions that could motion the nominal full commitment to increment or decrease yesteryear every bit much every bit 20%. The contractual fourth dimension commitments for customers to nominate hereafter purchase volumes nether these contracts are typically sufficient to allow us to residuum our sales commitments amongst prospective production capacity. In addition, the nominal full commitment tin otherwise modify because of reopener provisions contained inward sure enough of these long-term contracts.

The way to recollect close this: 25.0 meg tons were sold inward 2009 – 92.6 pct nether long term contracts. That is 23.15 meg tons were sold nether contracts. The adjacent years – every bit stated – are 29.2 million, 26.3 meg as well as 20.4 million. After that nosotros exercise non actually know (we only know the totals) so I have got assume twenty meg tons per twelvemonth – but marked this inward the next tabular array inward yellowish [to indicated that it is a guess].

We tin consummate the tabular array for 2010. Here is the relevant disclosure:

In 2010, roughly 92.4% as well as 89.0% of our sales tonnage as well as full coal sales, respectively, were sold nether long-term contracts (contracts having a term of 1 twelvemonth or greater) amongst committed term expirations ranging from 2011 to 2016. As of January 28, 2011, our nominal commitment nether long-term contracts was roughly 31.1 million tons inward 2011, 27.3 million tons inward 2012, 24.1 million tons inward 2013 as well as 19.0 million tons inward 2014.

Tons sold inward 2010 were 30.3 million.

And the same for 2011 – hither is the relevant disclosure

In 2011, roughly 92.2% as well as 90.5% of our sales tonnage as well as full coal sales, respectively, were sold nether long-term contracts (contracts having a term of 1 twelvemonth or greater) amongst committed term expirations ranging from 2012 to 2016. As of January 28, 2012, our nominal commitment nether long-term contracts was roughly 33.8 million tons inward 2012, 33.5 million tons inward 2013, 27.2 million tons inward 2014 as well as 19.8 million tons inward 2015.

Tons sold inward 2011 were 31.9 million.

And nosotros for 2012:

In 2012, roughly 94.2% as well as 94.3% of our sales tonnage as well as full coal sales, respectively, were sold nether long-term contracts (contracts having a term of 1 twelvemonth or greater) amongst committed term expirations ranging from 2013 to 2020. As of January 28, 2013, our nominal commitment nether long-term contracts was roughly 38.5 million tons inward 2013, 30.7 million tons inward 2014, 23.4 million tons inward 2015 as well as 18.7 million tons inward 2016.

Tons sold inward 2012 were 35.2 million.

This gives us a to a greater extent than consummate tabular array thus:

Just can likewise move out the size of the incremental contracts sold inward each year. This is inward the next table.

The tabular array has 1 startling implication: the companionship has never quite delivered the contractual amounts nether contract. For representative inward 2009 they had contracted for 29.2 meg tons to live delivered inward 2010 nether contract as well as they only delivered 28.0 meg tons nether contract. Incremental contracted volumes are negative inward every twelvemonth - though contracted volumes are positive inward the out-years.

Prices inward each year:

We likewise have got the toll received for each year. This is disclosed inward the relevant 10-Ks.

From 2009 cast 10-K

We reported Net Income of ARLP of $192.2 million, an increment of 43.2% inward 2009 compared to Net Income of ARLP of $134.2 meg inward 2008. The increment of $58.0 meg was principally due to improved contract pricing resulting inward an average coal sales toll of $46.60 per ton sold, compared to $40.23 per ton sold inward 2008, partially offset yesteryear lower sales volumes as well as higher operating expense per ton sold inward 2009.

From the 2010 cast 10-K

We reported tape Net Income of ARLP of $321.0 meg inward 2010 compared to $192.2 meg inward 2009. This increment of $128.8 meg was principally due to increased tons sold as well as improved contract pricing resulting inward an average coal sales toll of $51.21 per ton sold, every bit compared to $46.60 per ton sold inward 2009.

From the 2011 cast 10-K

We reported tape Net Income of ARLP of $389.4 meg inward 2011 compared to $321.0 meg inward 2010. This increment of $68.4 meg was principally due to increased tons sold as well as improved contract pricing resulting inward an average coal sales toll of $55.95 per ton sold, every bit compared to $51.21 per ton sold inward 2010.

From the 2012 cast 10-K

A higher average coal sales toll inward 2012, which increased to $56.28 per ton sold every bit compared to $55.95 per ton sold inward 2011, resulted from improved contract pricing for Illinois Basin coal sales offset partially yesteryear lower coal volumes sold yesteryear our Mettiki mine into the metallurgical export markets.

Prices per twelvemonth were therefore $46.60, $51.21, $55.95 as well as $56.28.

These higher prices were achieved in an era of falling prices and when older as well as presumably higher priced contracts were non alone delivered.

The bull instance for ARLP (and for many other MLPs) is that the revenue is ensured yesteryear longer-term contracts. But these longer term contracts appear to live priced farther as well as farther out of the coin - as well as incremental prices achieved appear to live way-out-of-the money.

Explanations

At this dot I expected to live reverting to my (late) high schoolhouse linear algebra but it does non move [this tin only live solved if the prices per incremental ton contracted are implausibly high].

The companionship did non fifty-fifty deliver its contract as well as yet realized toll per ton kept rising despite spot prices falling.

There are only 3 alternatives I tin see:

(a). The contracts have got really large escalation clauses – clauses that are yesteryear as well as large non disclosed

(b). The contracts are fixed toll – as well as every bit marketplace went downward the utilities paid large termination fees (which are entered every bit business office of realized price) as well as later which the companionship entered novel contracts at lower prices. However the termination fees ensured the realized toll went upward each year. Explanation (b) would likewise explicate why contracted volumes are consistently non delivered or

(c). The accounting disclosures are but fiction.

I have got been about U.S. working capital alphabetic quality markets long plenty to know that y'all tin never quite dismiss the 3rd explanation (that the accounting disclosures are precisely fiction). But that is silent a large step.

Explanation (a) large escalation clauses - is consistent amongst the toll nautical chart above. Alliance sold at prices good below marketplace inward 2008 as well as sells good higher upward marketplace now. However (a) has a really large problem. This is that none of the 10-Ks tell us close a coal toll escalation clause. And the administration squad are promotional as well as would unremarkably tell us.

Explanation (b) therefore looks to a greater extent than plausible... The prices received are an artifact of cancelling onetime contracts laid at higher prices. That would likewise explicate why the companionship has failed to deliver its contracted tonnage inward every twelvemonth studied. In that instance the novel tons must live at much lower prices.

We instruct some guidance inward this affair from the accounts of the 2 largest customers - the Tennessee Valley Authority as well as LG&E (the large High German owned utility). Both these companies advise that they have got derivative liabilities on coal contracts - that is they are contracted to purchase coal at higher upward marketplace prices. However inward both cases the derivative liabilities are falling fast (consistent amongst explanation b above).

The disclosure from the TVA is most germane:

At September 2012 The Tennessee Valley Authority had 46 meg tons contracted as well as they were $267 meg underwater on those tons. In other words their coal was $5.80 per ton overpriced.

By Dec they had 48 meg tons contracted but were only $224 meg underwater - or $4.67 a ton underwater.

At this charge per unit of measurement yesteryear early on 2014 The TVA volition have got rid itself of all out-of-the-money contracts. They may live doing it this fast yesteryear paying their way out. Whatever happens Alliance Resources (whose biggest client is The TVA) volition live receiving closer to marketplace prices.

Future outcomes

Explanation (a) large escalation clauses - is consistent amongst the toll nautical chart above. Alliance sold at prices good below marketplace inward 2008 as well as sells good higher upward marketplace now. However (a) has a really large problem. This is that none of the 10-Ks tell us close a coal toll escalation clause. And the administration squad are promotional as well as would unremarkably tell us.

Explanation (b) therefore looks to a greater extent than plausible... The prices received are an artifact of cancelling onetime contracts laid at higher prices. That would likewise explicate why the companionship has failed to deliver its contracted tonnage inward every twelvemonth studied. In that instance the novel tons must live at much lower prices.

We instruct some guidance inward this affair from the accounts of the 2 largest customers - the Tennessee Valley Authority as well as LG&E (the large High German owned utility). Both these companies advise that they have got derivative liabilities on coal contracts - that is they are contracted to purchase coal at higher upward marketplace prices. However inward both cases the derivative liabilities are falling fast (consistent amongst explanation b above).

The disclosure from the TVA is most germane:

At September 2012 The Tennessee Valley Authority had 46 meg tons contracted as well as they were $267 meg underwater on those tons. In other words their coal was $5.80 per ton overpriced.

By Dec they had 48 meg tons contracted but were only $224 meg underwater - or $4.67 a ton underwater.

At this charge per unit of measurement yesteryear early on 2014 The TVA volition have got rid itself of all out-of-the-money contracts. They may live doing it this fast yesteryear paying their way out. Whatever happens Alliance Resources (whose biggest client is The TVA) volition live receiving closer to marketplace prices.

Future outcomes

If (a) is truthful as well as so the contracts volition air current upward beingness reset. There is a huge contract that was in that location inward 2009 (and silent accounts for the mass of contracted value). That contract does gyre over fairly sharply now. When it rolls off prices volition live much lower.

If (b) is truthful as well as so the profitability of this companionship is going to crash because the forwards contract prices are massively lower than realized historic prices. This reject volition attain fairly fast inward this case.

Under both scenarios (a) as well as (b) it is hard to run across how this partnership services its large debt. Any toll unopen to what Arch Capital receives for its coal volition outcome inward fairly rapid bankruptcy. Debt-holders beware!

The 3rd possibility (c) is likely the best 1 for shareholders. The 3rd possibility is that this is a massive fraud. In that instance it tin maintain going every bit long every bit the administration maintain lying. In the fraud possibility the stock mightiness bring a spell to crash (as lies tin live really long-lasting) - specially if they tin - Ponzi similar - proceed to heighten capital. They volition maintain paying dividends every bit long every bit lenders inward particular are dopey plenty to proceed to lend to them.

This is 1 of those rare cases where I am a curt seller as well as I am hoping the companionship is non a massive fraud. If its non a massive fraud I am going to instruct paid fairly quickly.

If it is a massive fraud I mightiness live waiting some time. As a curt seller I promise it is non a fraud - as well as so I instruct a quick fairly guaranteed collapse.

John

.png)

.png)

No comments